The Ultimate Marketing Due Diligence Checklist for Acquisitions

There’s one key area of the PE due diligence process that most firms overlook: marketing.

Assessing a company’s marketing before an acquisition can give you critical insights into whether or not the business has a healthy long-term prognosis.

How big is their TAM?

What is the lifetime value of a customer compared to how much they’re spending to acquire one?

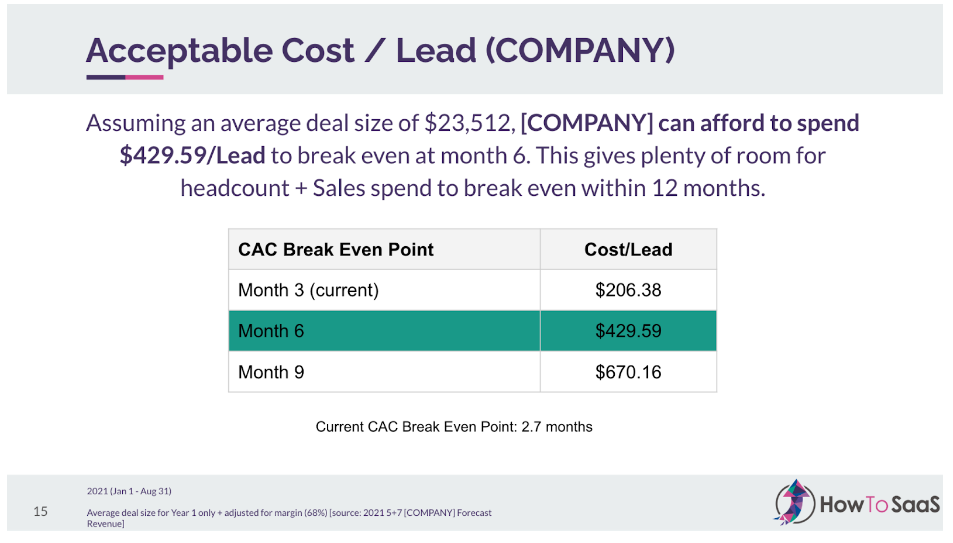

Are the assumptions included in their financial forecast based on historical data?

Answering these questions can help you get a better understanding of the financial health and future prospects of the company you’re considering acquiring, but they’re ones that many firms fail to consider – or don’t realize that marketing can even impact.

Given the cost associated with making a bad purchase, both financially and in terms of the time devoted to an investment, it’s well worth reviewing these questions prior to proceeding with an acquisition.

If you can determine that a company hasn’t set itself up for success before sinking additional funds into it – or worse, getting a disappointing return when it’s time to exit – any additional time spent reviewing these metrics is time well spent.

If you haven’t considered marketing as part of your due diligence process for acquisitions – or have wanted to, but weren’t sure how – this guide is for you.

Take a look at our checklist if you’re ready to dive into the process yourself, or keep reading to learn just why conducting marketing due diligence is so important, as well as all the factors to consider when conducting marketing due diligence for mergers and acquisitions.

Prefer to read this post as a PDF? Click here to download.

Why running a marketing due diligence assessment matters

At many B2B SaaS companies we’ve worked with, marketing is relegated to a supporting role, rather than being seen as a crucial driver for the business.

It’s considered only as the function that creates social media posts and writes emails for sales to send out.

However, companies that don’t see marketing as a growth lever often struggle to expand further down the line compared to those who are consciously investing in marketing.

They may be unable to create enough pipeline for sales to work, or might be unable to create enough brand awareness to stand out against their competitors when a deal comes down to the wire.

That’s why it’s so important to review the marketing potential and performance of a target company prior to acquisition.

Assessing a company’s potential for marketing growth across all possible facets – from the current marketing budget to the team structure to the activities they’ve undertaken – can show you whether the company has historically demonstrated that they are able to capture demand in their market and have a clear trajectory to expand.

Alternatively, it can help you determine that the company doesn’t have enough growth potential to make the investment worth it.

For example, they may not have product-market fit, may have over-indexed on sales hiring rather than developing a sustainable path to pipeline generation, or be unable to grow because their competitors already have much better market share as well as better tactics.

We’ve seen this with some of the companies where we’ve conducted due diligence. The acquisition did not move forward given what was revealed as part of the due diligence process, of which the marketing audit was a key factor.

If you do decide to proceed with the deal, reviewing what’s already been done can also show you what still needs to be done to realize the potential of your investment within the first hundred days post-acquisition. It sets you up to hit the ground running once the deal has gone through.

Feeling like this will take more bandwidth than you have to spare? Reach out to us for support.

If your team is ready to handle it on your own, read on to learn more about the steps you need to consider as part of this process.

16 critical areas to cover when conducting a marketing due diligence assessment

Reviewing our marketing due diligence checklist as well as this post will give you a clear idea of the steps you need to take in order to confirm whether a company’s marketing is in good shape.

The order of this audit moves from the most high-level items to the most granular, since we recommend starting with a bird’s eye view of the team’s current marketing strategy and activities overall before delving more deeply into each individual area of focus.

By following this order, you can determine which areas actually drive results for the business and spend more time reviewing them, rather than those that are more incidental.

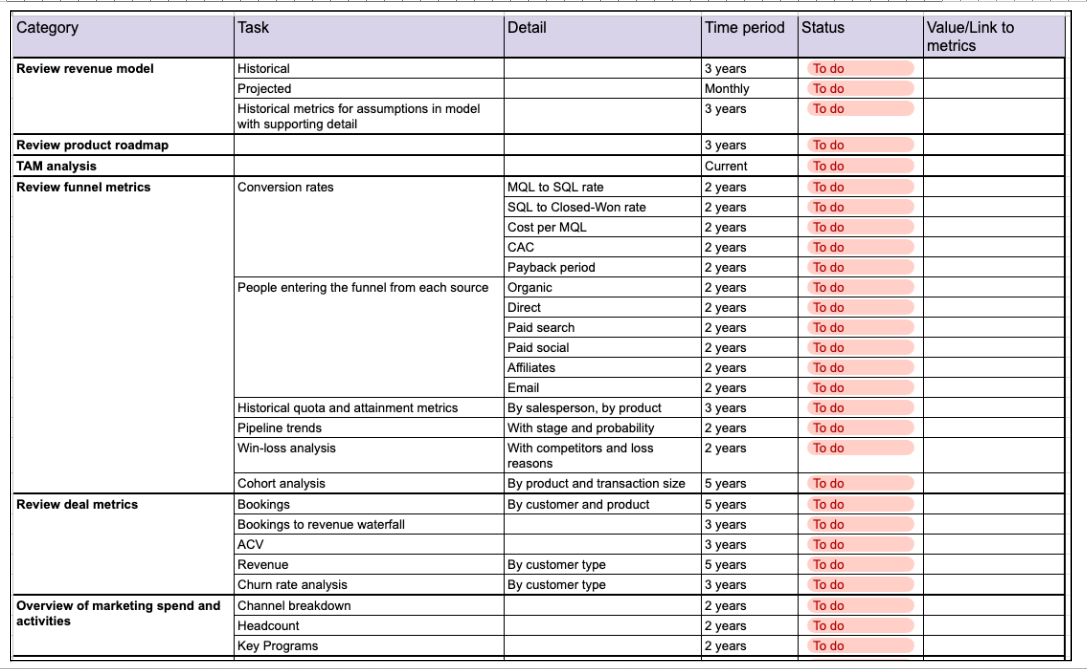

- Review revenue model

- Review product roadmap

- Conduct a TAM analysis

- Review funnel metrics

- Review deal metrics

- Review marketing spend and activities overall

- Review marketing pipeline contribution

- Analyze channel and campaign performance

- Assess potential paid media spend

- Assess potential to scale SEO

- Assess opportunities to scale marketing

- Assess strategic growth opportunities

- Evaluate marketing team and org structure

- Evaluate technology stack

- Build financial forecast

- Review all the above as a whole

1. Review revenue model

Your marketing audit should start with a foundational question: how much revenue has the company generated overall historically, and from which sources?

From a marketing standpoint, this data should ideally be in a cohort-based waterfall model, with the time it takes for a lead from different sources to convert built in as well as different weights given to each touchpoint a customer has interacted with throughout their conversion journey.

Sounds great, doesn’t it? Unfortunately, the reality is that most B2B SaaS companies will not have this level of granular segmentation in their data.

However, as long as there’s some level of attribution provided, it can serve as a starting point to determine whether the company’s marketing budget and their CAC to LTV ratio are in a healthy position.

They should also have a forecast for the next year available to review, which should include the projected return from the various marketing sources they plan to invest in.

As you go through this exercise, the assumptions included in their forecast should also be reviewed and compared against the data provided to ascertain their accuracy and validity.

2. Review product roadmap

Prior to analyzing the existing marketing strategy, it’s important to determine the product direction to ensure marketing initiatives are aligned with the overall company strategy.

Overall, your goal in reviewing the product roadmap through a marketing lens should be to ascertain whether or not the marketing team’s vision is in line with the company’s vision for the product. If it isn’t, this may indicate that a shift in marketing strategy is required.

Some questions to consider when reviewing marketing campaigns once you’re familiar with the product roadmap are:

- How is marketing currently set up to support new product launches?

- Does the company’s positioning on the website and marketing materials follow the same direction as the product roadmap?

- Does the product direction appear to be in line with what the audience wants?

3. Conduct a TAM analysis

Considering the total addressable market for their solution can help determine whether or not the business provides a worthwhile target for acquisition. Other factors to consider are how much of the TAM is left for them to capture, and their current market share relative to that of their competitors.

The size of the company’s total addressable market should also be reflected in their marketing strategy. In general, companies with a smaller TAM need to focus on account-based marketing tactics, creating highly personalized outreach to reach their target audience. Companies with larger TAMs, on the other hand, can focus on an inbound approach, using tactics that are aimed at capturing demand more broadly. Keeping these approaches in mind while reviewing the rest of the company’s marketing mix can help you determine whether their overall plan of attack is sound.

4. Review funnel metrics

Reviewing the conversion rates from lead, to opportunity, to closed-won (or whatever terminology the company uses) can help you determine whether the company’s win rate has increased or decreased over time. Tracking this can help you see whether marketing activities are becoming more or less effective, as well as whether they’re targeting the right audience.

This process should also include reviewing any data the company has around the reasons they lose deals against competitors and other closed-lost reasons. This can help determine where marketing can support sales efforts, as well as spotting any red flags related to product functionality.

Learn More: 3 Ways Marketing Should Be Using Full-Funnel Reporting

5. Review deal metrics

Looking at a company’s revenue is obviously always part of the due diligence process, but considering it through a marketing lens can give you additional insight into whether or not their revenue growth is sustainable.

The average customer value (ACV) can also be used to determine how much you can spend to acquire a new customer. As a general rule, companies with a higher ACV can afford to spend more to acquire a single customer, whereas those with a lower ACV should focus on less expensive channels.

Ideally, companies should be able to recoup their customer acquisition cost (CAC) in twelve months to maintain sustainable growth, though some companies in a high scale phase with a low churn rate may choose to break even more slowly. You can look at the blended average of CAC and ACV for all channels to start, before segmenting it as you continue to assess individual activities.

Another facet to consider is customer churn: what percentage of customers are sticking around year over year, and whether or not it’s decreased or increased over time.

Depending on the data available, this can also be segmented by acquisition source (for example, did customers who converted on a particular campaign stick around longer than others?) and by customer type (do certain verticals appear to churn at a higher rate?).

Overall, if it appears older customers are churning at a higher rate than new customers are being acquired, this may be a sign that the product isn’t sticky or has significant issues that need to be addressed – or that marketing activities should be focused on retention rather than acquisition.

Learn More: 3 Questions to Cover in Your Marketing Due Diligence Period

6. Review marketing spend and activities overall

Once you’ve reviewed some of the top-line metrics, you can start conducting an overall assessment of the company’s marketing. This initial review should include which channels the brand is focusing on, how many people are on the team and what their roles are, their current marketing budget, and their key activities. Once this has been determined at a high level, you can move on to investigating which channels are specifically responsible for these results.

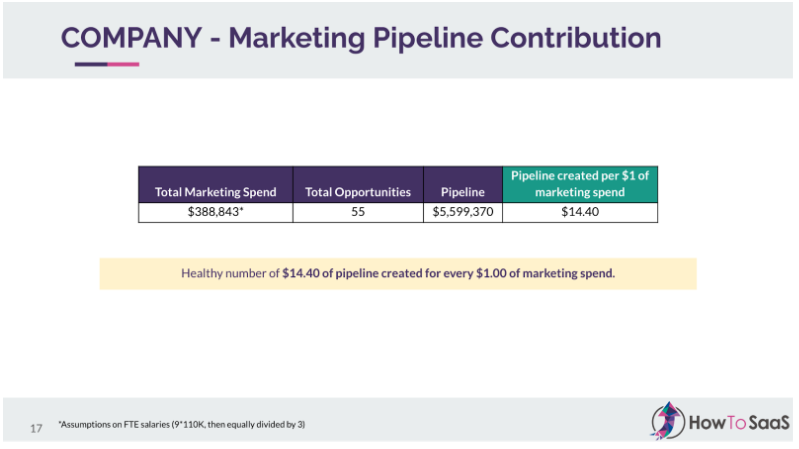

7. Review marketing pipeline contribution

Two of the most important questions that you should be able to answer throughout the due diligence process are: how much pipeline is marketing driving overall, and what proportion of the total pipeline is marketing influencing?

There is no specific right number or percentage, since it’s dependent on factors like the company’s go-to-market strategy, their revenue team structure, and more. However, it’s important to have a starting point that can be used to set future goals and benchmark against as further investments in marketing are made.

The difference between the amount of pipeline generated by and the amount of pipeline influenced by marketing should also be considered, especially for brands with longer sales cycles where marketing is focusing primarily on brand awareness and/or sales enablement activities.

You can also look at how much pipeline is generated per dollar of marketing spend to determine whether or not the team’s spend is efficient relative to the amount of pipeline being generated.

Although there is again no one-size-fits-all number here, companies should ideally be generating more than a dollar of pipeline per dollar of spend to ensure that they’re not just breaking even.

8. Analyze channel and campaign performance

Once you’ve had a chance to determine where the company has been focusing overall, you can dive into the performance of the individual campaigns and channels they’ve been running. Conducting a more granular analysis will show you which ones are driving conversions at a higher rate, and which ones aren’t worth spending additional time and budget on.

However, it’s also important to remember that different marketing channels will have different costs of acquisition as well as different audiences and potential reach. Some channels will also be primarily used for brand awareness, meaning that they might not look impressive in terms of lead generation, but are still crucial to ensure that the company is continuing to maintain its presence in the minds of future prospects.

Reviewing individual channels may also expose gaps in the company’s tracking and data operations. Although some channels will always be more difficult to attribute to revenue than others, such as social media, marketing teams should still have a general understanding of how each channel is contributing to their market presence, whether that’s through generating brand awareness or directly generating revenue and leads.

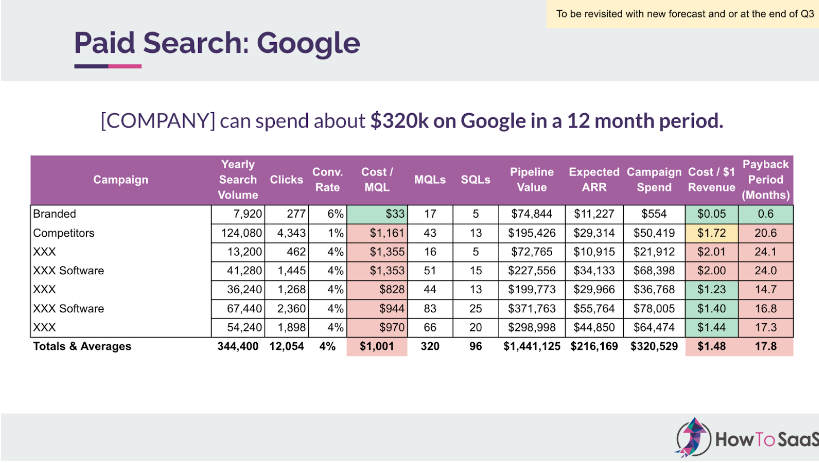

9. Assess potential paid media spend

Now that all the historical performance data has been established, it’s time to look forward and determine where budget and resources should be allocated in the future.

The first place we typically look is at paid media spend, since this can often be the easiest to tie back to revenue. Determining whether or not there is a larger opportunity in paid media will often come down to the budget that the team has available, and where it’s historically been allocated, though some level of optimization will often also be required on existing campaigns.

It will also depend on the channels that are applicable to the brand. Some channels offer finite returns, such as Google Ads – there will only ever be a certain number of relevant keywords that the brand can bid on.

Others, such as Capterra, offer a diminishing return – it may not be worth spending more on a higher position if it makes the cost per conversion too high.

And as with any marketing initiative, which channels are selected should depend both on their past performance and on their potential to reach the brand’s target audience.

Learn More: How To Scale Paid Media - Regardless of What Stage You’re At (+ FAQs)

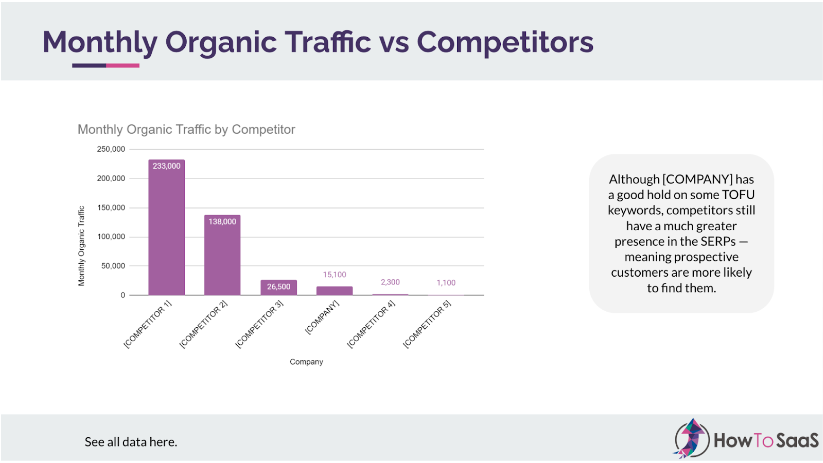

10. Assess potential to scale SEO

To determine the available market opportunity for organic traffic, we recommend reviewing the company’s current organic traffic compared to the search volume of available keywords in their market. We particularly recommend looking at keywords that are middle-of-funnel and related to their product or service.

Assessing how much organic traffic competitors and other sites in that market are getting, as well as how many and which keywords they’re ranking for, can also help provide a benchmark.

Deciding whether or not to focus on SEO as a channel will also depend on the company’s go-to-market strategy.

For example, for an inbound marketing-driven motion, particularly for a company with low deal sizes and short sales cycles, SEO can be a very valuable channel. The brand can target educational keywords, ensuring prospects return to their site again and again to find the answers they’re looking for.

However, for companies that have a longer sales cycle and target executive-level prospects, SEO may not be worth devoting as much attention to, since those prospects may require higher-touch, more personalized marketing efforts to convert.

Regardless, at a minimum, companies should aim to rank for the BOFU keywords that best describe their services (for example, Hubspot should be and is ranking for the keyword “CRM”) to ensure that prospects who are already in-market are able to find them easily.

As with other channels and campaigns, they should also be tracking deals touched and revenue from SEO to know whether it’s worth scaling their efforts.

Prefer to read this post as a PDF? Click here to download.

11. Assess opportunities to scale marketing

Once you have a better understanding of the company’s overall marketing efforts, you can determine which ones are worth keeping, expanding, or cutting.

To begin creating a new forecast, you can consider where to scale spend on existing channels or reallocate spend from channels that have historically underperformed.

There may also be channels that you’ve come across in your analysis that the team has yet to explore, which may provide an increased scope for marketing contribution to revenue.

These may be based on activities that another team needs support with – for example, establishing a partner marketing function if the sales team has already begun to work with resellers but there’s an opportunity to scale.

It could also be based on larger plays that the company has yet to explore, such as creating a community within their space.

There may be some clear gaps in the current marketing strategy that need to be filled in order to scale more effectively. For example, if a company is bringing in a lot of website visitors but their conversion rate from visitor to lead is low, it’s a sign that conversion rate optimization needs to become a strategic priority.

This is also where assessing the company’s brand value comes into play. If they’ve built relatively little brand awareness compared to other companies in the space, it becomes exponentially harder to scale marketing’s impact. Some questions to determine this include:

- Is it well known in its space?

- Are people speaking about it positively online?

- Do they have a community of passionate supporters?

If the answer to all of these is “No,” additional attention may need to be devoted to generate positive brand awareness, depending on what stage the company is at and what other marketing foundations they have in place.

12. Assess strategic growth opportunities

As you’re reviewing what the marketing team has done so far, you may see chances for them to invest in or support completely new initiatives to increase top-line growth.

For example, if the company’s prices haven’t changed in three years, the time may be ripe for them to increase their prices.

Alternatively, if they currently serve the enterprise market but haven’t entered the SMB market, there may be a desire to devote marketing resources to expansion.

Regardless of the basis, the potential for new initiatives should always be reflective of the company’s go-to-market strategy and brand values to ensure they’re not going in an irrelevant direction.

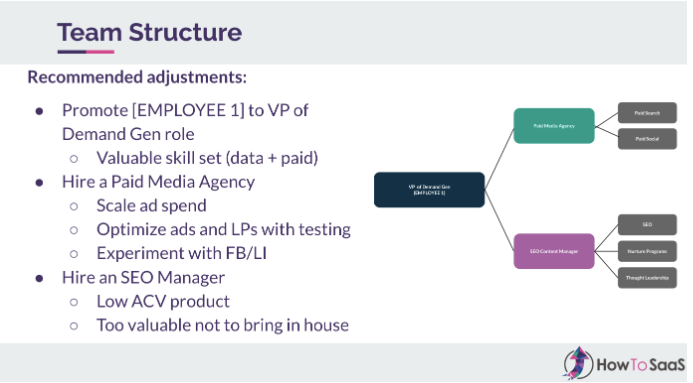

13. Evaluate marketing team and org structure

The structure of any marketing team should depend on the opportunities available.

For example, if there’s a lot of volume that can be captured with SEO, do they have a team member who’s qualified to lead this initiative?

Or, if you’ve identified that the company should be focusing on a sales-led go-to-market, is there a team member who’s able to work with the sales team to determine their needs and create sales enablement content?

In some cases, there may be a mismatch between the go-to-market strategy and the team. In that situation, restructuring or additional headcount may be needed for them to operate at peak efficiency.

Particularly in larger companies, there may be opportunities to combine forces across teams or business units for greater efficiency and effectiveness. This might look like creating a brand team that’s aimed at corporate cohesion, or creating centers of excellence for a specific function who work across every product line rather than having individual teams within each company.

14. Evaluate technology stack

When left unchecked, it’s easy for a tech stack to bloat beyond what’s needed.

Reviewing which tools the marketing team is currently using, how much they’re spending, and what they’re used for can help you identify inefficiencies or gaps that need to be filled in order to better execute on the chosen strategy. If you’re looking at a merger or an addition to a platform company, there will likely be redundancies (and therefore potential savings) in their combined tech stacks, or a need for a single, centralized platform.

An example of tools that can be cut are those that aren’t needed for the go-to-market strategy desired (for example, an ABM platform if the company is focusing on inbound distribution), or ones that are being used for campaigns that aren’t pulling their weight.

Alternatively, there may be additional opportunities in areas in which they don’t currently have a tool. For example, if SEO has been identified as an area of growth but they don’t currently have any SEO software, it may be worth adding that to the budget.

15. Build financial forecast

Based on the historical cost of acquisition and conversion rate for each channel, as well as who on the team is able to execute on these plans, you can now build out a more accurate forecast of what can be expected from marketing over the next year and compare it with the initial forecast provided by the team.

16. Review all of the above as a whole

After considering all of the above, you should have a better idea of the opportunities that exist to scale the marketing function – or whether it’s possible to scale it at all.

Creating a summarized version of these insights based on each functional area, like the example below (which you can get as a template in our marketing audit checklist), can provide an easily digestible view for the rest of your team and help clarify which areas need to be focused on most urgently.

One final thing to consider: whether or not the results you see for each of these areas are good or bad will depend on many factors, such as the company’s marketing maturity, their budget, their go-to-market strategy, and more.

That’s why analyzing marketing strategy is as much an art as it is a science – it requires a deep understanding of all of the components involved, as well as an ability to sift through the data to determine which of it really matters.

How to gather the right data for a marketing due diligence assessment

Now that we’ve covered all of the data you need to make an informed decision around the state of a company’s marketing, you should have a better understanding of the task that lies ahead.

But this may raise another question: where can you find all of this information?

The simplest way is to connect with the marketing leader at the target company and ask them to pull the reports discussed above.

This has the added benefit of showing the state of the company’s data. If they’re unable to provide you with much of this information because they don’t track it or aren’t able to quickly find it, that’s also a red flag to consider as part of your assessment.

However, we realize that this may not be an option depending on when you choose to start this process, as well as your internal policies around the dissemination of information and that of the company you’re hoping to acquire.

If that’s the case, some of this information can be collected without access to the company’s systems by using third-party software platforms to assess their performance.

For example, Ahrefs can be used to review the company’s SEO performance as well as their competitors’. For paid advertising, you can review the platforms they’re spending on directly – for example, if they’re advertising on Capterra, you can review their listing as well as that of their competitors’ to see how their rankings compare and their number of reviews.

This will not show you how each individual campaign or channel is performing with the level of detail we’ve discussed above, but will at least provide a high-level overview of the state of their marketing.

How How to SaaS can help conduct a marketing due diligence assessment

After going through these steps, you should now have a better understanding of everything that’s involved in conducting a marketing due diligence assessment, as well as how to get started gathering the necessary information.

However, getting clarity around these questions isn’t easy if you aren't deeply familiar with marketing strategy.

Having executed on many marketing due diligence assessments like this, we can confirm that it’s not a straightforward process.

Your team may not have the expertise, the time, or the software required to do it in-house.

That’s where How to SaaS can help.

Our marketing due diligence assessments allow you to focus on what you do best while we handle the marketing evaluations. When it comes time to close the deal, you can proceed with confidence knowing that you have a clear picture of the opportunity available.

We can review a business’s marketing strategy in only a week or two, ensuring that the deal isn’t being held back, and share a comprehensive readout with your team so that you can see all the possible pitfalls and opportunities.

To see what that might look like for your next investment, take a look at this anonymised version of an assessment we created for a previous client.

Regardless of whether you choose to proceed with our checklist or with our support, given the investment required both financially and from a time standpoint when acquiring a company, we believe that conducting this assessment is well worth it.

We realize that conducting a marketing due diligence assessment might seem like the least of your worries when it comes to acquiring a new company, and it might be one that’s continually being bumped down the priority list.

But doing so can make the difference between acquiring a company that’s poised to dominate its category – versus one that’s destined to fade into obscurity.

Subscribe to SaaS Marketing Simplified!

Get bite-sized insights on SaaS marketing, growth and strategy in your inbox a few times a week.