4 Critical Inputs for Your Marketing Team Structure

It's a question a lot of our clients ask us: what does your marketing team need to look like for you to maximize the value you're capturing?

There’s no quick answer here: depending on where you are as a business, the answer is going to look different.

In this post, we’ll walk you through a framework for building the right marketing org structure for your particular situation.

4 considerations when structuring your marketing team

The realities many organizations experience are that:

- Marketing teams are usually small and mighty. They're usually in charge of a lot of items, projects, tasks, initiatives, and large revenue targets.

- Aggressive growth targets are being set by the board or by the executive team. There isn't nearly enough bandwidth to execute on what's needed to hit those targets or do all the activities you need to take the company where it needs to go.

- At the same time, there's an inability to get approval for more budget for additional headcount that's required.

The framework we cover in this article will help you get approval for expanding your marketing team, regardless of the situation you're in.

But, before we start on the framework, it's important to understand what the critical inputs are to figure out the right work structure.

What we've seen inside a lot of businesses is there's almost a wishlist of roles they need. They often go with whatever budget has been approved, pick out the one or two roles they require most, and that's the one they ended up funding.

There is a better, more scientific way to figure out the right org structure for your business and what the hiring roadmap looks like as you’re trying to build that.

There are four critical factors to consider in your decisions on org structure:

1. What stage of maturity is the business at?

Depending on where you are - whether you're a startup, you're in series A, or you're owned by private equity - the answer here is going to look a lot different.

2. What’s your business model?

Are you selling a low-ACV product to a large market, or are you an enterprise B2B company with limited targets you're going after? That will inform who you need to execute on your marketing strategy.

3. What are the growth opportunities available to your organization that you need to prioritize?

For example, if you’ll be focusing on cross-sell or upsell initiatives, your team will look different than if net new or inbound marketing is the focus.

4. What are your revenue targets and budgeting plans?

You can use this information to inform the org structure and perhaps even plug into this budgeting cycle to make the right business cases.

Which maturity stage is your marketing team at?

It's critical to understand what starting point the business is at. This might be:

- A new go-to-market. This is often either because it’s a startup or you're launching a new product. In these cases, the marketing team is usually quite limited. It might be founder-led, or one or two people.

- A sales-led organization. Sales is the primary revenue driver, Marketing is a support function, and less than 10% of pipeline is being generated by marketing efforts.

- An organization with nascent marketing. Marketing investment is still quite limited - usually less than $300,000. In most cases, the marketing team is less than three people, and the pipeline they generate is still around 10% or less.

- An organization with some marketing impact. You have four to seven people, and marketing-contributed pipeline is 10-20%.

- A sophisticated marketing organization. Marketing-generated pipeline is often 25-50% - in some cases, we've seen 70-80% - and the marketing team is larger than 10 people.

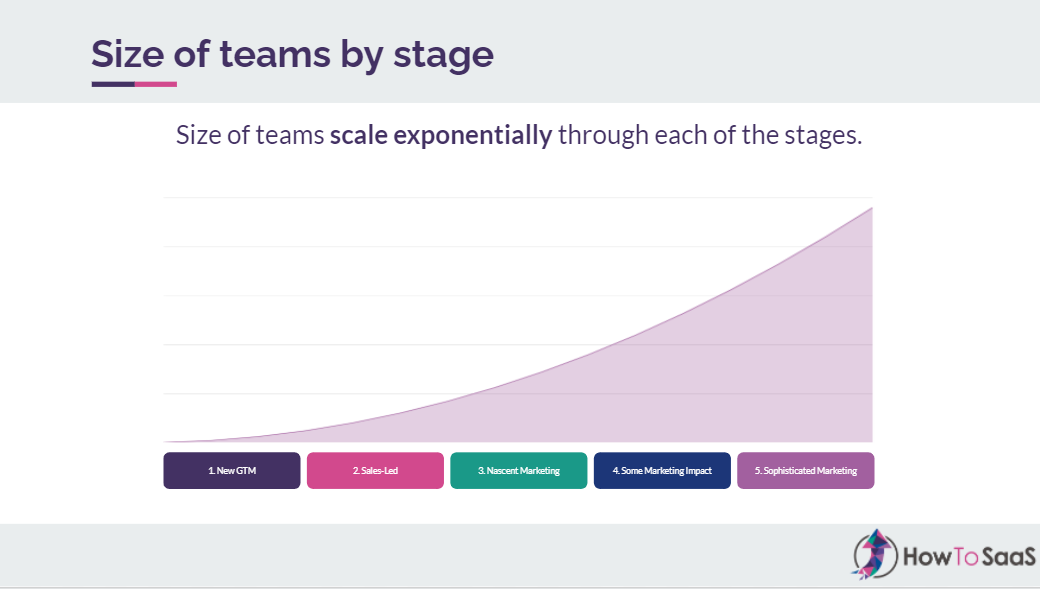

As you're going through the different stages here, the size of marketing teams scales exponentially.

For example, we have one client that has over a hundred marketers on their team, but they have 20 product lines and they’re doing $800 million in revenue across different geographies, markets, verticals, product lines and segments. For them, having 100+ marketers makes a ton of sense. But we've also had clients that have $5 million+ in revenue and they're closer to the sales-led model and have three marketers on their team.

Understanding where you are as a business is the starting point. If you're in a sales-led organization, a marketing org chart that says you need 15-20 people is very unlikely to get funded. Instead, you may start with two or three critical roles to prove out what's working and what's not working. Then, you can use business cases to draft extra initiatives, and that's how you get additional headcount.

Does Your Marketing Team Match Your Go-To-Market?

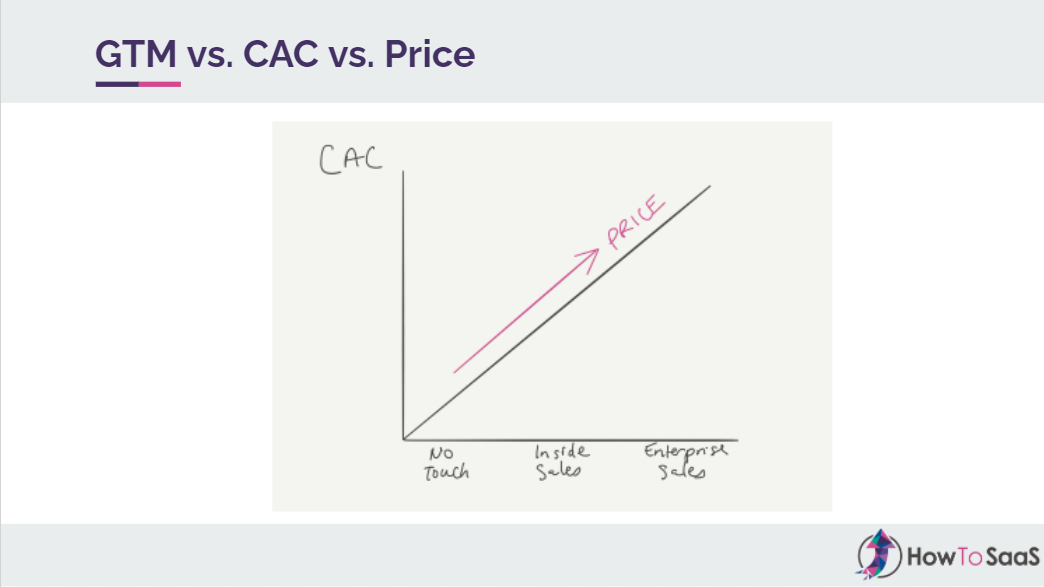

Similarly, you need to look at your go-to-market model against your cost of acquisition.

Inside self-serve businesses - for example, companies like Calendly - having an enterprise sales team is usually not applicable. They may have some sales reps, but, in general, Calendly is using a no-touch approach. Their cost of acquisition is very low, and so is their price point as a result.

The marketing model of self-serve businesses will look different from a company that's selling enterprise products - for example, Salesforce or HubSpot - who have large sales teams and a high price point for their offering.

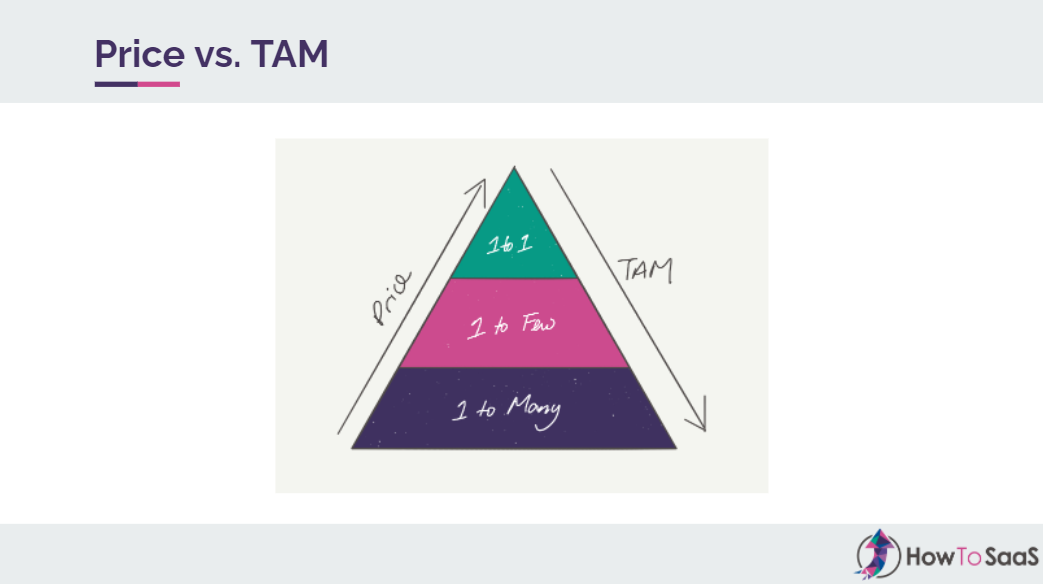

The model above looks at your ideal customers and target market with the filter of the size of deal and how many people are out there. If you’re targeting the 500 biggest consumer packaged goods companies in the world, you're likely going after whales. Your average deal sizes are north of $300k, and that's your entire account list.

Conversely, a company like Calendly may have a lot of customers on their free plan and some customers paying $10 a month, with an average deal size that’s closer to $100 a year. In between, there are lots of other variations. There are deal sizes of one to 5,005 to 50 and 50 to 300,000.

Depending on where your business is trying to find customers, your marketing org structure will need to look quite different.

If you target the 500 largest CPG companies in the world, you need to do one-to-one communication for those accounts. As a result, you need to have a very heavy sales team because you can spend up to a million dollars to acquire each customer and still break even in the first year. Your marketing efforts will be focused on supporting the sales team, including sales enablement content, product marketing, and account-based marketing.

Conversely, if you’re hunting rabbits, deer, or mice, you may be going after an inbound and self-serve approach. You’ll likely focus on more digital channels, keeping your CAC in check, where our payback period is north of two. if anybody with Google calendar could be your customer, you have to take a one-to-many approach.

You need to have some sort of total addressable market analysis or segmentation analysis. For example, to say that your market size is worth $5 billion and it's made up of 5,000 potential customers. That will inform the type of marketing team you need, because you’ll need to work on different activities.

Sub-functions of marketing and which you should focus on

So, what do those activities look like? There are eight key sub-functions:

- Demand generation. Programs and campaigns that focus on driving pipeline.

- Content marketing. Making sure you have assets for every stage of the buyer journey so the buyer can educate themselves or use content to get to the next stage in their journey until they're eventually ready to purchase.

- Customer marketing. Marketing to your existing base and driving either up-sells or cross-sells to increase their average deal size or how much revenue you’re generating per account.

- Product marketing. Educating customers on the product and functionality features to improve retention and usage.

- Corporate marketing. This is more of the traditional marketing activities, such as brand comms events, and PR activities. For example, you may need to go to major CPG events to be present in that marketplace and catch the right accounts into your funnel.

- Marketing ops. Building the data infrastructure and reporting on all these different activities so you have an idea of what's working, what's not working, the ROI on marketing activities, and which channels are performing better so you can reallocate.

- Sales enablement. Supporting the sales team with the right collateral so they can be more successful and close more deals.

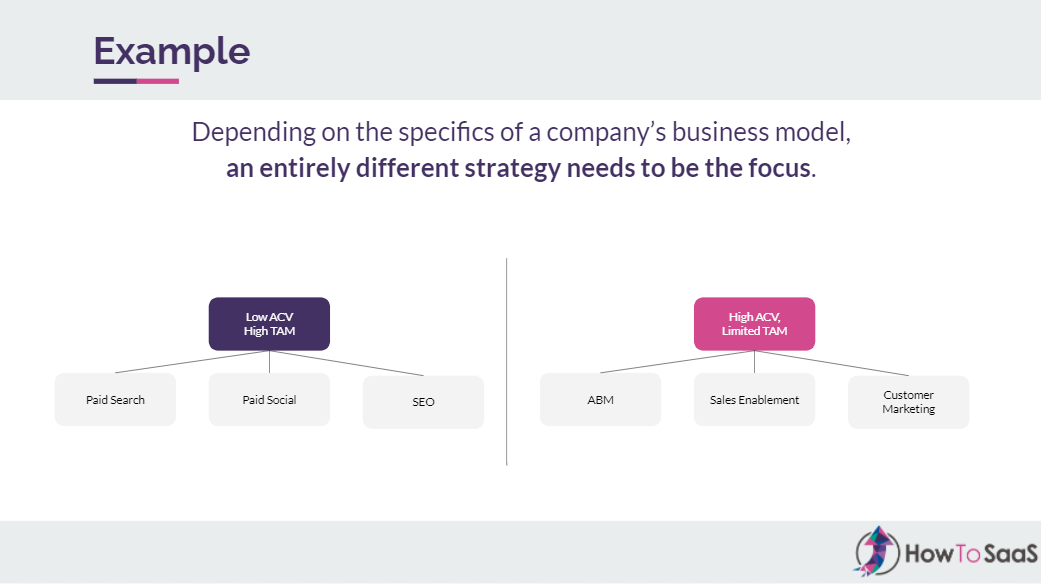

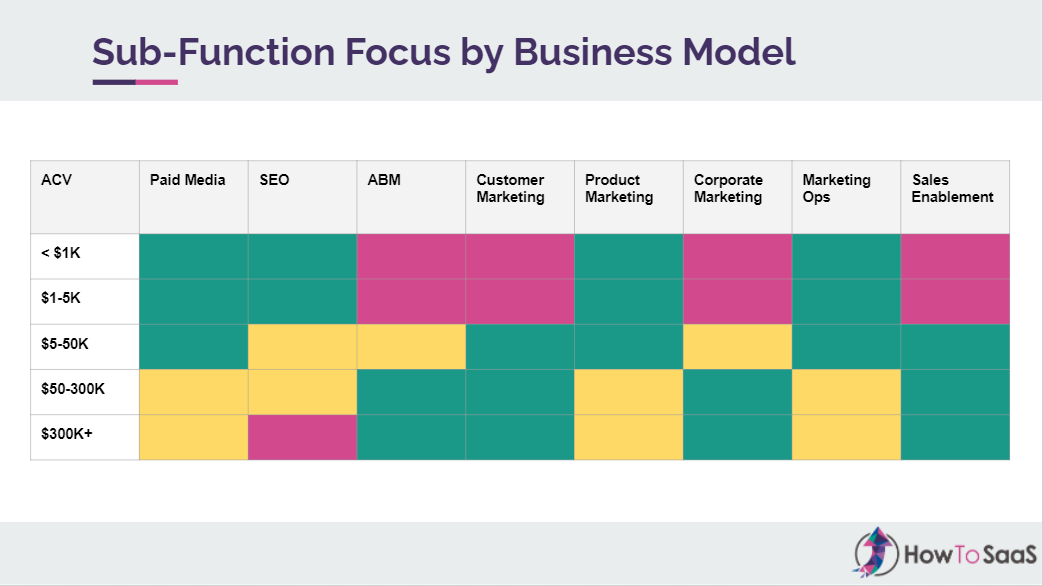

Depending on the business model, the mix of activities across these sub-functions will look quite different for each business:

On the left side, this might be what a company like Calendly does, with a focus on paid search, paid social, and SEO as primary drivers for getting users into the funnel. They're likely focused on product-led growth as their core driver, but from a marketing activity standpoint, they're likely looking at these three.

Conversely, if we're talking about that enterprise B2B company that's targeting the top 500 CPG accounts, they have a limited TAM and high ACV. This mix might be more focused on account-based marketing, sales enablement, and customer marketing to existing accounts to grow average deal sizes.

An easy way to filter this is to look at ACV and map it against all of those functions we just discussed.

Segments in green are essential for a company or product line within that ACV. Yellow segments are areas where you would likely have some investment. Pink segments are things your business probably shouldn’t be investing in.

For example, it’s unlikely that Calendly would do ABM unless they were going after companies with 1000+ employees that need some sort of calendar management software. But for a B2B enterprise company, ABM makes total sense.

Similarly, corporate marketing or sales enablement as a core revenue driver is probably not valuable for companies that have deal sizes under $5,000, but quite valuable on the sales enablement side. When you have large deal sizes and long sales cycles, the sales team needs as much collateral as possible.

You can then start to think about what that mix looks like for your business, how you would want to use the limited marketing budget you have accessible to you, and how you would weight the available headcount so you can prioritize the right roles the most important subfunctions.

Identifying opportunities where you need more marketing support

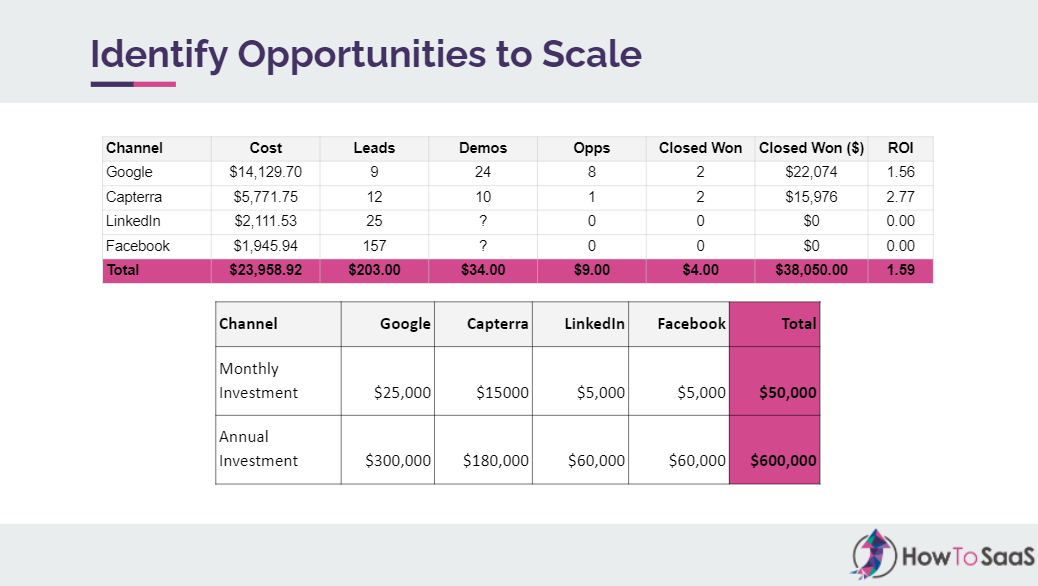

At this point, you need to start looking at the opportunities where you want to scale. For example, if you’re looking at paid advertising as a core driver for the business, you need to see how much room there is to scale that.

For example, this business spends about $24,000 on paid media. They generated about 38,000 in closed-won dollars and their ROI was 1.59. They can easily take that 23,000 and monthly spend and scale it to $50,000 per month, leading to a $600k annual spend.

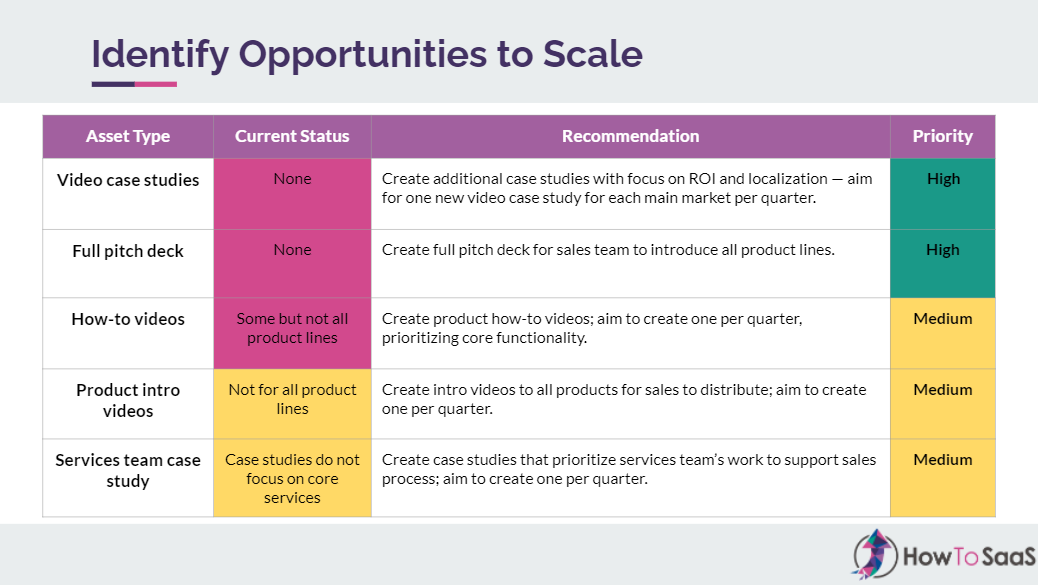

Similarly, you could look at content and map out which items you actually have for sales enablement or nurture, which you need to build out as a priority, and which you could push to later. If you need case studies, that might be higher on your priority list, and that would inform which roles you need to support your growth plans.

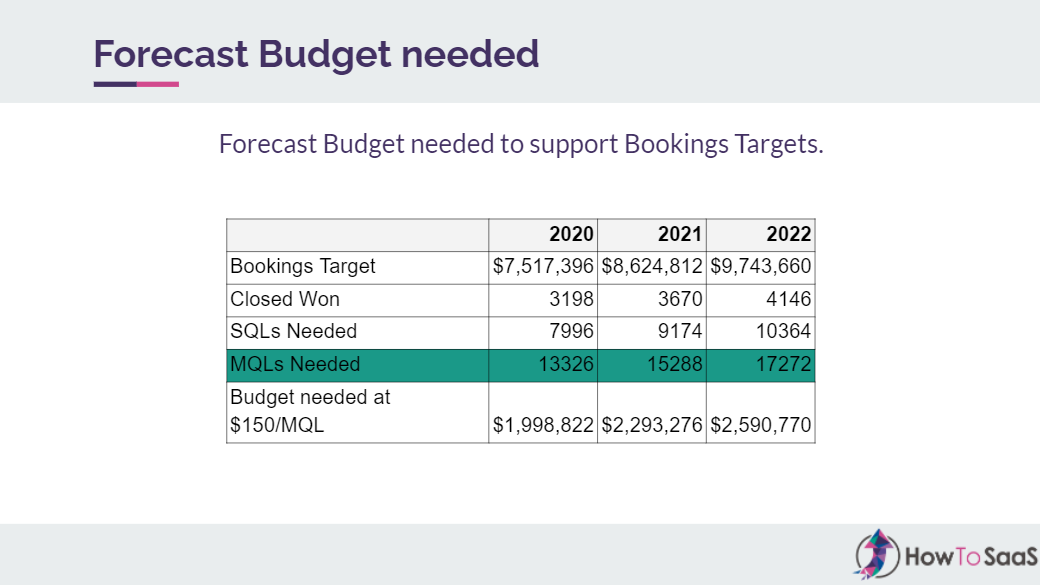

The final thing to look at as you go through this process of forecasting ROI opportunities and the investment required is the overall budget needed. To understand the number of MQLs required, look at your conversion rates through the funnel:

- What percentage of MQLs get to SQL?

- What percentage of those get to closed-won?

- What's the dollar value of each of those deals?

- Are you on track with the number of MQLs and level of investment?

- If you’re running behind, how much budget do you need?

In this company, their threshold is $150 an MQL. So, their marketing budget for 2022 would need to be 2.5, $9 million. Do they need to input more budget to hit those targets? And, if they get more budget, how would they deploy it?

This is a high-level example, but you should do this work for every channel and come back to the budgeting metrics to pinpoint how you would deploy that budget in terms of programs, across different channels, or potentially even headcount.

Add in a layer of how long it will take you to generate an ROI on that investment. You can take that projection to an investment committee to get approval for additional budget that will fuel the next steps in your marketing org structure. A lot of businesses skip to this step, but because the first three steps have not been completed, marketers are very unlikely to get the budget they want.

For a successful headcount ask, you need to be able to outline:

- Where the marketing org is currently.

- Your strategy going forward.

- The opportunity available to you.

- What you’re missing out on capturing.

- The people you need to capture it, and what they would be working on.

- The ROI they're going to generate.

With all this information, you're far more likely to get your budgeting asks approved because it brings into alignment the board’s planning for the business.

Grow your marketing organization by understanding what phase you're in

Let’s take a look at five different phases of marketing organizations. There can be many more variables, but the key point is to understand your starting point and follow the steps we outlined to present how your marketing team needs to grow.

Phase One

This is where a lot of startups or founder-led businesses find themselves. There's likely some sort of a junior content marketer or demand gen specialist on staff, and everything else - for example, design, development, SEO - is usually outsourced to freelancers.

The key here is to get marketing programs off the ground so you can get data proof points you can take back to the CEO or the board. That relies on this person being a full-stack marketer. You need someone who can write, run campaigns, build ad creative, do some reporting…

Phase Two

As companies grow past that stage, they’ll likely have a third tier where there’s a VP of Marketing or equivalent role. You might have directors for each subfunctional area and then specialists working beneath them. For example, under a Director of Demand Gen, there might be a paid media specialist and a paid media agency. Under a Director of Content, you might have a content specialist and product marketing specialist. SEO might be split out, especially if it’s an inbound driven business. And then you have a Marketing Ops Manager and these four people are the people that are reporting to the VP of marketing.

Companies that have this type of org structure are usually at the $5-10 million mark. Their marketing team is making an impact, but they're not a fully fleshed out marketing team yet and there's a lot more growth left to capture.

Phase Three

There are a lot more roles that can be added underneath the functions we just listed. You may have, for example, a corporate marketing or event team with an events manager or a PR comms leader under that person.

The revenue targets are likely ramping up for the VP of Marketing. The number of MQLs or pipeline marketing needs to drive might be 2x or 3x what it was for an organization at phase 2.

Phase Four

This is where we draw a distinction between what a VP of Marketing and a CMO would do. A CMO has a lot more purview and access to a lot more budget. There's a dedicated product marketing team, corporate marketing team, and inbound and outbound dimensions, including some SDRs or BDRs reporting into the outbound demand gen function. These roles might be in sales, but oftentimes we see this model as well. There are multiple agencies involved: somebody that's helping with paid media, a freelance content writer, a Salesforce partner on the marketing ops side, for example.

Organizations at this stage are usually north of $20-25 million and they're experiencing significant growth, so they need enough people to support all the different marketing activities. Oftentimes these types of companies also have more than one product line, but this approach is totally functionalized - it's not split out by product line because they haven’t reached a level of scale where they need to separate out by product line yet.

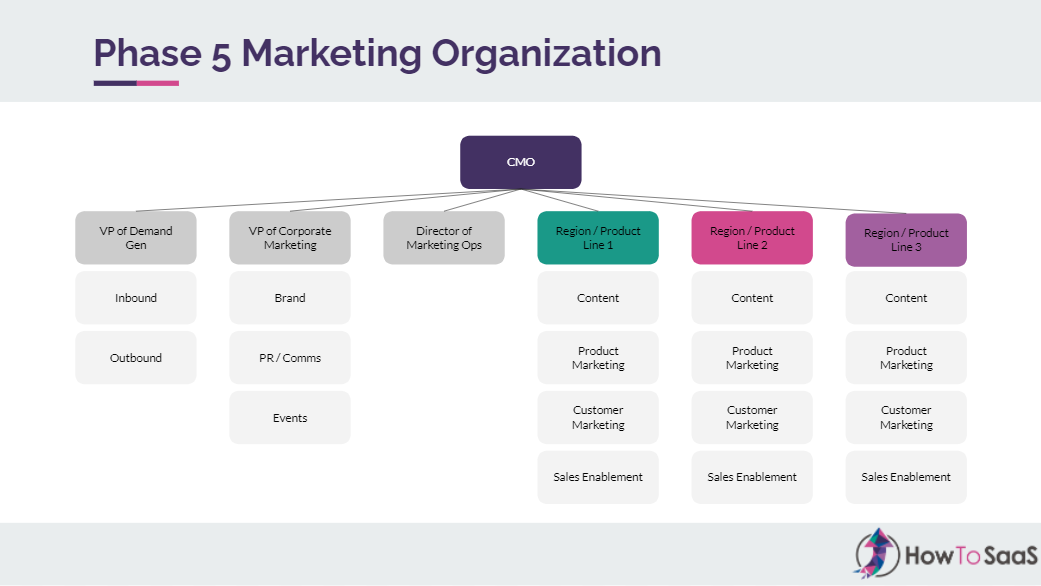

Phase Five

This is a simplified org chart. There may be 2x the number of people you saw in phase four, but you would see a regionalized or product-line focused team. There may be one product line in three different geographies, for example, and various subfunctions under each. Content, product marketing, customer marketing, and sales may be regionalized or product line focused. You can then have centers of expertise in marketing ops, corporate marketing, and demand gen that help all of those product lines across the board.

We usually see this in businesses that have 5-10+ product lines and where M&A is a key part of the growth strategy, so companies are being bought every quarter. There's a ton of complexity, so you need some sort of a parent company-level marketing team that handles some of these core functions. But the content looks different for each product line: maybe the language is different, or maybe there are legal distinctions in each product line that requires some level of subject matter expertise, so having this type of separation is critical.

Because there's so much more complexity to manage, the CMO here has to be far more talented than the VP of Marketing at phase three or phase four.

It’s important to identify where are you on the journey through these phases and to prioritize roles accordingly. To do that, you need to have the right business case to be able to prioritize the right roles.

The main takeaway here is to build the team that’s right for your context. That includes looking at the stage of maturity, your business model and strategy, the available growth opportunities, your overall financial targets and the available budget.

Additional factors are brought in depending on the number of product lines, your geographical expansion plans, and potentially the M&A activity. But you’re still working through the core functions that are needed for each product line.

Community FAQs

How do you accommodate for a brand versus demand strategies mix when it comes to team makeup?

That depends on the level of maturity of an organization. The key question is whether your particular business has captured as much demand as possible that is available on the marketing side.

Let's say you’re a mid-tier ACV business that’s hunting customers between 5k-50k. Your mix of marketing tactics would look like a combination of inbound, ABM, paid search, paid social, some product marketing and sales enablement. So the first question would be: are you capturing enough value from all these existing avenues? Until you've maxed these activities out, going down the route of brand-building can be risky. But, at the same time, it can help you feel how much pipeline is coming from paid media as an example.

Earlier on, if you’re at about $5-10 million, the focus should be more on maximizing these channels. But as you start to scale, the number of MQLs or pipeline per month is increasing, and there is a core set of activities that drives value for the business, you can shift your focus from capturing demand to creating demand. That's where you would focus on thought leadership and becoming a leader in the marketplace. That inevitably has an impact across the board.

One mistake we've seen is that companies will launch a podcast or a video series before some of the fundamental pieces are in place, so their conversion rates through the funnel aren’t good. Maybe people come to the site and bounce right off because your website is not structured the right way. Especially when you have a limited team, if half of them are working only on thought leadership pieces, that can create a problem when it comes time to hitting those targets.

How do you hire a CMO for their abilities?

This is where understanding what stage you're in is critical. Imagine you found a top-flight CMO and paid them top dollar to be a part of an organization that's at a really early stage. Inevitably, you would end up parting ways with that person, even though they're super talented, because you're likely paying them way too much to fill this role when somebody more junior can do this job.

Be careful not to overhire for the phase you're in. But it’s also important not to under-hire, where you need a CMO but you hire a VP of Marketing. For a huge, complex organization, you have to find someone that has either experience leading multinational multiproduct line organization, or has the capacity to do that as the next step in their career - not a VP of marketing that leans heavily on the demand gen side, because some other areas are likely to be ignored.

Is it better to hire from down up, or from up down?

So, should you staff up for the more senior roles first? Or should you hire a paid media specialist before you hire the director of demand gen, for example, or a content specialist before the director of content?

The answer depends on the org that you are in and the VP of Marketing that you have. I think, no matter what, your overall marketing leader is the role to hire for first, and likely you'll need someone that leans towards demand gen and content because that's what's going to move the pipeline the most.

If you have the right person in this seat, you could maybe skip some head of function roles and have people being staffed up under them - temporarily. If there are aggressive targets, you don't want the VP of marketing to be playing the role of director of demand gen, because then they can't support some of these other functions. So, there can't be much time between when a junior person is hired and when a director-level person is hired for that function area as well.

How important is it for marketing to be reporting to the CRO instead of being a separate function, especially in multiple founder companies?

In most cases, marketing reporting to the CRO is probably not a great idea - especially when Marketing is in charge of generating pipeline.

If you are a sales-led organization, odds are that Marketing does report to the CRO. That comes with its own set of challenges because the CRO is not as plugged in to demand gen activities. There are talented CROs out there, but in general, CROs are more sales-leaning. They don't look at marketing as a pipeline source - they look at it more as a sales leader function. Marketing ends up being more traditional - it does events, PR, comms and sales enablement, when it should be doing revenue-generating activities, like demand gen and content.

If you are in phase one and you have two or three marketers, it really doesn't matter where they report up to. But as you start growing through these stages of maturity, for people like the VP of marketing at phase three or the CMO at phase four to not have a seat at the table with the CEO is kind of ridiculous - especially when the brand is run through the marketing leader, and the CEO should be directly connected to the brand.

What are your thoughts about accommodating a chief growth officer versus a CMO?

A chief growth officer becomes more relevant in phase four and phase five, especially as you have multiple product lines and other growth levers that can be pulled. For example, if you have payments payment processing running through your business and payments revenues are a critical lever for you, a chief growth officer can bring together different product lines leaders from product and sales and marketing together to focus on that.

But it depends on the organization’s culture and structure. If there is a CRO in place and it's more of a sales-led organization, a CGO probably wouldn't be a good fit. But if a company has shifted to being more marketing-led and has a sophisticated marketing engine, a CMO could eventually graduate to a CGO type of role and bring those functions together, and the marketing leader is then just focused on pipeline generation.

What is a CMO paid for a small to midsize business - not a fast growth venture or PE funded company?

There are four variables here:

- The size of the company

- The stage of the company, in terms of the marketing organization. If your org looks like this, you need a far more talented CMO than if you have an org that looks like this.

- The complexity of the marketing problem at hand. Even if it's not a fast-growing venture, the more complex it is, the more unique the individual that you're looking for.

- The cities your business is running in. Are you a remote team, are you operating out of San Francisco, or are you in Norfolk, Virginia?

There’s a wide range. For a VP of marketing, you could start at $150k on the low side; for a CMO for a large business at phase five, you could be paying $300k+ easily.

Have you noticed any patterns in how Sales grows/adjusts alongside a growing marketing team?

We've noticed that a lot of sales-led organizations might have 40-50 people while the marketing team looks like it's in either phase one or phase two. They can grow independently of each other unless investors have decided to fund all the functions quite equally.

That being said, as marketing moves through these phases, ideally more pipeline is being generated. And as more pipeline is generated, you need more people to serve the leads that are coming in the door. So you're going to need more SDRs, more account executives, and more people to onboard additional accounts. Instead of just a VP of Sales and reps underneath that person, you might have a Head of Account Management, Head of SDRs BDRs, etc as well.

Let's say that ABM is a core strategy and that ends up producing a sales structure that mirrors this. ABM as a strategy usually follows a heavy segmentation exercise, that identifies the top verticals, the targets, and the top accounts in your TAM. You need to have sprints against that, where marketing is producing content and campaigns for those accounts and then Sales focuses on those accounts. In that case, you need to have a sales team that can be agile enough to have a structure like that, and that usually involves more people. We've seen companies that look like this, with about 50 marketers and 50-75 reps on the sales side.

Can these approaches be applied to any vertical and industry?

One hundred percent. Whether you're a tech-enabled service, B2B SaaS, or another type of platform, marketing teams go through similar evolutions, although the roles get adjusted a little bit depending on your specific market. Let's say you're a two-sided marketplace like Uber. Instead of having a Director of Outbound Demand Gen and a Director of Inbound Demand Gen, you might have one marketing leader focused on driving demand for riders and another focused on driving demand for drivers because you need both sides of that two-sided marketplace to grow.

How much should you spend on marketing headcount compared to programs?

A lot of companies get this wrong. In a lot of cases, we see companies that have 2-3 marketing people, and they're given a very limited budget. But in other cases, we see that that headcount is a 50/50 split with program spend.

Let’s say you have three people and you collectively pay them $200k, but your marketing program spend is also $200k. Ideally, with $200k on headcount, you should probably be spending $400-600k on programs because people can scale their spend with different channels. Paid media in particular is not dependent on headcount to scale. A 30-70, 25-75, or even 20-80 split between headcount and program would be better. Keeping your headcount at around 20% of your total spending would mean your team is incredibly efficient.

How should you prioritize the order in which you hire for each role?

Come back to the framework for building business cases and look at your available growth opportunities. Let's say we need to hire for all of these functions. You might have a bunch of great growth opportunities, but perhaps your board says you can only increase headcount by three.

Map out all the growth opportunities with the ROI and the headcount required to capture it. As you go through that exercise, you'll identify certain things that are more important than others. For example, if you're a company that's been built on inbound demand gen, it might make more sense to increase headcount on the inbound demand gen. On the other hand, if you think ABM is a core strategy but you haven't had the right people to prove this out yet, you might need more pilots. So instead of hiring an ABM manager or a director of outbound, maybe you could pilot that with your current content instead.

How can you convince the CEO/board that they should invest dollars into hiring for marketing rather than bringing on another salesperson?

This happens all the time. CEOs ask us if they should give marketing $100k more or hire a couple more sales reps. The answer is more about what the company wants to be and where they are in their journey.

If a company is sales-led, it's very easy to dial for a certain amount of dollars, get a certain number of deals in the pipeline, and you can always add more pipeline by adding more people. But at some point, sales efficiency starts to hit a ceiling.

Sales efficiency, revenue per rep, and conversion rates through the funnel, are key pieces of data. Marketing may be able to improve those conversion rates by running a webinar or creating sales assets.

It’s also important to work in a company where there is a belief that marketing is a core revenue driver and where the CEO buys into that. Otherwise, it's always going to kind of feel like an uphill battle. Getting internal buy-in is a core job as a marketer. You need to gather the right data and build the right business cases. But after a certain point, if you're not getting enough buy-in, the team may be stuck in its old ways.

Subscribe to SaaS Marketing Simplified!

Get bite-sized insights on SaaS marketing, growth and strategy in your inbox a few times a week.