Using Data to Build a Demand Gen Engine and Scale Marketing (+ FAQs)

Are you under pressure to deliver more (and better) sales pipeline, but aren't sure how to get more of the right kind of leads through the door?

In this post, we'll cover the core framework we take our clients through at How To SaaS to scale marketing and demand gen. You can use this approach to think about marketing for any company - a lot of the concepts you'll learn about here are first principles. By the end, you'll be able to apply this framework to your particular business.

We'll cover five sections:

- Market forces and dynamics at play that lead to the impact marketing needs to make inside organizations.

- Company dynamics and how to apply these principles for your specific scenario.

- Demand generation and a framework for prioritizing your demand gen roadmap that you can apply to basically any business.

- A step-by-step process for using data to scale up demand gen for your business or product line.

- Frequently asked questions from the community.

In this post:

Market Forces

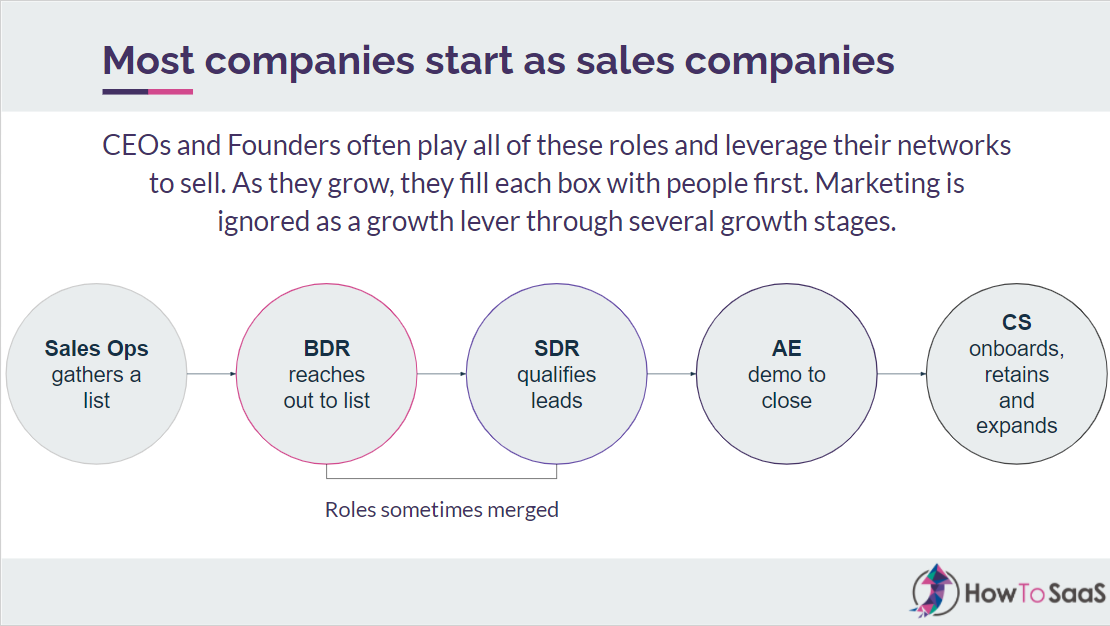

A lot of companies start off as sales companies. You’re probably familiar with this framework: it was popularized by the predictable revenue book.

You have BDRs and SDRs that are reaching out to some sort of a list and qualifying those deals. Then you have account executives that close those deals, and you have customer success that onboards and retains those accounts.

A lot of companies start with the CEOs and founders playing all of these roles. And then as they scale, they start to fill out the seats with other hires as their first hires on the marketing and sales side.

Theoretically, a company can actually grow to a $100M+ in revenue by just continuing to scale this model without investing into marketing enough. A lot of our clients are people who have built companies that are as large as a hundred million, and that might only have five to seven marketers on their team but maybe 70 salespeople. It's a common thing in a sales-led business. This ends up being your primary method of scaling the business and where most of your go-to-market funds go.

What we want to do is to change that. We want to make marketing more of a growth lever inside these kinds of businesses. And there's a good reason for that.

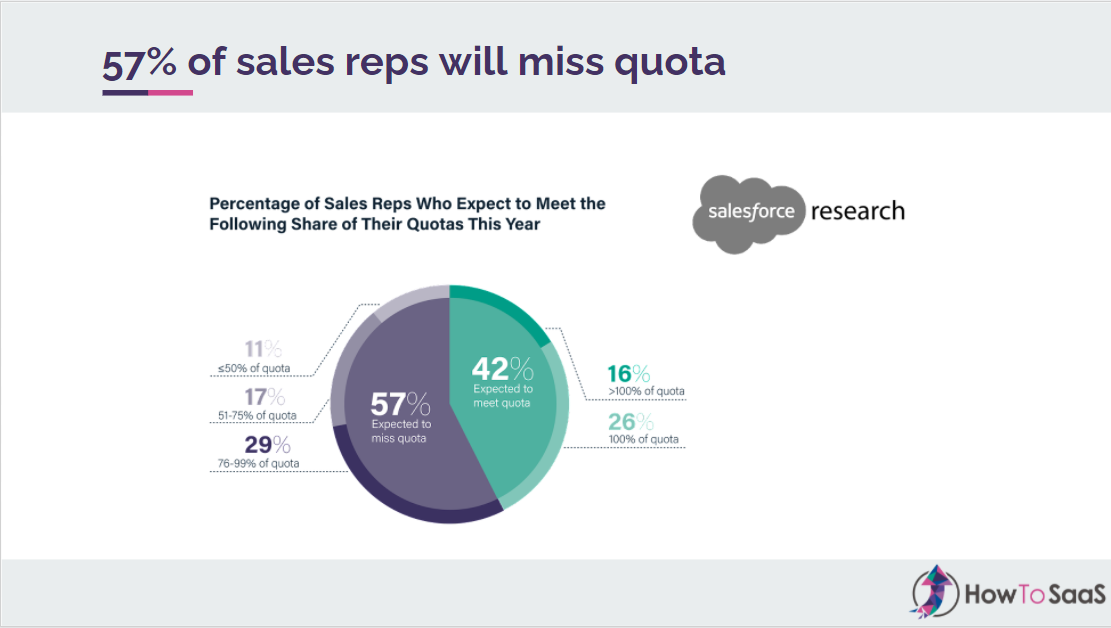

This is a study done by Salesforce which shows that about 57% of sales reps are expected to miss quota and about 26% just barely make quota. That means that, out of all the reps out there, only 16% are comfortably surpassing quota. Everybody else is just barely making it or are not making it at all.

That plays into how long VPs of sales end up staying with companies.

In 2010, the average tenure for a VP of Sales was about 26 months. It's declined to about 19 months in 2020, and just 17 months in 2021. At the same time, in 2021, the average account executive tenure was less than a year. You have an account executive whose job it is to close deals and they only have three or four quarters of runway to meet their quota. Otherwise, they end up either getting fired or going to another position. Especially with longer sales cycles, account executives need more time to make an impact.

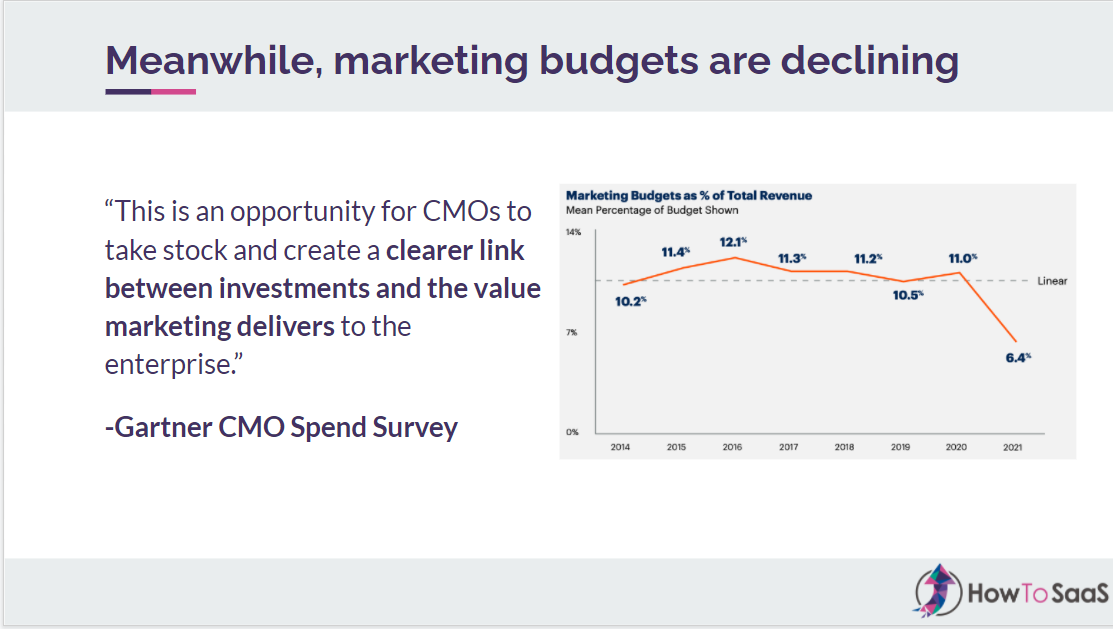

The reason for this is that marketing budgets have been stagnant for basically the last decade.

On average, B2B companies spend about 10% of their revenue on their marketing budget. 2021 was an anomaly: budgets were slashed because of COVID. Companies had less money to spend on paid media, events, and other channels where they previously allocated budget because it was a great place to save some costs. But, in general, it's about 10%.

If you want to grow a business and hit quota, this number actually needs to increase - especially as you find product-market fit and you know that once you acquire a customer, they're going to stay with you for a long time. At some point, you become a go-to-market organization, so you need to scale how much you spend on the front end to acquire the customer and grow the business.

In this study done by Gartner, one of the things they found was that marketers need to do a better job establishing a clear link between the investments they make and the ROI and value being generated from that spend.

Think about the metrics you're reporting on or taking to the board level. Are you looking at vanity metrics? Are top of funnel metrics your KPIs? That's won’t cut it. To bring marketing budgets to the board level, we have to be able to talk about pipeline, contribution, marketing sourced pipeline, and how much revenue is closing as a result of marketing efforts.

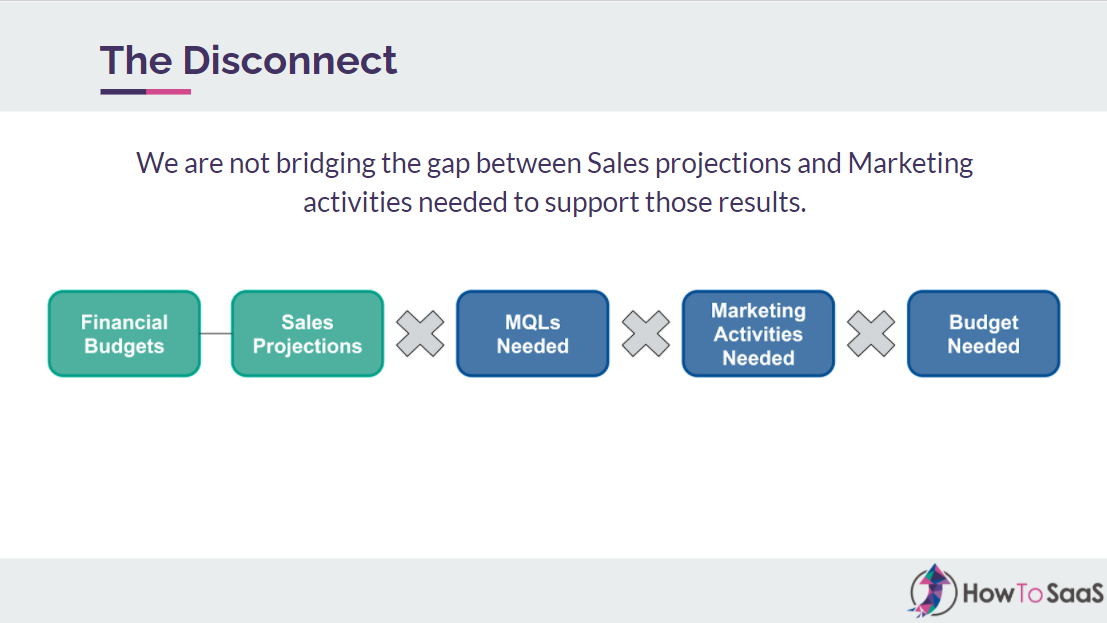

This disconnect happens across the board. In a lot of businesses, financial projections are made at the board level. The CFO, investors behind a company, and the CEO will pull together a growth model and say ‘here's how much we think we're going to grow year over year.’ That leads to certain sales projections being set, which ultimately informs the quota, the coverage you have, and how many reps you have.

But there’s some math here that isn’t being done. Look at those sales projections and ask: how many SQLs you need to support those projections, to have the right pipeline coverage to hit those targets? What activities need to be done to generate those MQLs in the first? And, finally, what is the right budget you need to fund those activities? Even if you understand how many MQLs you need, if your marketing budget is half of what it should be, you’re not going to hit those numbers because MQLs generally aren't free.

This is the big disconnect.

In general, Marketing doesn't have enough budget. Marketers do not make the right business cases to get the right amount of budget. And, as a result, because there's not enough budget at play, all projections, sales projections, and sales quotas are usually at risk.

That creates a situation where VPs of Sales leave early, many VPs of Marketing get fired, and companies miss their targets on an ongoing basis. Inside these businesses, marketing ends up becoming more of a support function. The activities are more traditional and are similar to what Marketing used to do a decade (or even two decades) ago.

The focus is often on brand, sales enablement, events, PR comms, product marketing. A lot of this work is important, and Marketing does need to do it, but it can't be the only thing Marketing is working on. A lot of this work doesn’t necessarily generate revenue. If this is all marketing is responsible for inside an organization, you can guarantee that Marketing's contribution to pipeline is usually less than 10% - maybe even closer to 2 or 3%. This is not enough.

This is actually a very common mistake made by VPs of Marketing. When they start, they often do a rebrand or launch a new website. Meanwhile, there aren't enough demand gen programs in place to ramp up pipeline and hit the targets they want to hit.

CEOs intuitively understand this.

This is another study done by Gartner where they asked tech CEOs what the most critical problems are that they’re trying to solve. Marketing/demand gen was one of the most important and urgent, but the CEOs’ confidence in their ability to solve it was not high.

The reason for this is that if you’re a CEO of a large tech company, one of the most common challenges you face is aggressive sales projections - especially as you raise more money or have more investors involved. A lot of companies don't have enough pipeline to support those targets, so CEOs will cycle through marketing leaders and see Marketing spin their wheels for months. When you don’t hit those targets, it's a cause for concern because the whole business is at risk.

At the same time, investors agree.

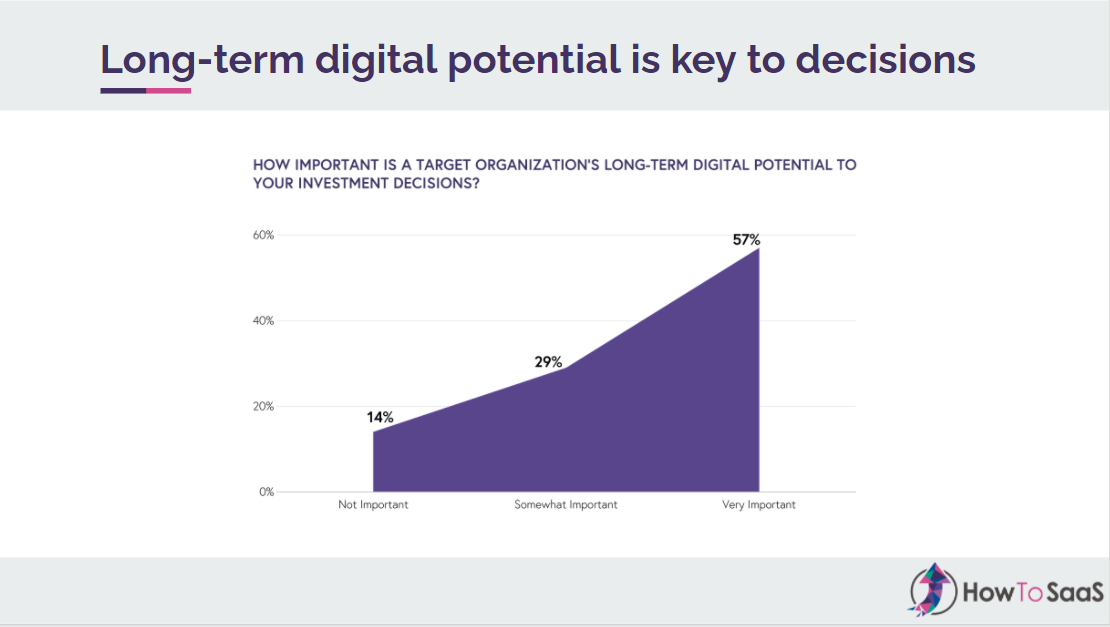

When you ask investors what the primary strategies are that they’re deploying to scale the value of portfolio companies, the number one strategy they do is integrating add-on companies. You've probably seen this with M&A activity and how rampant it has been for the last couple of years. But number two on the list is implementing digital transformation initiatives.

A big part of that is demand gen and scaling marketing efforts. When you look at the value creation plans that investors are building, digitization is the number one set of plays that they deploy inside their portfolio to scale those investments. At the same time, when they're deciding whether or not to make an investment in the first place, they're looking at the long-term potential of an investment on the digital side to decide whether or not to invest. 57% of investors say it's very important to their investment decision.

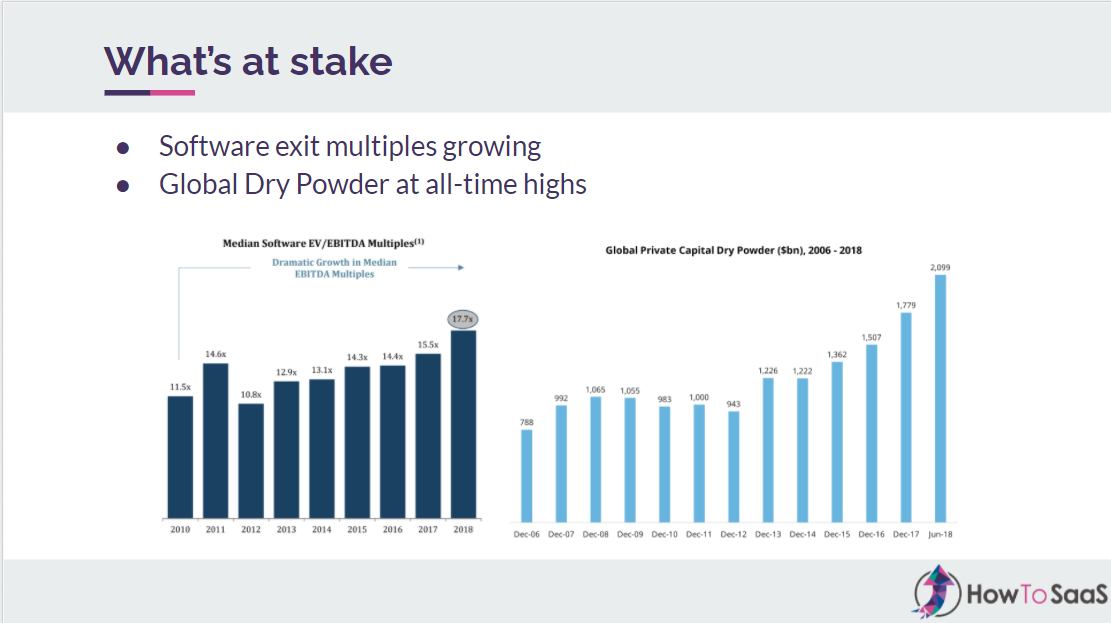

So why are they looking at these metrics? Simply put, the reason is that there's a lot at stake.

This is the global private capital dry powder in the world right now:

Dry powder is the amount of cash that's sitting in the bank accounts of investors that has not been deployed. The business model of these investors is to raise capital from large institutions or retirement funds and to deploy that capital to generate a return for their limited partners. If they can't deploy those funds, they can generate a return for their LPs.

This cascades downmarket, where you see software multiples going through the roof. In 2010, you could only get around 11x on your recurring revenue; as of 2018, you could get an 18x, and in 2021, that number climbed above 20. If you have a 5 million EBITDA business, you can theoretically sell it for $100M today because there's so much money out there competing for the same assets.

Especially if you're an M&A platform company, you've probably seen this: to close an M&A deal, there's a large corporate development roadmap, and you identify targets. It's like running a sales pipeline. Closing a deal takes a lot of effort and a lot of investment.

When investors are putting this much money into assets and paying such a premium price to acquire them, one of the big things at stake is growing that asset and getting a return on their investment. If you do pay $100M for an asset that's doing $5M in EBITDA, you better grow it if you want to see a return where you might sell that asset or take a company public.

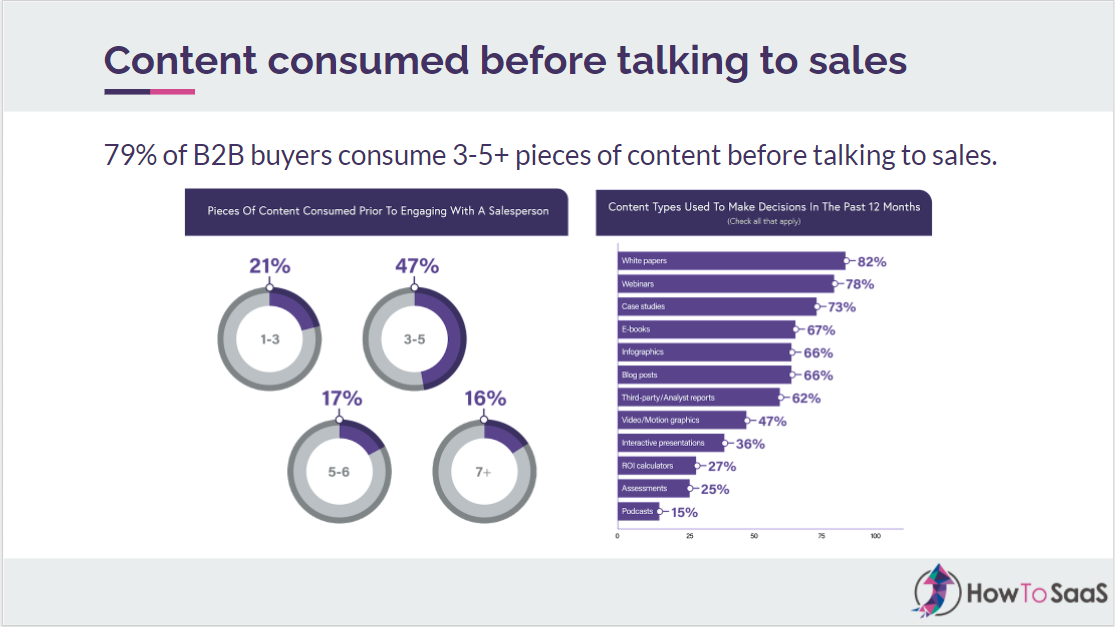

At the same time, how B2B buyers are buying is changing.

About 79% of buyers are consuming three to five pieces of content before they ever talk to a sales rep.

Think about how your buyer journeys are currently constructed. If it's contingent upon a sales rep doing the education, then you're likely behind already because a lot of customers are looking for information before they ever talk to someone.

Here’s another example from Gartner that shows where are buyers getting their information from:

As you can see, the buyers are getting information from both just as much through every stage of their journey, from problem identification all the way to validation and consensus creation before buying a particular solution.

What this means is that marketing needs to be playing a role at every stage of the buyer journey to nurture these prospects through to close. This involves creating a whole lot of content and having more programs out there.

The old way is for Marketing to just generate top of funnel leads and for Sales to handle the rest, but we need to build an organization that looks more like this:

Marketing is involved with the whole buyer journey and your go-to-market. This is the same for any type of business model, sales cycle, or average deal size. The same is as true if you have a self-serve model as it is if you're an enterprise B2B company where the average deal size is $2M. If your market is only 200 accounts, this better be the case even more so from the very top. The only way to get in touch with your key accounts is to have the right kind of content and programs out there.

It's clear that Marketing needs more budget. All the stakeholders involved agree, marketers agree, salespeople agree, investors agree, CEOs agree. But yet Marketing doesn't have more budget.

So what do we need to do in order to get there?

The answer is that Marketing needs to be more data-driven. This allows Marketing to take that performance back to an executive team meeting or board-level meeting to say ‘here's how much we invested, and here's how much we got back.’

This is a bit of an alarming stat to look at: 12% of marketers cite brand awareness as their most important metric. Only 1% look at lifetime value while 7% look at ROI. But these are the two metrics that really matter. If your LTV to CAC ratio is 10;1, you can spend a lot more on marketing. But if you can’t explain that to an investor with metrics, you're likely not going to get more budget.

We need to have a data model in place in order to get the right budget. From there, we can do all the fun tactical things in each channel or campaign.

Company Dynamics

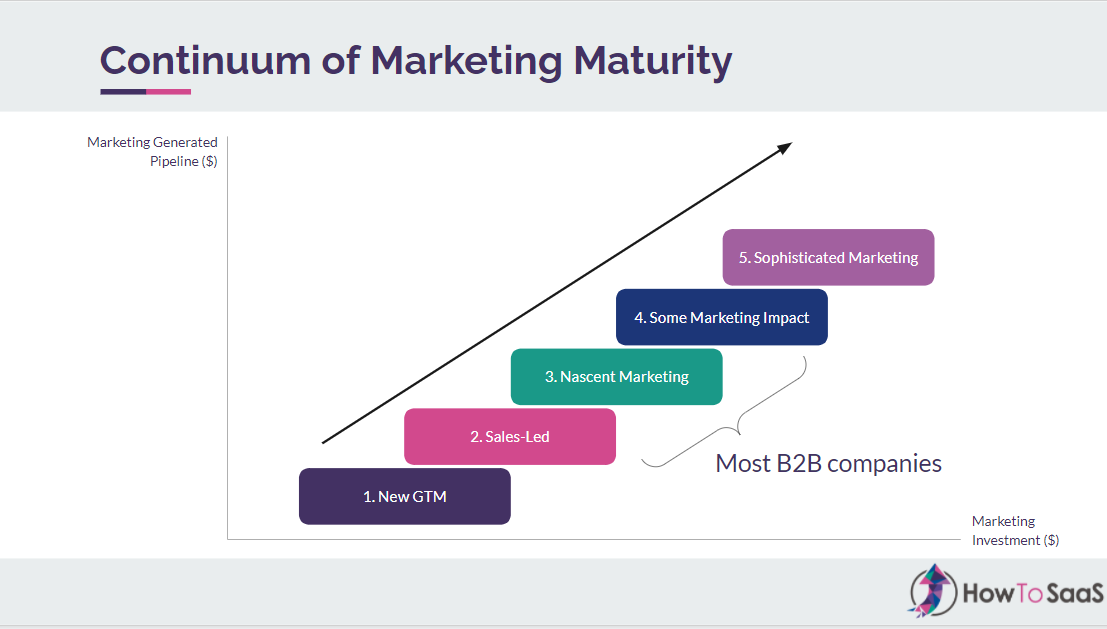

If you were to look at your company, you could probably put it into one of these five buckets in terms of your current marketing maturity:

- A new go-to-market, often where it's a new product. You don't really have much marketing and there's very minimal marketing investment.

- Sales-led. This is very common where Sales is the primary revenue driver and Marketing is a support function, with less than 10% of the pipeline being generated by Marketing.

- There's some sort of nascent marketing effort happening. Marketing investment is usually $300K or $500K, the marketing team is one to three people, and the marketing-generated pipeline is still likely less than 10-15%.

- Slightly more mature companies where Marketing is having an impact. Marketing is actually a revenue driver, contribution might be closer to 20%, and there might be four to seven people on staff.

- Very rarely, there are sophisticated marketing organizations where marketing contribution to pipeline is 25-50% and the marketing team is larger than 10 people.

Based on this, figure out where are you are as a business so you can figure out how to get to the next level.

Most B2B companies are between level two and four, with most of them being closer to levels two and three than level four. It's very rare to find a B2B company at level five of sophistication.

So what does a sophisticated marketing engine actually look like?

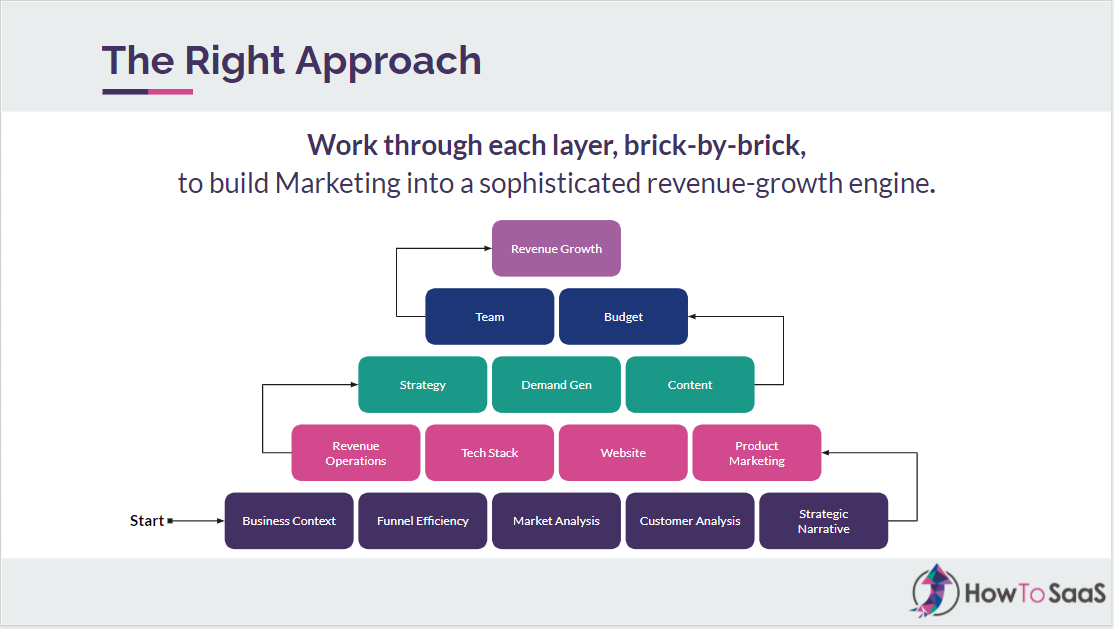

The way we think about this with our clients at How to SaaS is with five layers:

1. Layer one is foundational. This is basic stuff that you need in place in order to be able to do any kind of marketing. You need to know things like:

- The business context

- What's your average deal size?

- What's your total addressable market?

- What's your retention rate?

- Your funnel efficiency

- Your conversion rates at every stage of the funnel

- Your market

- Your segmentation

- Who your ICPs are

- Your customers are pain points

You need to build a strategic narrative. That’s where you differentiate yourself from the competition and have something different to say about your particular solution.

2. Layer two is infrastructure. This is also essential in order to be able to launch demand gen programs. This is your product marketing work, potentially your sales enablement, your website, your tech stack. Your revenue ops function so you can measure your performance.

3. Layers three and four are really where the bulk of value is created. At level three, you establish the right strategy for your business:

- What does the mix of budget look like when you're going to market?

- Which demand programs are you going to prioritize?

- What are you going to deprioritize?

- Which content programs or assets should we create before others? Should be focused on SEO? Should we focus on account-based marketing?

4. Once that's clear, at level four you figure out the resources you need to get there:

- Who are the people we need?

- What is the budget we need to fund these programs?

5. Together, these steps are how ultimately we get to revenue growth at level five. To get there, you need to have all of these bricks in place so that the engine is sophisticated enough to deliver that kind of value.

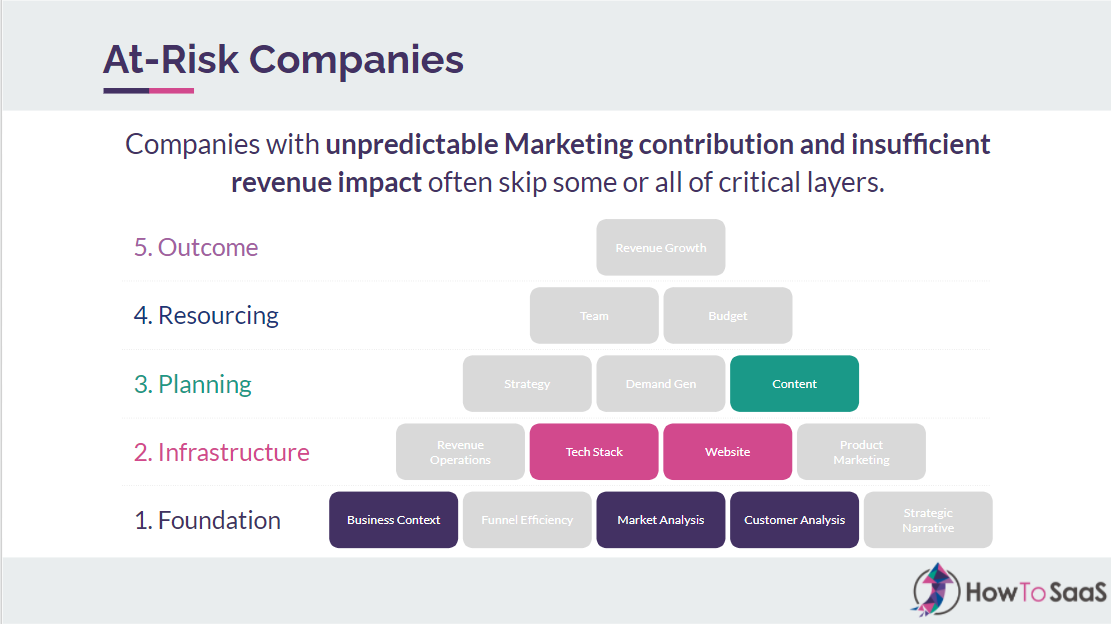

The problem is that inside most companies, it looks more like this:

There are usually some boxes that have been filled and there's good enough stuff in place, but a lot of other pieces are missing. A diagnostic, you have to grade your business or your company's marketing efforts. And if you have multiple product lines, you have to do it for each across all of these dimensions and ask:

- How good is our understanding of our market or customers for this product line?

- How good is our tech stack?

- How good are our demand gen programs?

- Do we have the right team for this product line?

- Do we have the right budget?

Then you can start to understand which maturity level you’re at.

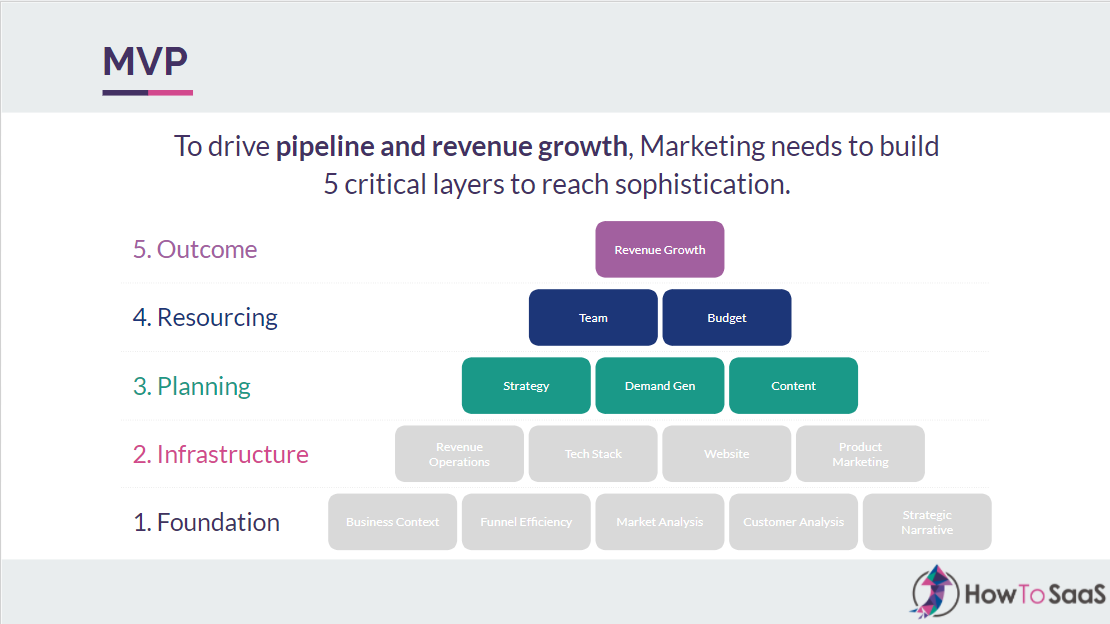

Ideally, you want to start here:

Then snake your way through the pyramid, working through each level. This is how you build something that's sustainable and that can actually stand the test of time. It gives you evergreen content around evergreen programs, so if people leave, you can always plug in new team members and continue to scale the business, because it's not too dependent on one particular program or person or an initiative.

A major barrier here is that there's often a lot of urgency inside businesses. There’s a pressure to work through the layers very quickly.

For example, if you’re a new VP of Marketing and you take six to nine months doing levels one and two, odds are, you're not going to keep your job very long. You're going to be spending so much time setting everything up, meanwhile, the company will be missing its sales projections. You have to find a way to jump through this as quickly as possible and eventually get to the revenue growth stage so you're driving enough pipeline to grow the business.

There are a few scenarios where this is important:

- If there's a new acquisition or an investment that's been made where you've just raised money, or you've just been acquired by PE. We need to ramp up marketing in the first 100 days.

- M&A platform companies where you're bringing together multiple companies that need to be integrated into a single platform. If you're adding on more companies every quarter, you have to get through this cycle much faster.

- In periods of transition. You’ve probably seen companies that have replaced VPs of Marketing, whether. Last certain team members or theirs, they're changing their product or messaging. They need to cycle through this process a lot quicker and get through the pyramid as fast as possible.

In these situations, you need to do something that's good enough in layers one and two and then get to layers three and four as fast as possible. We want to take an MVP approach to each of these boxes so we can deliver revenue growth faster.

One example of a mistake here would be if you were on HubSpot CRM and you decided to overhaul that and implement Salesforce. That is not an MVP approach. Even if you like Salesforce more and even if it's potentially a better system, you're going to sacrifice a ton of time that you need to get to that revenue growth point. If we can do enough of an MVP for each of these boxes and get to strategy, demand gen, content, team and budget, we're far more likely to help the whole business deliver on its sales projections.

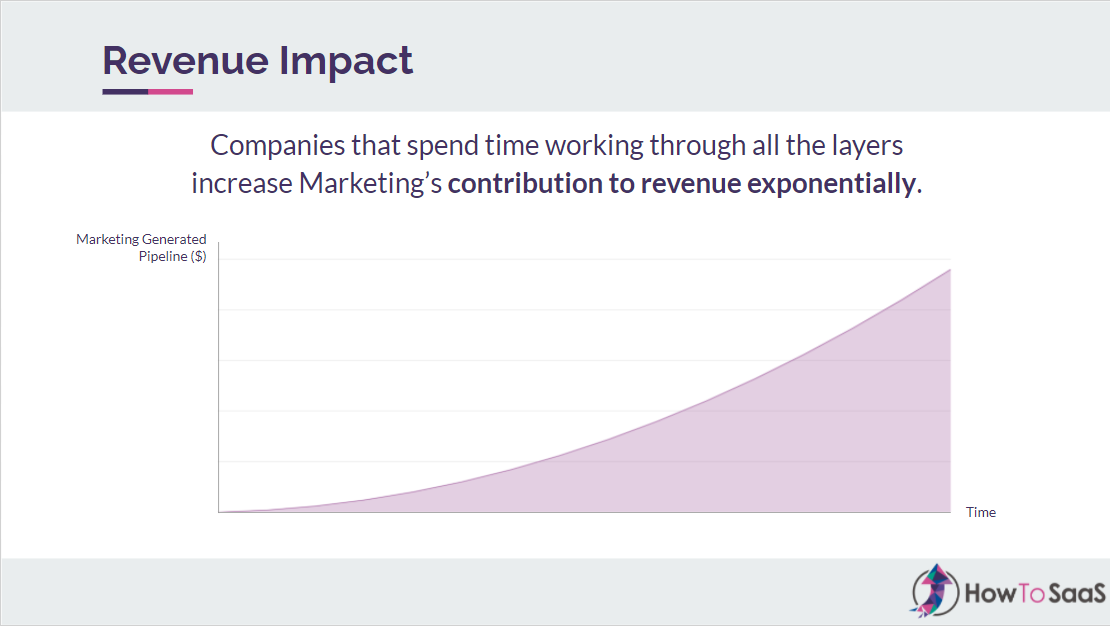

If you go through each of the boxes, Marketing's contribution to pipeline and the generated and sourced pipeline increases over time.

As you're going through the boxes initially, it's not going to look like you're contributing as much. But as you scale that impact over time, you can get to a point where Marketing is generating 30 or 40% of the pipeline that's being generated by the business overall.

The quicker you can get to these five boxes, the better:

Demand Gen Framework

Let's assume you've done the early work and have some of the fundamental pieces in place. You have enough people and demand gen systems in place, and now you actually want to ramp up demand gen. What’s the process to figure out the order you should launch programs in and where you should focus?

Start by understanding where people are in their buyer journey with you. Based on that, what are the programs you want to put into in front of them?

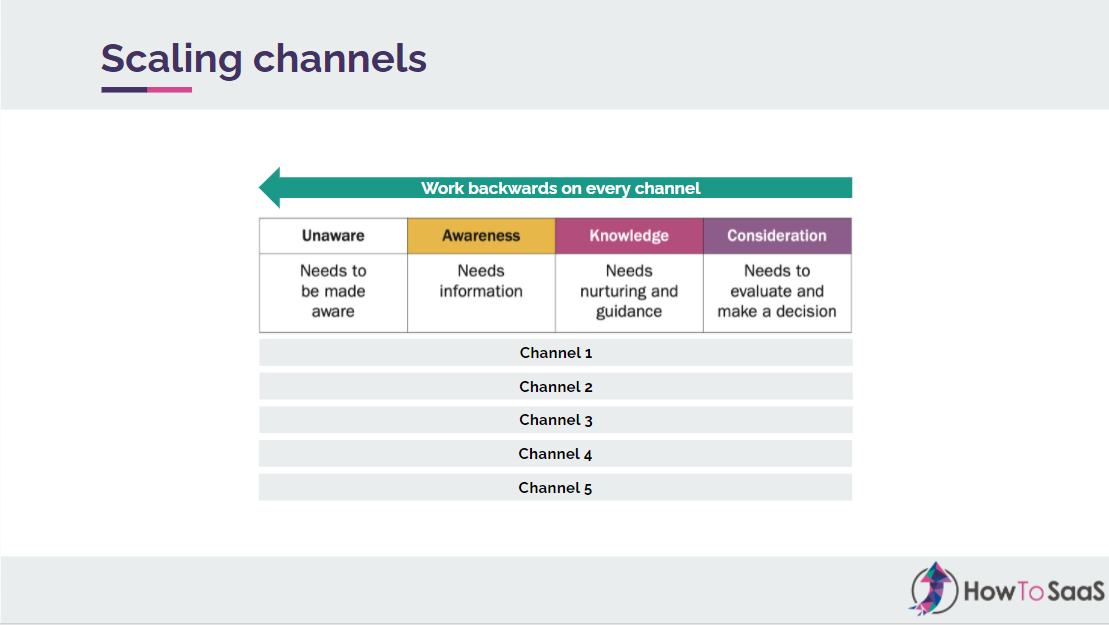

At a basic level, there are four stages:

- People that have no idea what we do.

- People that have some level of awareness and they need information.

- People that have some knowledge about our solution and other competitors, and are looking to make a decision.

- People that are actually considering our platform as their solution. We want to help them evaluate and make a decision.

Then, at each of these stages, we add these hot, warm, and cold swim lanes:

At every stage of the buyer journey, there are different needs that buyers have that we need to be able to address.

Somebody that's ready and in the market is in the consideration and hot stage. They might need to test drive the software, or to see a demo, or to talk to a sales rep.

But let's say somebody is in a problem aware state and they still need more nurturing to understand the problem a little bit better. How can we amplify the pain that they're facing, help them understand how they're losing time or money, or how they can grow their particular business faster by buying from us? All of those need nurturing to help them get to the stage where they're actually ready to consider.

If you look at the assets we need at each of these stages, there might be other things you currently don't have. That might be:

- A free trial or demo for someone that's in the consideration and hot stage.

- Case studies for people that are in this stage.

- Content upgrades for somebody that has come to our blog so they can enter the funnel.

- Once they've entered the funnel, maybe we need an educational webinar to get them to understand the problem in the first place.

- Maybe then we do have a software focus webinar.

All of these things slowly edge buyers forward diagonally to the top right segment and help get them into a buying window with us.

The key idea here is that order matters:

If you were to start in the cold and awareness quadrant, you're likely going to burn a lot of marketing budget and capital, even though what you really need is to show ROI at the board level. The CAC will be so high for people who have no idea what you do, even if they're an ICP, that the odds of them buying are going to be lower. And because the ROI isn’t great, when you come back to the board level, the performance is not good enough to go and lobby for additional budget.

Instead, start with the top right segment and work your way to the bottom left while filling out all the assets and programs you need at each of these states.

This isn’t restricted to a specific business model. In a product-led organization, you might use a free trial to support the buyer journey. Maybe you have a self-serve webinar, or maybe you have a lot of educational resources and email sequences that are nurturing people.

On the flip side, if you’re targeting enterprise B2B and running ABM programs for 200 organizations, maybe you should target the ICP at each of these stages with the right piece of content that's tailored to one-to-one communication. If you’re targeting the hundred biggest banks in the world, you could have assets for each of those hundred banks and then target them with custom content at each of those stages across the board.

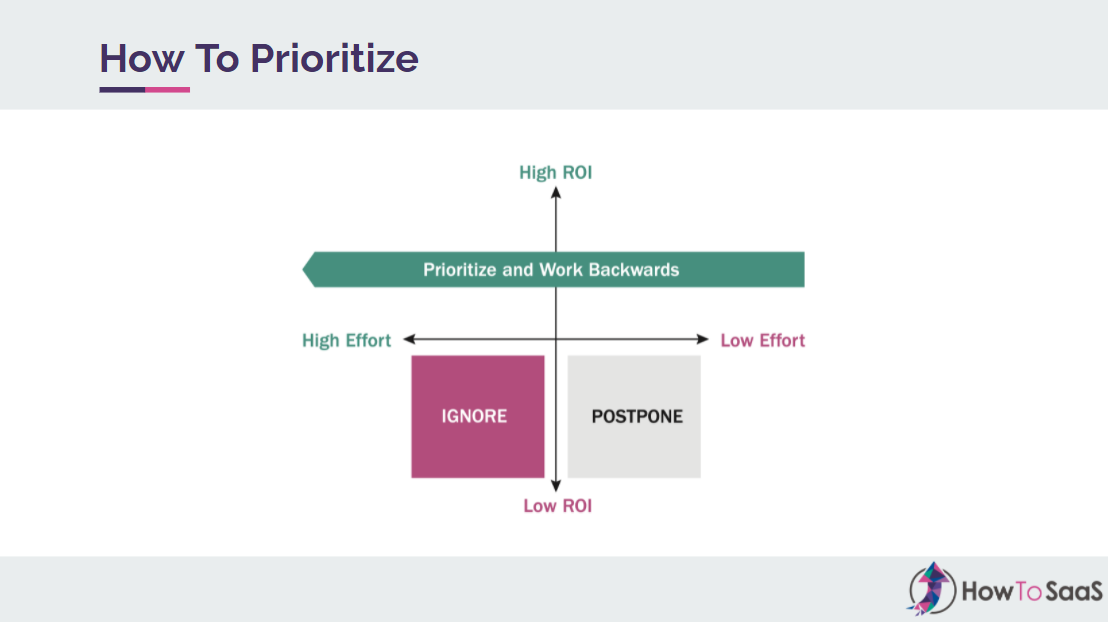

At the same time, while we're prioritizing against the buyer journey stages, we also want to look at which campaigns we can launch with the lowest amount of efforts that we get to value as quickly as possible. We can then work our way backwards to items that have high ROI but require a ton of time or effort.

Let's say a paid media program might take you a month to launch. Usually, that's the first place to start. You’re capturing demand that's out there, but at the same time, the amount of effort that's going into it is significantly less than some other programs - for instance, ranking for the top 100 SEO terms in your market. Even if it would be nice to be organically on the first page of Google, if you're a sales enablement software, for example, you would be competing with companies like HubSpot, Showpad, and a bunch of other players in that space. That's going to take you a whole lot of time, whereas you can get on the first page by just investing in paid media.

Do this process in every single channel and work your way backwards. Do the same thing for:

- Paid media

- SEO

- Events

- Account-based marketing

- And any other initiative that you're running

Work your way backwards from people who are most ready to buy to people who have no idea what you do.

The one caveat to this is that as you reach a certain stage of maturity, the bulk of the growth sits in the unaware and awareness stages. That’s because you have enough assets built out so that people who are in market or more ready to buy will find you because you've already done a lot of the foundational work.

A really good example would be a company like Shopify. They have a ton of assets. If you're looking for online store software or you're actually in market to have some type of online checkout, Shopify will show up. So their biggest win to be had is to educate people who are unaware on the benefits of becoming an entrepreneur or starting an online store. That's why you see Shopify do a ton of PR or sponsor a ‘build a business’ competition that encourages entrepreneurs to start their own businesses because that opens up a whole new market for them.

7 Steps to Scale Demand

Now we get into the operational part that brings this to life based on where you are as a business.

Step 1: Build out your MQL to closed reporting

Do you know the conversion rates for every stage of the buyer journey or in your funnel?

- How many people are crossing from being a captured lead or an engaged lead to an MQL?

- What percentage of the marketing leads become sales accepted?

- What percentage of those are getting to sales qualified?

- What percentage of those are getting to closed-won?

The reason this is important is that we eventually want to figure out our acceptable cost per lead. That will tell us how much can we spend on marketing on the front end and any particular programming activity, and help us measure whether each activity is actually working and effective.

You may want to split out your types of MQL. For example, prospect MQLs that have never bought anything from you should be looked at differently than an upsell MQL where you can cross-sell a different product or service or they can expand their account with your business. You need to be able to look at these stages and conversion rates for different segments of your buyers to be able to make better decisions.

Step 2: Full funnel analysis

Next, look at the full funnel above just the MQL stage because leads interact with your business in lots of other ways as well. That might include website visits, product qualification triggers if they take certain actions in your product, or interactions with sales or support.

Build out tracking for all these different stages so you have a better understanding of your acceptable cost per lead.

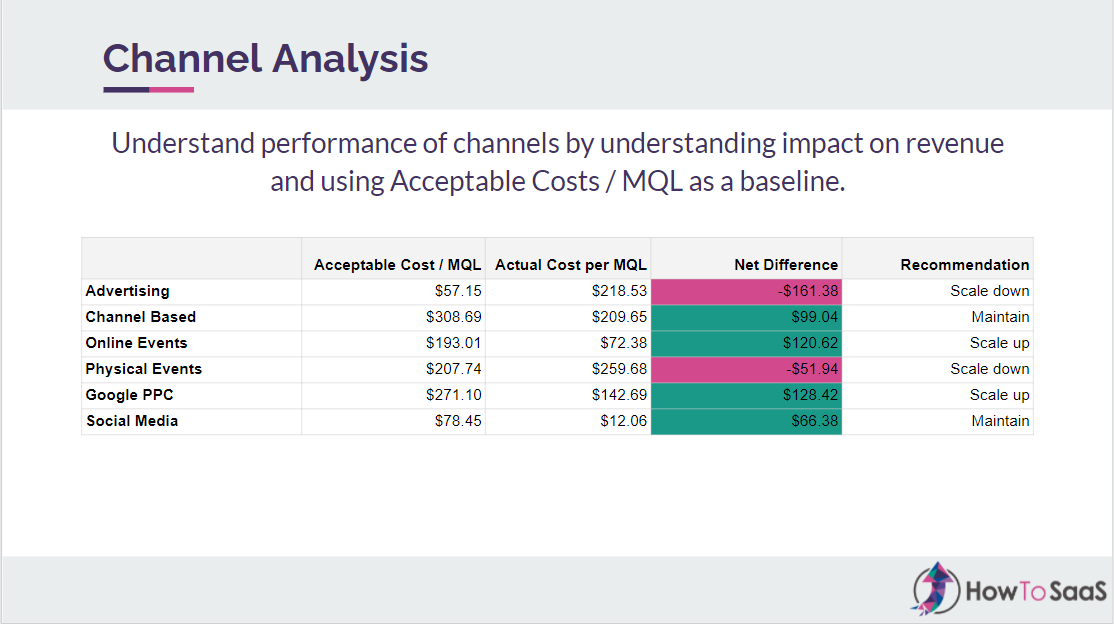

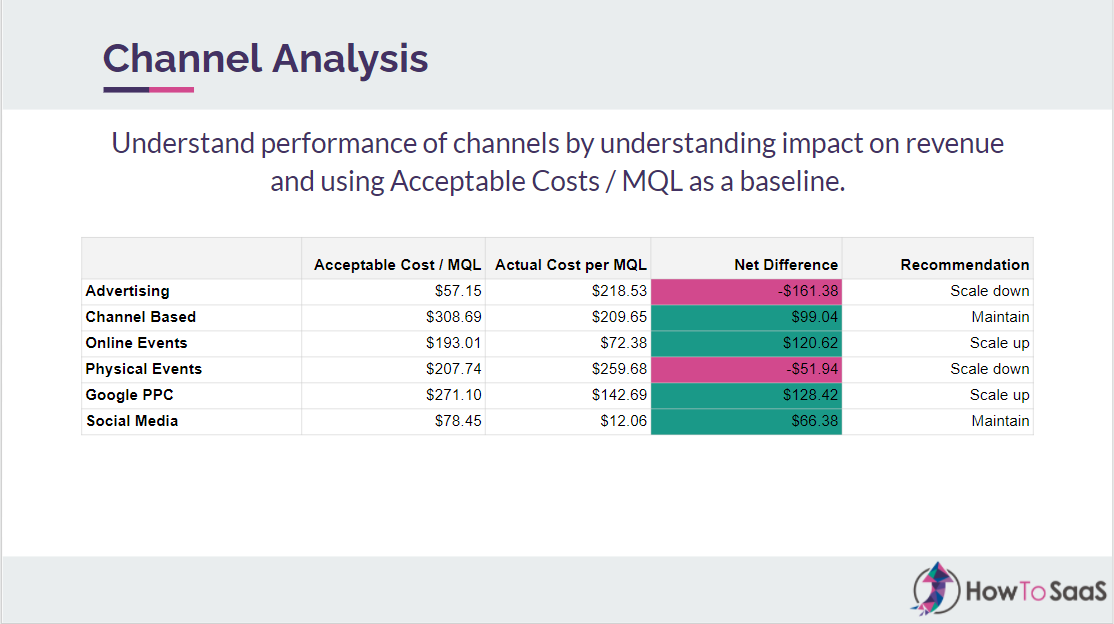

Step 3: Channel analysis

Shift that same attention to the channel level.

Here's an example of a business investing in advertising, events online and in person, Google search, and social media:

Let’s look at their acceptable cost per MQL and what they’re actually spending. You can see that in physical events, they can afford to spend about $207 per lead. And they're actually getting about $259 per lead. That’s not that bad, but it's something you wouldn't necessarily scale up because it’s likely taking longer to break even than we'd want.

On the flip side, on search, they can spend about $270 based on the conversion rates, but they're actually spending $142. So there's about another $128 per lead they can spend.

This is just Google ads in particular, and you could take it a step deeper. Look at the different campaigns you're running and at the ROI being generated.

In this example, about $8,000 is being spent on the Network Varient campaign, and the ROI on that is $4.80 to 1. On the flip side, there's Keyword Cluster B where they’re spending $83,00, where the ROI is about 38 cents on the dollar. Immediately, you can see this cluster is not the best use of ad dollars and likely needs to be scaled down, whereas the Network Varient campaign likely needs to be scaled up.

This exercise should be happening for every channel and every campaign on an ongoing basis, so you're constantly reallocating your budget on either a quarterly, semi-annual, or annual basis. What you'll find is that even with your existing budget, just through this reallocation exercise, you can grow your impact by 30 to 50% without ever getting another dollar for your marketing budget.

As you become more efficient, you’ll have the opportunity to ask for more budget by saying: ‘based on what we've spent in the past, our pipeline ROI is 2x what it used to be. And now we need more budget because we think we can scale pipeline by even more.’

Step 4: Identify Opportunities to Scale

Next, look at the opportunities to scale.

Inside any business, you’ll find that certain things are working well while others aren't. You want to be able to scale up the things that are working well.

For example, this company started by spending about $25,000 a month on paid media across four different channels. Their ROI on that was about 1.59, so they could use that as an indication to say, ‘Hey, we'd like to double our spend on Google, Capterra and LinkedIn. And if that continues to work, we might double it again.’ This is an example of an initial budget ask that helps you get to the next level.

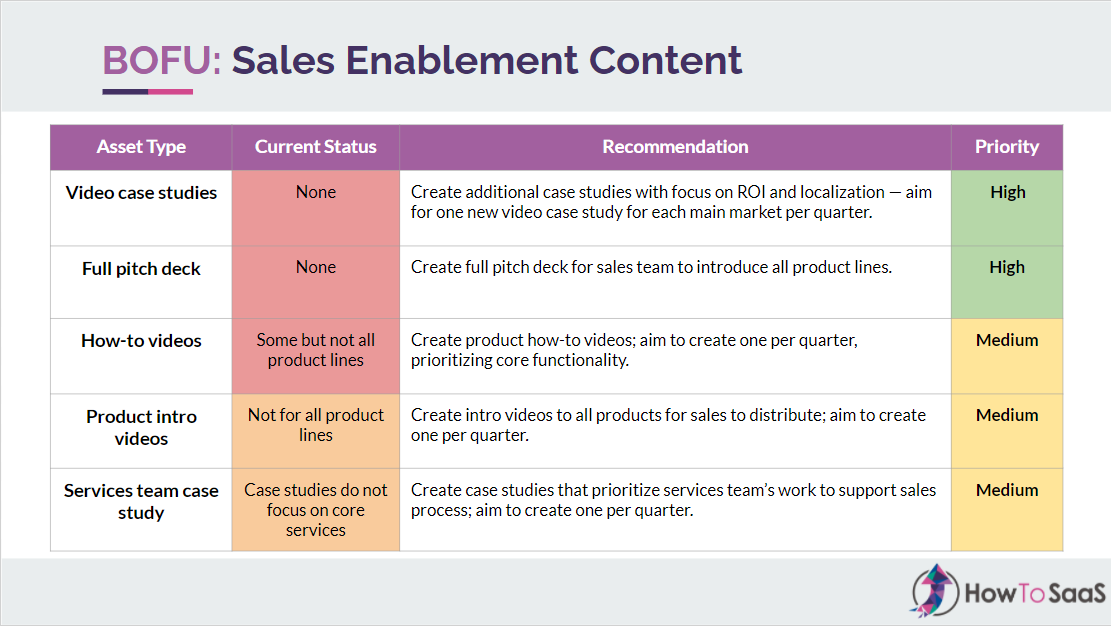

Step 5: Identify Gaps in Content

The next exercise you need to look at is the content needed at every stage of the buyer journey. As you're auditing your journey from awareness through to consideration and closing, ask: 'do we have enough assets at every stage to take the customer to the next step?' Identify the biggest gaps so the content team is working through a prioritized list that helps you build a real engine.

That content usually needs to be more evergreen, not one-off or topical. That means less COVID-specific content, for example. These pieces can be important, but it's not as important as having the core assets for your message built out.

Here's an example of a company that has a bunch of gaps on the sales enablement side:

Maybe they're good on SEO, but they don't have enough 'How To' videos or video cases. They don't have enough written case studies that the sales reps can use to actually close deals once they're in the pipeline. So, immediately, sales enablement content becomes a priority because we're working our way backwards and sales enablement content has a higher ROI. It's a higher priority than top of funnel content because it helps us convert the deal. Without that, what does it matter if we have more top of funnel volume?

Run through a similar audit and gap analysis across:

- Product marketing

- Sales enablement

- Nurture content

- Thought leadership

- SEO

And everything else in between. This allows you to identify the highest-leverage areas and fill out all parts of the funnel.

Step 6: Update Org Structure

As you work through demand gen and content, most businesses uncover that there's a lot more work to do for marketing than they previously thought. Often, there's not enough headcount to actually take on that work.

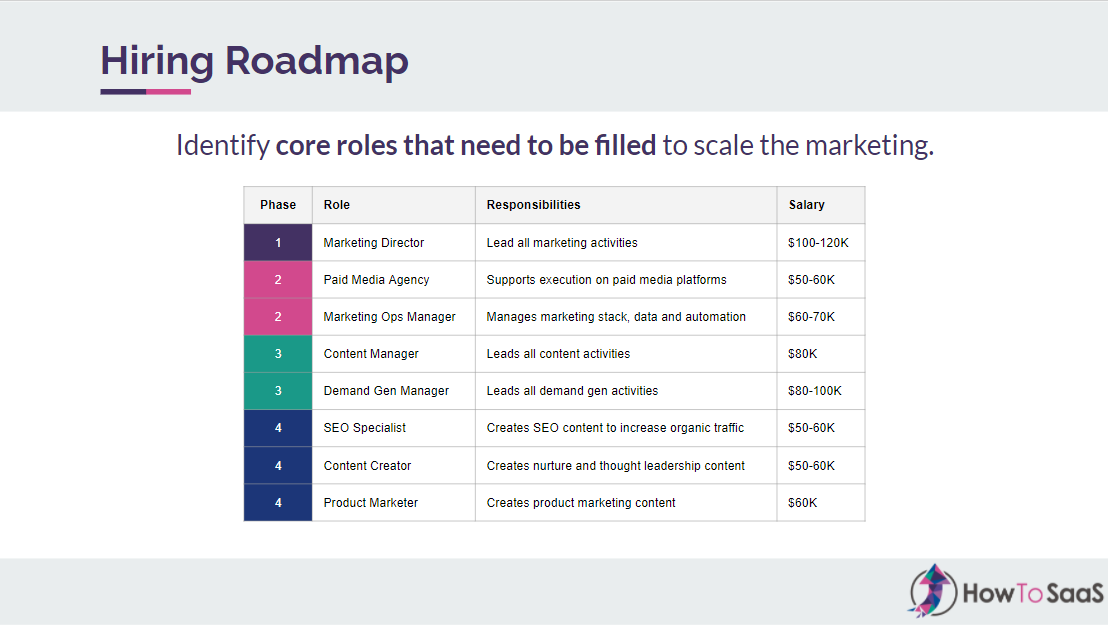

So, the next step is to build out a new org structure, identifying the biggest gaps in the organization in order to capture those opportunities. This usually leads to a change in org structure that looks something like this:

You might need additional headcount, or to move some headcount around, or to repurpose some roles.

You’ll end up with a prioritized list of the positions you need to hire for. Maybe you need a marketing ops leader because your data's not in order. Maybe you need an SEO specialist because there's a ton of top of funnel value. Maybe your paid media agency isn't at the right level yet, or you need more funding for that, or you need a new paid media agency because your current one isn't performing. You need to identify who the people are that you need to take your business to the next level.

Step 7: Analyze Marketing Budget Needed

Look at integrations and efficiencies and places to reallocate your budget. Look at puts and takes in the budget that allow you to free up dollars within the budget already have and make a net new ask for the following year.

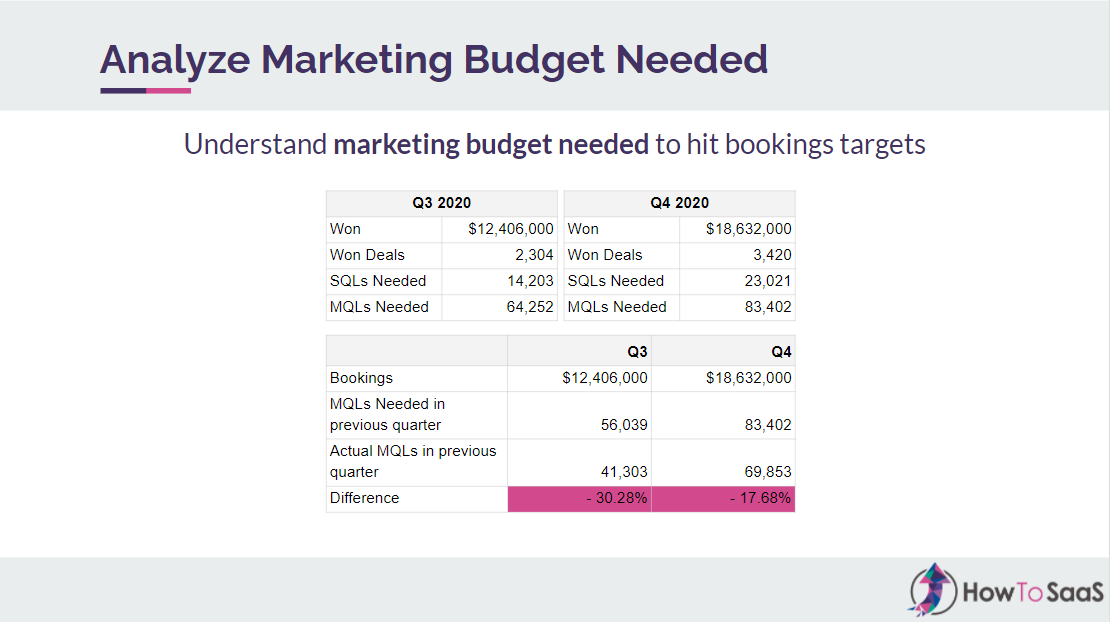

A good way to identify those puts and takes is to start with the pipeline or projections you're required to close for the year and working your way backwards from that. If, in fact, your projections are a finance exercise and not a bottom-up forecast, you'll likely uncover that there's a gap between how much budget you have and the pipeline you need to generate.

Start off with the dollar amount you need to generate in closed-won deals. You can then calculate how many deals, SQLs, and MQLs you'll need in order to deliver on that. Work your way backwards and you'll often see there's a big difference in the number of MQLs you need to generate in the previous quarter to support those targets.

Based on that work, you can now go back to the budgeting piece and say, ‘In order for us to actually be able to hit these targets, we need additional budget, and here are the gaps.’

Let's say you're short by $600,000. How does that $600,000 get split up between programs and headcount? And what is the ROI on that additional spend?

A lot of the things Marketing does are harder to quantify. For example, if you create more product marketing calls, it's hard to say how much each particular asset actually drove in terms of pipeline. But we know that doing all of those activities together will get us to our bookings targets. Think about it at a booking's target level, and then ask for the additional budget and allocate your resources accordingly.

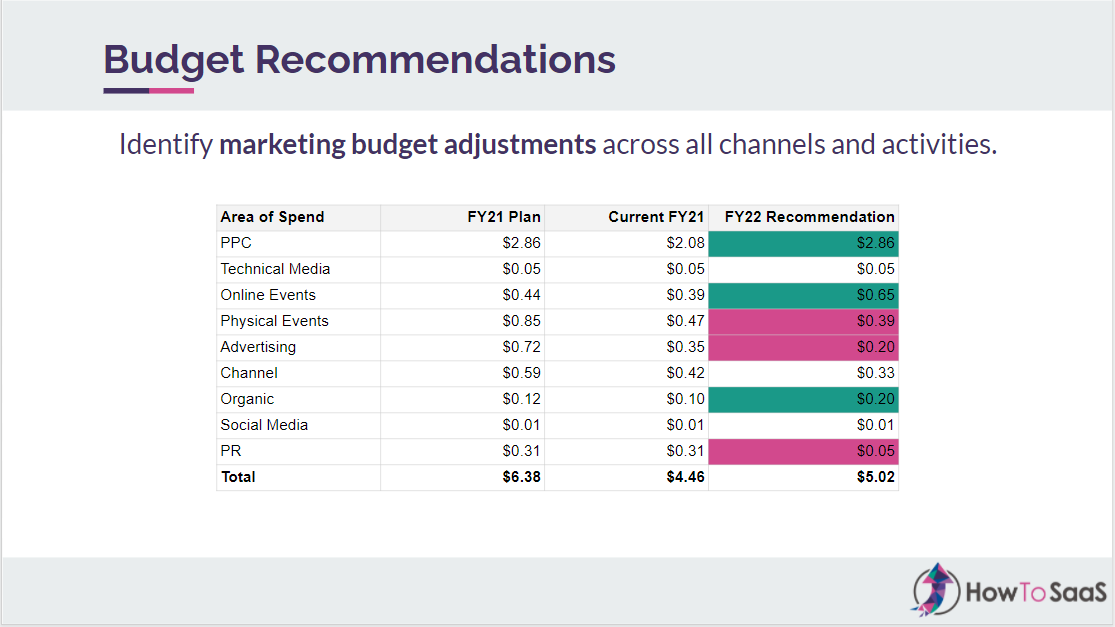

As you ask for more resources, you also need to be able to have a timeline and a staggered approach to those budget asks:

For example, you might ask for funding for four or five initiatives in Q1. Then, as those deliver results, you might increase your investment in those initiatives - for example, bringing on a couple more hires as the year goes on. But your content production will take time to ramp up. You'll onboard the marketing team, and then once the content is live, the real impact might actually be made in Q3 or Q4.

Whatever those dynamics are and the horizon for return from each investment, that needs to be calculated properly. If you promise everybody four quarters of impact because you've asked for more budget here, that's likely not going to be the case. A lot of initiatives will likely start to pay off in Q3 or Q4, so the additional investment is really going to make half a year's worth of impact.

Ultimately, once you’ve done all this work, you can come to the board with a different budget ask. Maybe your current budget is $4.5 million and you want to increase it to $5 million+. You need to show how it breaks down across the different areas of spend, the areas where you’re going to cut spend versus areas where you're going to scale spend, as well as the ROI. You can then take this to the board meeting, or to your CMO or CEO.

The aim of going through this whole framework is to be scientific about marketing and the asks that you're making. This is how you transform from being just a subjective or reactive marketing organization to a proactive one, where data is at the center of it. You're going to make a far bigger impact on the overall pipeline contribution to the business.

FAQs

If mature marketing is driving 30-40% of pipeline, why not 80-90%? Where's the rest coming from?

30-40% or 50% is the most common marketing contribution we've seen. There are elite companies where it might be 70%, but that's rare. In a product-led company, it could be 100%. But if it's an enterprise B2B sale, a lot of it will likely be partner-generated or from referrals or sales, so you have to account for that.

With increasingly complex buyer journeys and larger buying groups, does the notion of individual MQL as a core metric still make as much sense?

This is where this framework needs to be adapted to every business. If you are selling to an entity where there are 20 buyers in place, you definitely have to think about it at an account level. Think about the MQL as part of that larger account and the number of people that are engaging with you. You'd need to adjust for that.

MQLs overall aren't really the key metric. At the end of the day, it's pipeline. There might be 20 MQLs that only really result in one deal, so that's how you ultimately want to measure performance, but MQLs at least directionally help us understand conversion rates through the funnel.

How do you recommend someone who is a head of Marketing, but also the sole Marketing member/individual contributor, jumps through the pyramid as quickly as possible?

If you're a solo contributor, I would zip through levels one and two in one to two weeks, or as quickly as possible, where you get to good enough:

You gather whatever information you can, and then you move to level three and start executing relentlessly on demand gen and content by yourself in order to drive pipeline. You want to actually live on those two levels - you don't even need to live on team and budget because until you prove these two levels out, you won’t be getting any more budget. So if you're over-obsessing on market analysis and segmentation, for example, that's not going to serve you very well. If you spend too much time on those areas, the board will inevitably get impatient, so you have to be careful to not spend too much time there.

The one place you may want to spend some more time is on the strategic plan, because that can inform a ton of decisions in terms of how you go to market and where you do demand gen. Either way, our suggestion is to zip through to focus on demand gen and content, because that's how you'll make the biggest impact on the business.

How do you find leads in the consideration stage for a company with a low marketing maturity?

There are a couple of things that need to be done. Especially when you're earlier on your journey, because you don't have product-market fit or maybe you don't have enough referrals or enough case studies, you actually need to find people who can fit into one of two buckets:

- Bucket number one is people who are in market and looking for a solution. You approach this like a commodity play - you just show up in front of them. There's going to be a subset that actually wants to interact with you and learn more, so you leverage that.

- Bucket number two is focusing on the strategic narrative and differentiated position. You'll attract the people with whom your message resonates and you'd likely find a cluster of super users or super fans who are more likely to want to work with you. For example, with our business, we focus primarily on private equity-backed companies. We technically help all SaaS companies, but PE-backed companies are our sweet spot. Those are our super users and our people that refer us all kinds of business. You want to figure out who that is for you in order to get the highest return and get there as quickly as possible.

How do you calculate acceptable MQL costs?

Look at these conversion rates:

Let's say your average deal size is $10,000, and that 25% of your SQLs get to closed-won. That means that, per SQL, you can only spend $2,500. If 25% of your SQLs get to MQL, you can spend about $500 per MQL in order to break even within 12 months.

That being said, you don't always have to break even in 12 months. Depending on your cash flow situation, how much money you've raised, and where you are as a business, you may violate that rule at your discretion. There are tons of companies that have raised $200 million recently. Everybody's a unicorn nowadays. Those companies are not breaking even in 12 months. What they're doing instead is they're pouring gasoline and they're saying ‘We’ll break even in year two or year three. We want to capture as much market as possible, so we will allow our acceptable cost per MQL to be 3x what we would normally want it to be.’ So, depending on your business context and where you want that payback period to be, you would make a judgment call on your break-even period and acceptable cost per MQL. But 12 months is a good guideline to make that decision.

You talk about activities that should be ramped up in the first three months, but content and website usually take longer to see results?

That's true - in order to make an impact with your website, it might take longer. The point on these two levels is to find ‘good enough’. Maybe you have a half-decent website today, but there's a lot left to be desired. How would you take it to the next level? Everybody wants to overhaul their website. But, every day, you likely still have leads coming in through it. So need to make a decision on how much work to do based on where you are. An overhaul in almost every case is usually not necessary, unless there's an extreme scenario.

Instead, you could pick particular pages on the website that definitely need an overhaul. Maybe it's the homepage, maybe some product pages, or an industries pages that you need in order to increase conversion or speak to your particular audience. You can launch an MVP with those instead of overhauling things, so you can skip to the demand gen piece and driving traffic to a verticalized page, for example.

Let’s say you want to target the 200 top hospitals in the country, and you need a healthcare page for our site. You could just build a healthcare page on Unbounce (or a similar landing page builder), and then focus on a demand gen campaign instead of overhauling the website and having a perfect comprehensive industry section.

What's the best way to attribute MQLs with multiple touchpoints across our blog, email, social, paid events, etc.?

It's definitely a bit of a futile exercise to try to give every channel its due perfectly. Instead, I suggest starting with a very basic model for attribution, which might be just first-touch or last-touch. That's usually good enough where you have enough data to be able to see something that looks like this report:

Getting data that is good enough to pull this report together doesn’t take very long. You don't need a $100k attribution solution - you can do this with Salesforce or HubSpot. Once you have this, you have to triangulate the truth because the data inside this could be misleading.

For example, the Google PPC here looks like it has great cost per MQL, but it's possible that the reason it's doing so well is that we actually went to a physical event and spoke on stage, and then those people ended up finding us on search. In that case, Google PPC gets the credit and physical events don't.

You can build a multi-touch attribution model in a complex sales cycle where there are multiple buyers. But what you really need is enough to say, ‘Based on our understanding and these metrics, we think this is roughly the impact of all the efforts we're making. We're going to continue allocating spend to some of these other channels in order to make an impact.’

How do you understand which content is driving the most quality leads? What metrics do you recommend?

With content in general, it's difficult to think of it in terms of whether a particular asset is more valuable than another asset. Instead, start with your strategic narrative. Think about what your unique story is about the solution for this market, and what your thesis is there. What does each player in this space need to understand in order to win? Build content based on that and then distribute it across different channels.

For Google search, that’s straightforward - if you're selling e-commerce software, for instance, you need to rank for e-commerce software. It's easy to see that you need to produce a content asset for that and it's simple to measure the impact. But there's a ton of content related to e-commerce software that has nothing to do with those search terms. It might be about how to start an online business. You can have a unique take on that kind of asset, looking at:

- What type of online business should you start?

- Should it be an e-commerce store?

- Should you sell online courses?

- Should you start a SaaS product?

- What is the process that goes into an e-commerce store?

With these assets, you're getting into educating the market. You can use this type of content with your strategic narrative to educate customers not only on search but also on paid social and every other channel that you're interacting with customers on.

At that level, you're looking at it less on the value of each asset and more at how much is content an overall contributor, in terms of top of funnel visitors or email subscribers or people moving through the pipeline, because each piece of content helps you nurture people to the next stage.

Are you keen to apply a framework like this to your SaaS business?

How To SaaS helps CEOs, CMOs and investors scale marketing to drive enterprise value. Learn more about How To SaaS engagements.

Subscribe to SaaS Marketing Simplified!

Get bite-sized insights on SaaS marketing, growth and strategy in your inbox a few times a week.