How To Scale Paid Media - Regardless of What Stage You’re At (+ FAQs)

How do you scale paid media to drive more pipeline? How do you think about it in a framework that lets you build scale and grow the business faster?

This post won’t get into tactical details and specific plays, or examples of plays other companies are running - that gets too much into the nitty gritty. Instead, we want to give you a framework of how to think about the problem, how to implement this in your company, and the principles that are almost evergreen, regardless of where you are.

We'll cover:

- The process to scale

- Auditing current spend

- How to optimize, reallocate and scale

- How to identify new channels and campaigns

- Testing and collecting results

- How to adjust budget allocation

- FAQs

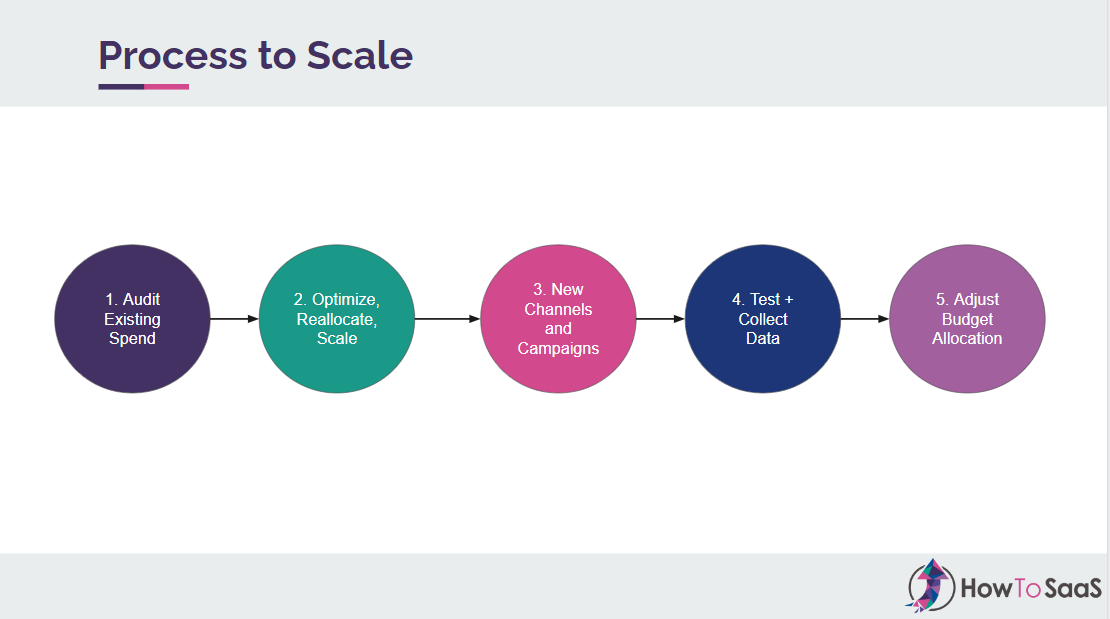

Process to Scale

There’s a five-step process when we're thinking about scaling paid media. This applies whether your monthly paid media spend is $5,000 or a million dollars.

Step 1: Audit your existing spend and see how it’s performing - what's working, what's not working.

Step 2: Optimize, reallocate and scale. Once you've identified which campaigns, programs and channels are really doing well for you and which things aren't doing as well, you likely want to optimize or reallocate budget away from struggling campaigns and to scale up the ones that are working.

Step 3: Identify new channels and campaigns, based on avenues you haven't tested previously but you see as potential opportunities the company should at least experiment with.

Step 4: Deploy the adjustments we've outlined in steps 2 and 3 and start to collect additional data.

Step 5: Based on that additional data, adjust your overall budget allocation. This is where you might lobby for additional spend or optimize and work within the spend you currently have.

Step 1: Auditing current spend

There are three levels to this process:

- Overall spend

- Channel analysis

- Campaign analysis

Overall Spend

Start with a bird's eye view - how much are we spending every single month and how much revenue are we driving?

In this example, this company does incredibly well with paid media. They're spending upwards of $100k in some months, and their ROI is above one on their spend. This means they're breaking even on their paid media spend in the same month that they're spending those dollars.

Obviously, in B2B companies with longer sales cycles, having an ROI like this is quite unlikely. In that case, are you making 10 cents on every dollar that you invest in paid media? That's still pretty healthy because you know that you’re paying back your investment within a year. Or, conversely, are you making only 5 cents for every dollar you invest? At that point, it ends up becoming a point of risk for the business.

This is basic level data. Whether or not you have detailed multitouch attribution set up, you can at the very least have a high-level idea of how much money you’re putting in and how much revenue you’re getting out, so you know roughly if each channel is profitable or not.

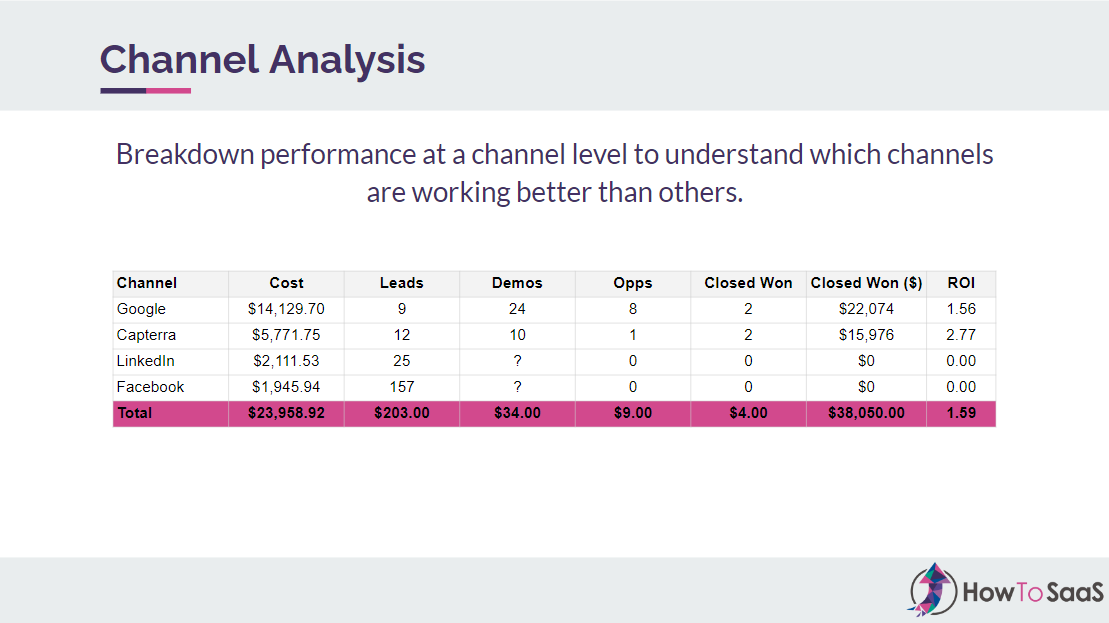

Channel Analysis

Once you understand on a monthly basis if you're profitable or not, take a look at specific channels to see which ones are working and not working.

The example above is from a company that's far earlier in its paid media journey. You can see they're spending about $14k on Google. They got nine leads and 24 demos. Eight of those demos became opportunities, and two led to closed-won. Because they spent $14k and closed about $22k in revenue, that’s a solid ROI - they're breaking even well within their payback benchmarks.

Similarly, on Capterra, they're spending about $6k and getting nearly $16k back, giving them a solid ROI. That's where it's scaling.

You can see that they're not nearly as profitable on LinkedIn and Facebook. While it's early days for this company, this is something to keep an eye on to see which channels overall perform well for you and which ones don't.

One of the common questions we get asked is how to measure Google versus LinkedIn versus Facebook. People point out that Facebook is usually last-touch, not a first-touch channel. Sometimes people watch a video on Facebook and then come through branded search, so Google ends up getting the credit.

All of those things are definitely true, but starting off with a basic report like this can give you a pretty good idea of what's working and what's not. And then you need to triangulate the truth with additional data points. For example, maybe on this $2k ad spend on both Facebook and LinkedIn you got hundreds of thousands of views on certain videos and you see a branded search spike.

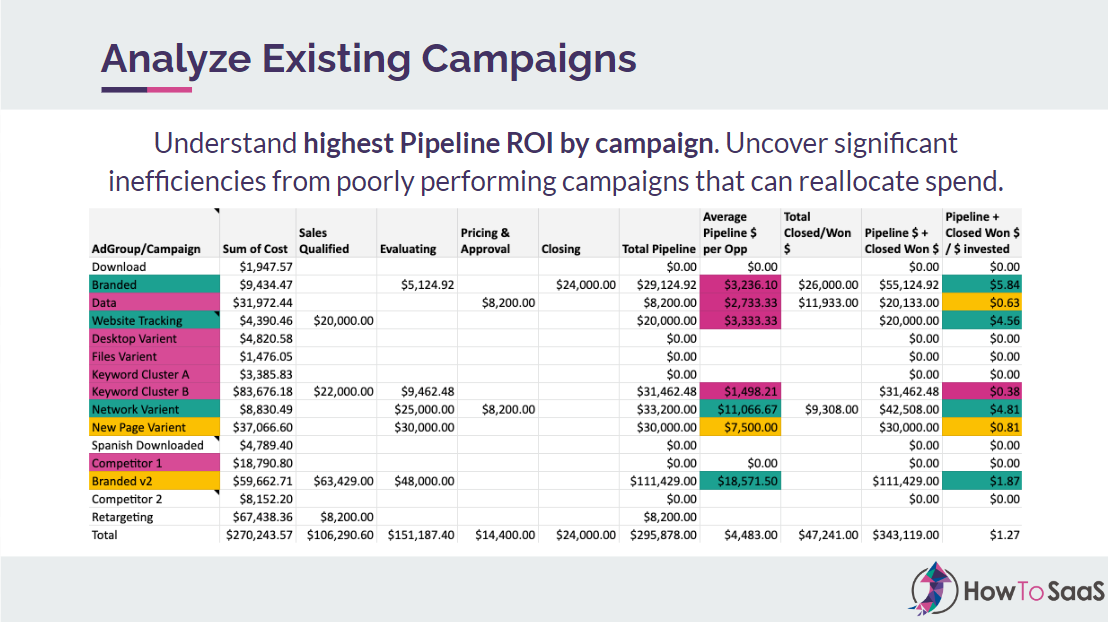

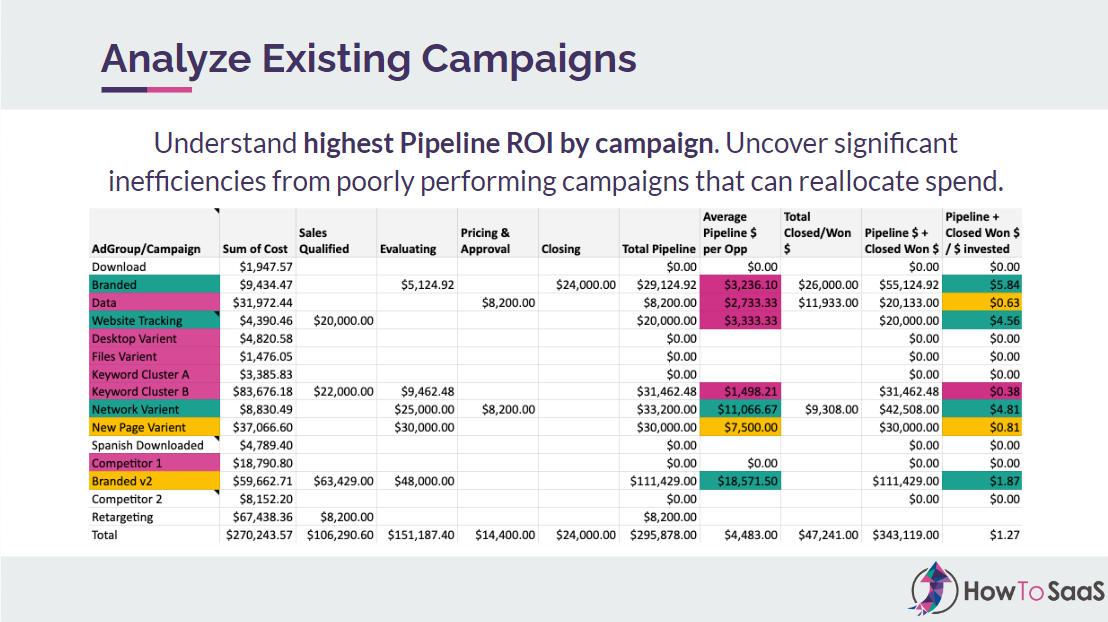

Campaign Analysis

Then, you want to look at your specific campaigns. What's working within a specific channel, and what's not?

For example, within Google ads, this company's spending about $270k a month on paid media. There are some campaigns that are performing far better than others - you can see that in the far right column that shows pipeline plus closed-won invested. There are some campaigns that are returning 2x, 4x or 5x on investment, and there are other campaigns that are only making 38 cents on every dollar invested. Immediately, those become opportunities to either reallocate or optimize spend.

They're spending about $83k on keyword cluster B and getting 38 cents on the dollar back. On the network varient campaign, in comparison, they're spending about $9k and they're getting $5 back for every dollar invested on a 12-month basis. Reallocating spend from keyword cluster B to this campaign makes a ton of sense. Without doing this exercise, it’s very hard to identify where you need to make those relocations or optimizations.

There are also places where, instead of reallocation, you need to tweak and test and optimize. For example, the new page variant campaign in this example is spending about $37k and getting about 81 cents on the dollar, which is not bad. In this case, you might need to:

- Change your ad copy

- Change the keyword clusters associated with this ad

- Change your landing pages to improve conversion rates

- Look at your down-funnel experience for that particular set of keywords. Do you have a different nurture stream and is the sales team reaching out in time?

If the 0.81 ROI can be bumped up to 1.5 immediately, this becomes a campaign where we can reallocate additional budget.

Similarly, if we look at the spend at a campaign level in the example below, you can see that display retargeting is not doing anything really for them. There's no pipeline, even though there are a bunch of MQLs. It seems like they're getting low-quality leads here.

Conversely, if we look at some of these late funnel campaigns, they're doing incredibly well - particularly this late funnel C campaign (and the branding campaign, which is more obvious).

Looking at the late funnel C campaign, they've generated about $500k in opportunities on $90k spend. And they've also closed $250k out of those $519k opportunities - almost a 50% conversion rate to closed won. Immediately, this campaign becomes a place where you want to put even more budget than the $90k per month you've previously allocated.

Step 2: Optimize, Reallocate and Scale

So then the question becomes: how much more should we invest?

Identify Room to Scale

Depending on the channel and the campaign type you're looking at, the metrics to identify the room to scale are different. Particularly with search, a really good indicator is search impression share. What percentage of the time are you in the top four results? How often is that being lost due to budget versus rank?

For the late funnel C campaign you can see in this example, this company is investing $90,000 but is only showing up in the top four results 68% of the time. A quick win here is to get this number up to 90%: you would immediately see a ton of more conversions, a ton more pipeline and likely even more closed-won deals.

For a similar metric for paid social, you could be looking at ad frequency. If you've identified a list of contacts or prospects that you're targeting, how frequently do they see your ad? Are they seeing it once or twice, or are they seeing it 10 or 12 times?

If they've seen the ad 10 or 12 times, you're likely be at a more saturated state with that audience than if they've only seen it once or twice. If they've seen it once or twice and it's an incredibly profitable campaign for you, you likely want to put more budget into it so your prospects see it more frequently and are able to engage with it. Over time, if it gets to the saturation point where they've seen it 10, 20 or 30 times, you’ll potentially need to change up the creative or the offer to get the same audience into a different stage of the funnel.

In the slide above, we're using search as the example, but the same principles apply across different channels.

Analyze Total Potential Spend

Similarly, here's another company where, across the board, almost all their campaigns except branded search has a SIS is under 50%, and paid search is quite profitable for them. There's a ton of opportunity here if you identify all these campaigns and double or even triple budgets.

This company is running 10 campaigns that are costing about $100k a month. But you can see that campaign one eats up a bulk of the budget and the rest of the campaigns are mostly under $5k or $10k.

Forecast out the maximum amount you can spend on these particular campaigns. While this company is spending $100k a month, they actually have the potential to spend an additional $500k a month on these campaigns.

That’s not to say that you would scale to $500k right away. This part of the analysis is just to say how much more room is there for us to get in front of the right audience.

The second step of that process is to gradually increase the investment each month, identifying if your cost of acquisition is still in check and your payback period is still within 12 months. For example, at a monthly spend of $500k, it may turn out that the payback period is actually two years because you're having to overbid the whole competition. In this case, you probably wouldn't normalize here - you may end up normalizing at $220k instead.

By doing this exercise, you're able to identify how much more room there is in your market. Given how many conversions you have, where do you think there are opportunities to invest a lot more budget?

Review Total Spend by Funnel Stage

Next, take a look at where the spend is going by funnel stage.

One of the most common things we like to preach is working backwards: starting from people at the bottom of the funnel and working backwards to people who are less ready to buy and need more nurturing.

That being said, the more mature your organization gets and the more performance there is at the bottom of the funnel, inevitably, you need to move allocation higher up in the funnel.

In the example above, this company is spending:

- 7% of their budget at the top of the funnel

- 37% of their budget at the bottom of the funnel

- 56% of their budget at the middle of the funnel

What you'd likely want to do here is to increase budget allocation to the bottom of funnel, decrease allocation to the middle of funnel, and give a little bit more weight to the top of the funnel so we can get more top-of-funnel leads.

There is a bit of a caveat here. At the top of the funnel, you're going to find more expensive leads, so you want to ideally only go there if the middle of the funnel is maximized or it's inefficient, just to find some additional opportunities.

But, in a lot of cases, in companies that have reached some level of scale - for example, the company in this example is spending over $250k a month - focusing more on top of the funnel makes sense. If you're earlier in your journey, bottom and middle of funnel should eat up most of your budget - or maybe even just bottom of funnel.

Review Channel Spend by Funnel Stage

Similarly, you want to look at the breakdown at a channel level to identify where the opportunities are.

Within Google, LinkedIn, and Facebook, there are different sets of campaigns you can run at every stage of the journey to identify whether you’re actually optimized at every stage of the funnel.

On Facebook and LinkedIn, a bottom of funnel campaign might be a retargeting ad to anybody who's been on your homepage or your pricing page. A middle of funnel ad might be to somebody who downloaded a white paper and who you're trying to encourage to come to a demo or webinar.

If you’re under-investing in bottom of funnel campaigns, it's a good idea to ramp up your allocation before you get to a top of funnel cold prospecting campaign that's targeting a job title or a Clearbit list you've created.

As you’re ramping up from bottom to top of funnel, ideally you want to look at this across all channels. You might start off with:

- Late funnel advertising on Google with branded search and competitor search campaigns

- LinkedIn ads retargeting custom audiences

- Facebook retargeting

You can then slowly layer on additional campaigns.

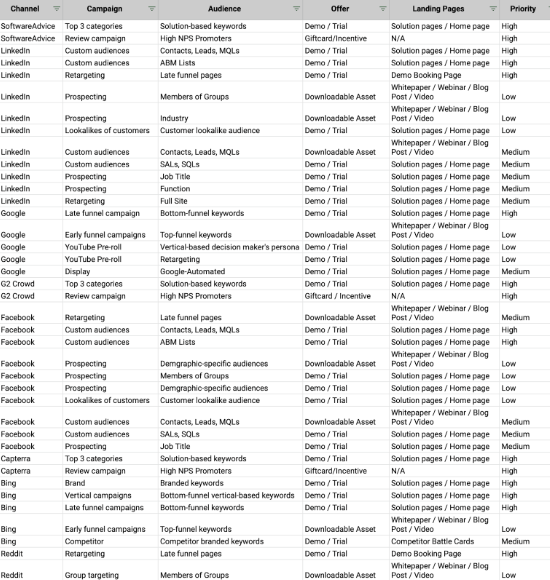

Step 3: Identify Additional Channels

As you go through that analysis exercise, identify additional channels where you can invest your paid media dollars. Here, you can look at which channels play a role at each stage of the buyer journey to get them through to the next stage.

Channels like Google Ads, Capterra and G2 software advice are often in this consideration stage where people are already ready to buy.

Facebook and LinkedIn are more nurturing and cold prospecting channels unless you're using retargeting to bring people through your funnel and moving them to the next stage.

At the same time, channels like Capterra and G2 also play a role as a research tool. If somebody's in the awareness stage and is searching for ‘best membership management software’ or ‘best sales enablement software’, for example, they're likely going to come here, read a bunch of reviews and testimonials, and then go to multiple competitor sites and maybe set up demos on multiple sites as well. You'll likely want to be active in these channels for that reason.

The last group is people who are in the unaware section and don't really know a solution exists. Maybe they have some level of problem awareness, but even on the problem side, they need more education. Leverage platforms like LinkedIn, Google, Facebook and Reddit to educate them on what the problem is and to start looking for a solution.

Look at the additional channels you need to build out these stages. Each of these channels will have a list of campaigns at each stage, and you can map all of those out to create a roadmap.

The diagram below is a simplistic version, but if you were to plot your company into one of these three stages, it would give you an idea of what level of maturity you're at.

- Stage 1: Companies that don't have some of the basic campaigns live, fully optimized or scaled up. For example:

- Late funnel branded and competitor campaigns on Google.

- Listings on the top three relevant categories on Capterra and G2.

- Retargeting custom audiences on LinkedIn.

- Retargeting on Facebook and Instagram.

- Stage 2: Companies that have a bunch of those campaigns launched. Here's where you:

- Launch mid-funnel campaigns on adjacent competitors. For example, if you have a note-taking app, you might start looking at productivity software keywords, or other competitors.

- List in adjacent categories that are similar to what you do. For example, if you're a sales enablement software, you might want to list for content management system categories.

- On LinkedIn, you're doing cold prospecting to the ICPs you're going after.

- On Facebook and Instagram, you're using some custom audiences.

- Stage 3: Once companies have optimized stages one and two, you're likely going to the top of the funnel and trying to find people who are unaware with early funnel and cold prospecting campaigns.

If you look at the most sophisticated SaaS companies, they're often playing at stage three. But the mistake many other SaaS companies make is that although they're not really at stage three in terms of maturity, a bunch of their budget is going to stage three programs.

While you do want to bring people who aren't yet aware and who aren't in the market into your funnel, you need to start with people who are in the market to get the flywheel turning and provide proof points for which paid media campaigns are actually contributing to the business. So, building out all these campaigns in stages one and two are essential before we get to stage three and start talking about things like the dark funnel.

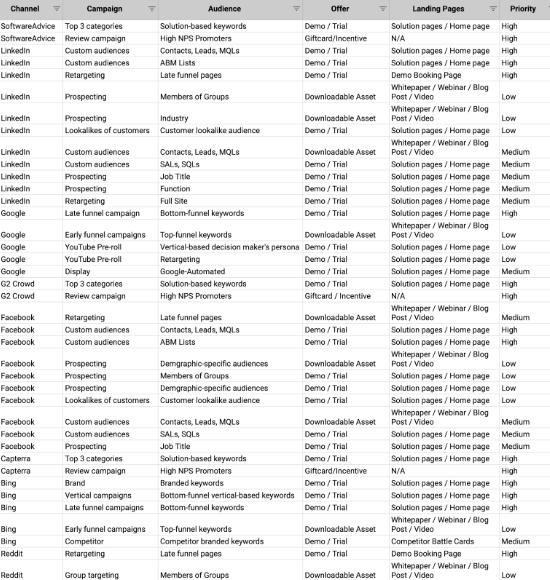

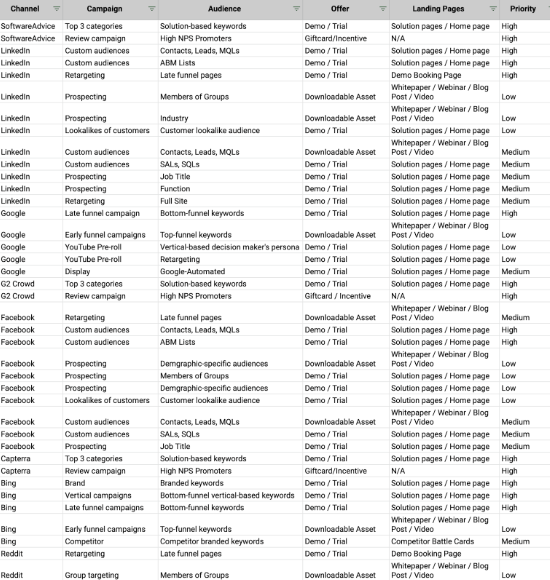

Build a Roadmap

For each single channel and campaign, you want to list out all the potential campaigns you could run on that platform on LinkedIn, Google, Facebook, Bing, Reddit, etc. List out all the potential campaigns and prioritize them.

For example, a LinkedIn retargeting ad to people that went to your homepage or pricing page is more important than a LinkedIn ad that is targeting everybody that went to your blog. They're both retargeting campaigns, but retargeting people that have gone to your blog is likely not your highest priority.

For the most part, you don't want to have dedicated funnels for people that went to a blog post on cyber security, for example. You could offer them a guide on cyber security to put them in an email sequence and nurture them through to a demo. But, alternatively, you could just focus on the people that have been to your homepage, pricing page or demo page and try to get them to the next stage in the sales funnel.

You want to go through a similar exercise for every single channel, identify all those different campaigns and say: what comes first? Do we need a YouTube pre-roll ad? Probably not, if you don't have a late funnel campaign or competitor campaign set up.

As you prioritize the campaigns, it's likely going to turn out there are 20-30 campaigns you've never launched but you need to launch first before you get to those earlier funnel campaigns.

Budget Allocation

What you eventually want is to build a budget allocation. Looking at it by channel and by stage of journey, how much budget do we want to allocate to each of these areas?

It might turn out that your split looks something like the following table. In this example, the company has $80k to spend:

- Google is getting $20k

- LinkedIn is getting $20k

- Capterra and software advice are getting $16k

- Facebook and Reddit are getting $12k

This becomes your experimentation budget.

Step 4: Test and Collect Results

As you launch the campaigns, it might turn out that the Reddit campaigns were a total miss, for example, while the ones on Capterra and Software Advice went really well. In this case, maybe you reallocate budget from Reddit to Capterra.

Overall, Facebook retargeting is doing fairly well in this example, so let's keep that going. But let's say that only half of that spend is actually bringing in leads, so perhaps you allocate the other half to LinkedIn. You could also scale up Google because that's working really well, so maybe instead of $20k you increase that spend to $30-40k.

Start off with this budget allocation, but it's never set in stone. Part of your job is to constantly keep tabs on it, to make sure that you're updating it on a month-to-month basis.

How we do that is by launching the ads and collecting results. Similar to what we were looking at earlier in the campaign and channel analysis, you need to start doing that on an ongoing basis to measure what's actually working.

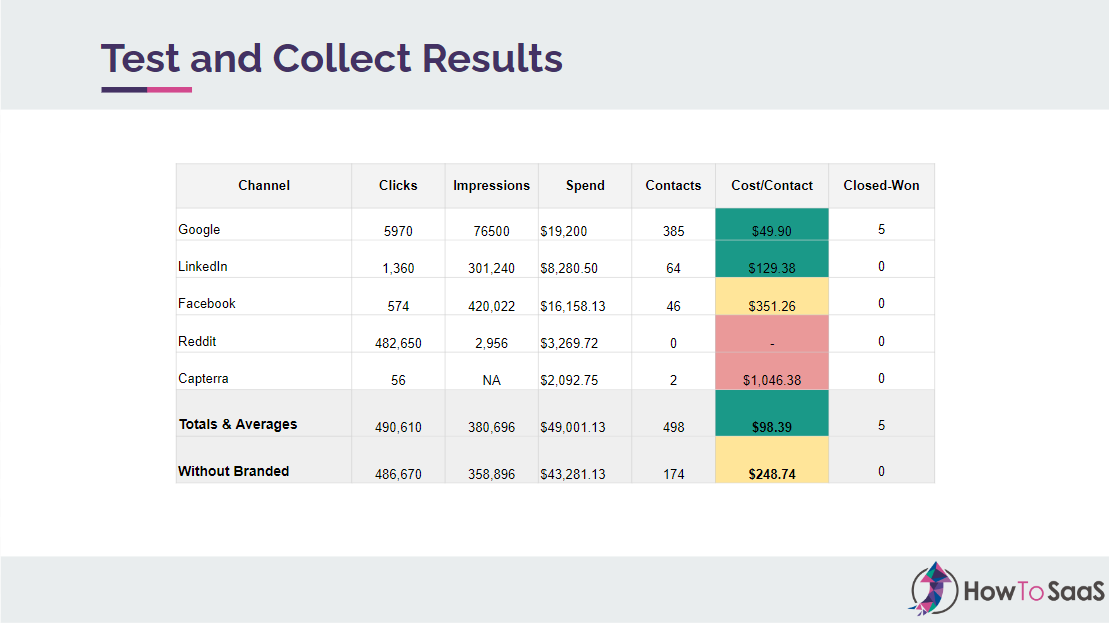

As an example, Google and LinkedIn are working really well. Facebook is kind of working and Reddit and Capterra are not working at all in terms of contacts generated. But then if you look at closed-won deals, only Google seems to be working in this particular case.

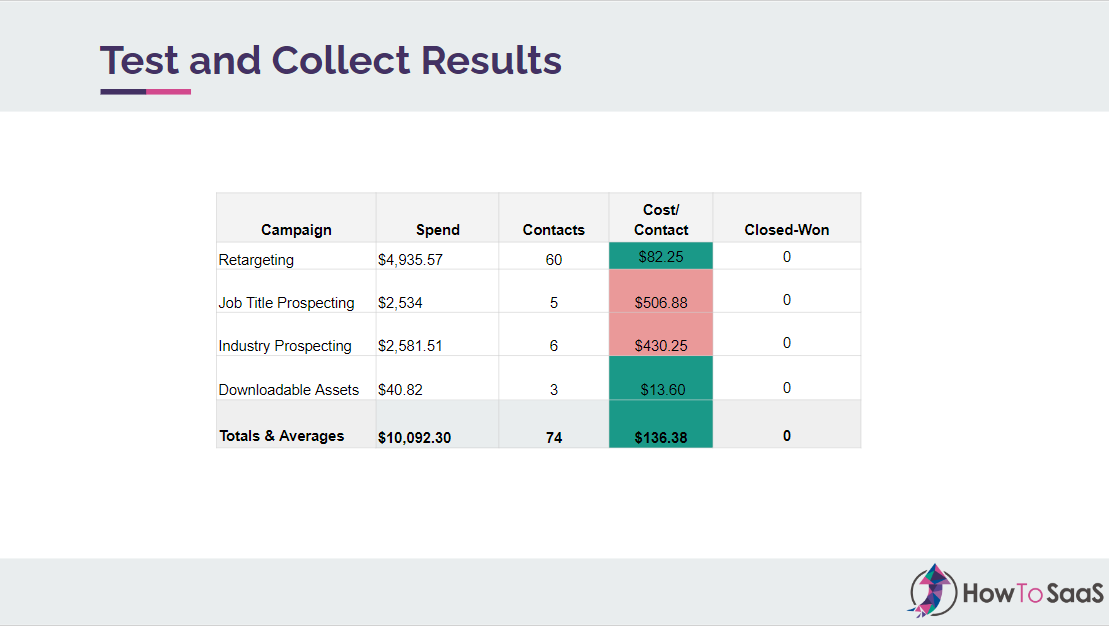

Similarly, when we look at the company above and their spend on LinkedIn:

- Retargeting is generating a ton of contacts

- Prospecting campaigns aren't doing that great

- Downloadable assets are doing fairly well, even though we haven't spent that much money here

This gives us some idea of which campaigns we want to potentially scale up or scale down. We can then bring this data to a budget allocation step.

Step 5: Adjust Budget Allocation

Let’s say our January budget was $85k and we actually spent $80k.

- Instead of $50k, we want to spend $62k on Google in February.

- We want to reduce our spend on LinkedIn, Facebook and Reddit.

- We want to slightly reduce Capterra spend to $4k.

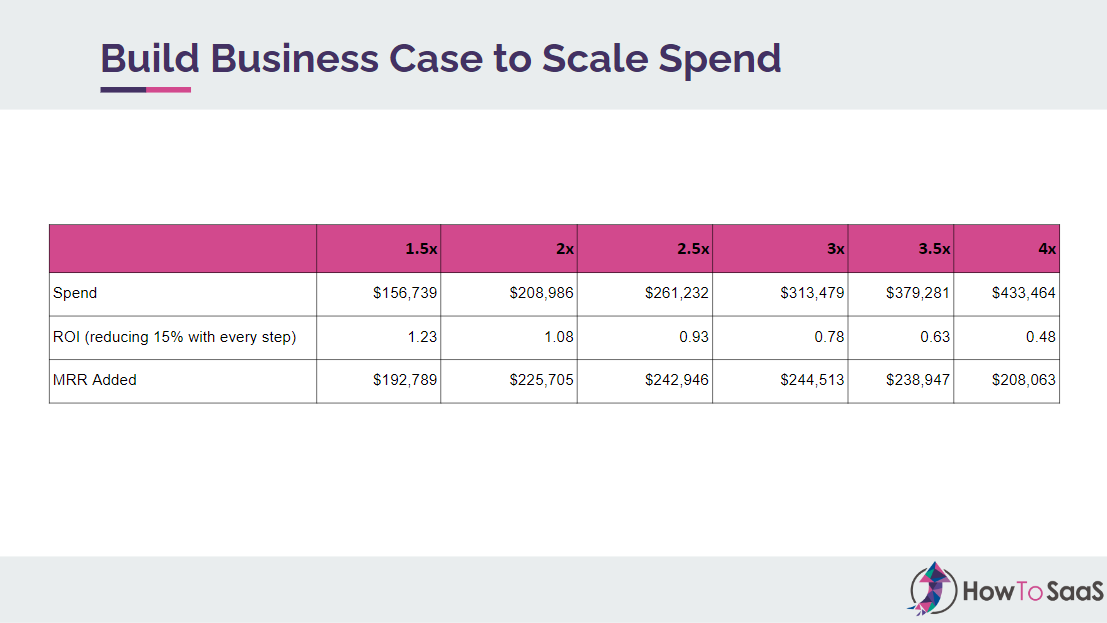

At the same time, we want to build business cases. As we go through budget allocation exercises, it'll likely turn out that some campaigns are working really well and we'll need a lot more budget to scale them through to the next level.

That means forecasting out what that spend will look like.

If we increase our spend by 1.5x, we still have a significant ROI and we add a ton of MRR. But if we increase it by 3x, our ROI decreases from 1.23 to 0.78. So, although we add more MRR, we're actually losing money over the 12-month period and our payback might be like 14 or 15 months.

We want to normalize and understand what the break-even point is and what we're comfortable with. We could spend more, but we're going to get less efficient as time goes on. Maybe the point at which we normalize is at 2x current spend where we can still break even within a year and we're able to add a ton of MRR.

In order to calculate these numbers, you need to do the analysis above, and also take a look at the MRR and churn rates. It might turn out that you're bringing on $225k MRR but half of it is churning within the first three months, so your ROI calculations are broken. Keep an eye on not just the conversions and closed-won deals but retention too - especially when you're dealing with month-to-month contracts and a lower ACV.

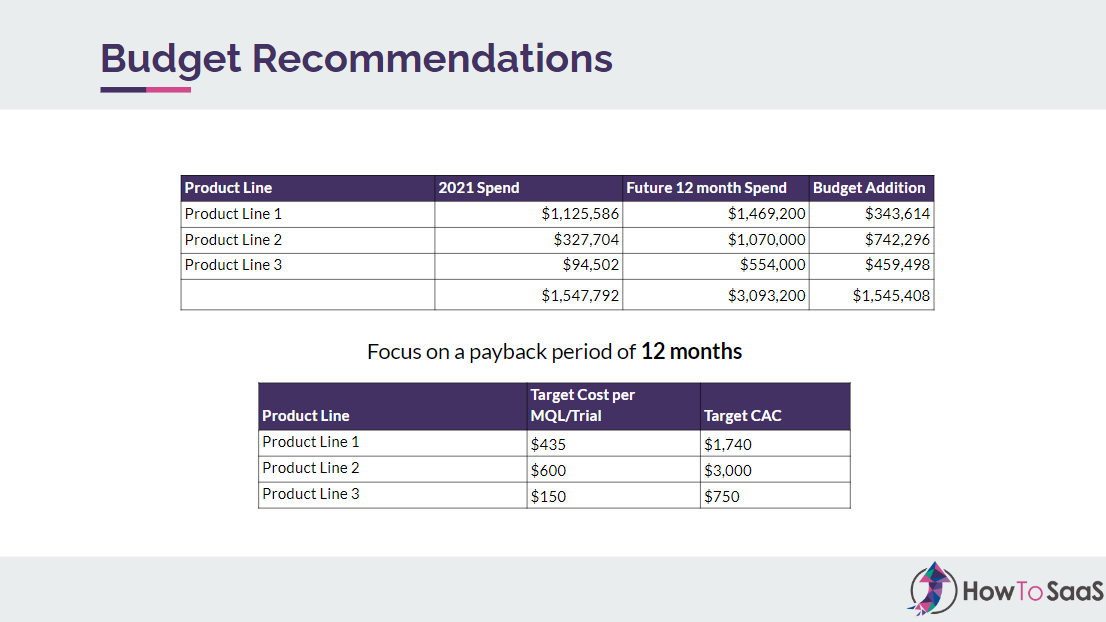

Assuming that those numbers do hold up, you want be able to come to your CEO or board for an increased budget allocation and say: "we used to spend $125k a year and we want to change that to $300k a year on paid media. Here's how that breaks down by channels, and we have the underlying data to support it."

You could also split this up by product line:

- Product line 1 goes from about $1.1 million to $1.4 million

- Product line 2 goes from $300k to $1 million

- Product line 3 goes from $95k to $500k.

Our total budget goes from $1.5 million to $3 million for paid media, and we're doubling our overall paid media budget.

It's also vital to present a way that you'll track accountability on this. For example:

- Keep the payback period within 12 months.

- Target a certain cost per MQL/ trial

- Target a certain CAC rate

If we're within that range, that means we can keep our spend at these levels. If we're not, we need to make further adjustments and optimizations.

At the end of the day, this is where we want to end up: to be able to come back with a budget recommendation that allows us to scale up.

Final Thoughts

What you're seeing in this blog post is a mechanism for constantly measuring and having that discipline to check in weekly, monthly, quarterly, and annually to see what's working and what's not. It's also a mechanism to have numbers you can bring to an executive team meeting or a board-level meeting to say that, yes, you can scale up the number of leads, MQLs and SQLs you have in the pipeline. But, to do that:

- Here's how much more investment it's going to take

- Here's where we're going to deploy

- Here's what did and didn't work

- Here's how we know we're going to be able to scale to the next level

FAQs

- What's the biggest mistake you see people making with paid media?

- What are your thoughts on reporting on branded campaigns separately?

- How can you accelerate this process?

- How are you know the ROI change on a campaign?

- What are your thoughts on paid media management software?

- How does category creation affect paid media?

- What types of creative unpaid social work best for B2B SaaS?

- Do you have a best practice roadmap?

- Do you measure cash collected?

- What software do you recommend for campaign-level revenue tracking?

- How do you recommend using paid media for ABM?

What's the biggest mistake you see people making with paid media?

I'd say the number one thing is this idea of allocation by stage of funnel and doing the wrong things first.

This is an underlying framework we've shared in the past, which is this idea of hot, warm, and cold swim lanes attached to stages of the buyer journey.

The idea is that we need to work backwards from people who are most ready to buy in this top right quadrant to people who are not yet in-market.

There is a good number of marketing resources and content out there that suggest you need to focus on just thought leadership content as a way to drive market demand. That has some validity. But what I find is that a lot of marketers over-index on that, and don't do some of the basic playbook items that need to be done to build the internal political capital to fund those activities.

For example, if you go and launch a podcast and do a ton of sponsored video content on Facebook, you may build your brand over the course of five years. But if in the next six months you don't increase pipeline, you're going to lose your job as a marketing leader and you won't be able to see that playbook through.

So a really big part of making this playbook a success is starting with some of those quick wins and working our way back to other opportunities.

You also have to trust the product. This is a really big lesson as a marketer: if you're at a company that has a phenomenal product that’s capable of converting and has a good sales team or good customer success team, doing the right plays in the right order goes such a long way. Those other assets that the business has - like the product, a free trial, or a sales team that is really good at converting - those will also do their job, but your job is to actually get people in front of the product or the sales team in order to convert, and having a lot of trust in that goes a long way.

If you're in a place where the product or sales team is incapable of converting, then we have a much bigger problem and almost need to go back to the drawing board as a business. But as a marketer, you have to have faith in that overall funnel.

I saw you reported on branded campaigns separately. What are your thoughts around that? Is the assumption that branded should always perform better down the funnel?

In a lot of cases, I would say that's probably true. Branded in general leads to higher conversions because people have often heard of you from somewhere - they might have gotten a referral, or know you from some research they've done themselves - and they just come to your site directly and convert.

We think that looking at branded and in isolation is tricky because a lot of the nurture content will influence the branded conversions. So that's why when we come back to this overall monthly report:

You need a monthly report of how much should we spend each month, how many MQLs, SQLs or opportunities and closed-won deals we have each month. Look at the overall trend as a way of informing, if all the different components in the marketing engine are actually driving value, and branded becomes a part of that.

But, for example, if there's a significant lift in branded after you've been putting out a lot more content, well, the content is definitely helping branded search. So you kind of wanna factor that in when you're looking at branded results.

If you're under a time pressure to deliver results from paid media quickly, how do you recommend accelerating this process?

Start with the quickest wins and people that are most bottom-of-funnel to validate initial spend. Especially recently with all the different cuts to valuation and the state of equity markets you all have probably seen and money is much harder to come by, having a payback period of 24 months just doesn't work. It was easy when everybody was getting a unicorn valuation. Those metrics are what matter and what you want to bring to the board level:

Let’s say you start with 10,000 in. We per month and generate $12,000 in Mr. From that. Your payback is in a healthy place. And now you want to scale to the next level where instead of $10k, you spend $25k, and you want to deploy it on mid-funnel or earlier funnel campaigns. And then come back in a quarter or so and show that that $25k per month is now generation $27k in ARR.

That's how you slowly increase it. If instead you take that $10k, put it all into launching a podcast and do it for six months, it's not going to be the best result in the short term, and the pressure will eventually lead to somebody getting fired.

How do you know that ROI on the campaign is reduced by 15%?

We are obviously making some basic assumptions. For example, let's say we were advertising for something very competitive, like eCommerce software. I could get in the market with some initial ad spend, let's say $100k month, but to go from $100k to $1 million a month, I'm now going to be competing far more heavily across all terms with Shopify. So whatever I put my bid at, they're gonna overbid me. And then it's kind of do a bidding more with other players to like Wix and Squarespace and things like that.

So, inevitably you have to have some basic assumptions - it's not an exact science, and in some cases, you'll have more information, because you'll know exactly what competitors are spending or you'll have historic data. But in other cases, you have to make an educated guess and then test and adjust your educated guess to be able to come with that.

But, at the very least, 10-15% decrease with every significant increase in spend makes a ton of sense in terms of what we've seen.

What are your thoughts on paid media management software that now allows you to manage everything from one platform and use algorithms to manage ICPs, change bids, etc?

Using bid optimization software is not a bad idea. People use a CUO people use, you know, word stream for certain things and those kinds of platforms are good. But I would still say that those platforms are only as good as the user or the person that's guiding the strategy. So whether it's an agency or an internal team doing it, it's really dependent on that.

So even if you leave it to its senses, it may turn out that you have a broad match campaign running, and it's just optimizing for that. Perhaps the broad match is capturing all kinds of additional keywords that don't really optimize for what you sell. That's why we encourage people to look at this type of campaign analysis to see the pipeline all the way through to closed-won.

Tracking this on a monthly basis is really good practice for a demand gen manager to know that although they may be optimizing with software, is there down funnel pipeline that is actually closing and leading to business for us at an acceptable rate?

How does category creation affect paid media, if at all?

Category creation is a really hot topic right now and I think every company needs a unique tilt in terms of how they think about their business and how they differentiate themselves in the market. What we are walking through here is a systematic framework to scale up the technical campaigns you're running. On a category creation side, we would start off by seeing what the category is that we want to create and what is the core messaging to differentiate ourselves?

For example, with How To SaaS, we think of ourselves as a marketing management consulting firm. We are not an agency, and we don't try to compete for agency business. So when we think about us as that specific category, there is not a ton of demand for that if you were to just look at Google search volumes. But what we do is we create that demand by having the right story, the right content behind that, and then leveraging the right platforms to get people into our funnel. That might mean building custom audiences on LinkedIn, or targeting CEOs of large software companies, or running a campaign for fractional CMO and Google AdWords.

But then as they enter the funnel, the content they encounter is not a tactical solution. It's not like, ‘optimize your Google ads and come work with us’. It's more about helping you build out your marketing strategy. We help you build out your, uh, looking at investments and looking at their marketing potential. And when they see that messaging combined with the tactical campaigns you see in this presentation, that comes together on the category creation side. But that's just on the paid media front. On the content front, that's why we have books, why I put out my drawings on LinkedIn, and why you see our webinars. It's all part of that process, but paid media needs to combine with that overall strategy.

What types of creative unpaid social are working the best in B2B SaaS right now - high production or content that feels really organic?

There's a bunch that I think are worth testing, regardless of what type of solution you're selling. Coming back to this roadmap, you want to test all of it.

You may, for example, want to run an ad to a downloadable guide. There's a ton of content out there that says to ungate everything. In some cases, you may want to test a gated piece of content and get somebody into your funnel. In another case, you may want to just do a two-minute video that directs straight to a landing page or a demo form. in other cases, just a video in itself. And you're just directing it to the consumption.

You want to test out all these campaigns, but the key is to do it in the right order. If you just launch video ads across the board, without any calls to action, just to build your brand, that kind of looks like you're doing a short value-add video. My guess is that if you're a B2B solution, that's not gonna work as your first go at what you should do with paid media. Instead, build it step by step - do you have late funnel assets built out, or late funnel campaigns live, and the right assets as collateral? We need for those campaigns and then work your way back to something like that.

In general, case study ads, downloadable guides, videos… everything really works - i's just a matter of where you are on your journey and what's the right campaign you should be investing in next.

Do you have a detailed blueprint for a best practice roadmap? For example, a standard paid media and campaign setup?

This depends on if you're asking for the right type set up across different platforms. I would say what you're seeing on this slide is the right way to think about it:

If you're asking about the best technical way to configure Google ads, there are people that I would say are better at that than we are because agencies have that dialled in a lot more than we do, but really it's about thinking about what is the right roadmap for configuring all that and coming back with the right set of campaigns. What is the order you're working on? The campaigns are almost more important than the technical because the technical is almost a commodity at this point. There are so many agencies and freelancers that do paid media, but if you can just configure a basic retargeting or late funnel ad, you've already won half the battle. I would say the better question is what is the right order to do these things in?

Do you measure cash collected or is this totally based on total customer value/contract value?

Contract value should be the starting point when you're looking at closed-won revenue. When the deal closes, you don't really know churn rates, but you want to measure your overall cash collected and churn rates throughout the funnel and get that as a feedback after the fact, so really good demand gen leaders check the downstream implications of their campaigns.

Let's say campaign one had a payback period of six months, but the customer is mostly churned by month three. It's not really a good campaign at that point. On the other hand, campaign two could break even at 12 months and have an LTV of five years, so you want to look at that.

The second part of this: let's say you are prepaying for the annual contracts. It may turn out that a customer is paying for year one on month one and year two on month 13. So technically you get two years' worth of payment within 13 months. That's really important from a cash flow perspective because cash flow in 13 months is actually 2x your annual contract. If you were being aggressive with paid media, you could decide to break even on month 15 because you are cash flow positive by month 13, regardless. That gives you the freedom to spend more upfront. A lot of companies don't do this, which is kind of surprising, given that you are collecting the cash, you're not in a cash flow negative position if you're being more aggressive with paid media - especially if you know customers are gonna stick around with you for 2, 3, 4, 5 years.

What software do you recommend for campaign-level revenue tracking for non-SaaS/eCommerce products?

Basic level campaign tracking inside Google ads. If you're using Shopify or something, you should have enough with a combination of Google data studio, Supermetrics and a couple of other middleware tools. Overall, if you have Google Analytics configured and you have the right tagging on each of the campaigns, you should be able to triangulate the value you generating from a lot of these campaigns.

If you're on the B2B SaaS side, there are a bunch of attribution tools out there. You can go from something that's complex as visible. there's a platform called dream data, there's a bunch of other software platforms out there. I will caution against attribution software - it can be complex to implement. It ends up becoming a very big project when really base level first touch or last touch attribution is enough and your HubSpot or Salesforce or part on in combination can give you a pretty good report to make decisions without necessarily adding another attribution, software tier.

How do you recommend using paid media for an ABM approach?

It's definitely different than an inbound approach. When you're thinking about Google - let's say you're targeting the biggest 100 hospitals in the country and targeting one or two specific roles inside those hospitals - Google's not going to do much for you in those instances. Here is where some of the air cover and more content-driven campaigns like unpaid social are far more valuable. You almost need nurture streams built out on social with a combination of video and other assets to your ideal customer profile on LinkedIn and Facebook, especially depending on the audience, to be able to nurture them through.

Having a platform here can be helpful, like a six sense where you can target micro audiences with content that's specific to their account, and working directly with the sales team so if they're reaching out to these 10 accounts in the next quarter, you focus your marketing campaigns, collateral, and programs on these channels to those 10 accounts as well, so you're working together with them.

Subscribe to SaaS Marketing Simplified!

Get bite-sized insights on SaaS marketing, growth and strategy in your inbox a few times a week.