How Marketing Needs to Help You Deliver On Your Investment Thesis Growth Levers

The revenue opportunities PE investors identify during the due diligence process usually form a big part of the investment thesis and are pinpointed as core growth levers. After the acquisition, starting to build out the strategy for these leavers and put them into practice is a top priority. Seventy-two percent of investors are looking to validate their investment thesis in the first 100 days. You’ve paid a high price to acquire the company, so it makes sense to validate the core growth levers early to make sure you’ve made the right move.

To make this likely (or even possible), everyone needs to be clear early on what is expected from them. Marketing leaders need to be fully aware of how each of the strategic levers in the investment thesis connects to their function and responsibilities, so they can help make sure the company meets those projections.

There are seven core strategic growth levers often included in investment theses:

Servant Leaders

In honour of Tony Hsieh, who inspired me with his commitment to building a phenomenal culture, delivering exceptional customer experiences, and growing his local community with his time and resources.

Put servicing people at the heart of everything you do and you'll inevitably build something great.

Also, highly recommend you reading Delivering Happiness -- one of the best books on service ever written.

Price vs TAM

Your Price Point and Total Addressable Market play a huge role in how you Go-To-Market.

Large TAM, low price --> Take a 1 to Many approach, drive volume and focus on efficiency. Inbound should be at the core.

Small TAM, high price --> Be super customized and personalized in your marketing. ABM should be at the core.

Somewhere in between --> Mix both approaches for a happy medium.

This is why starting with your company's specifics is important. Don't just buy an ABM solution because you watched a video from a martech vendor.

Truly understand your business and figure out which approach best fits your reality.

Authority Content

Most companies focus on creating content for the funnel. This includes:

- Awareness content to bring in more leads

- Nurture content to turn more leads into MQLs or MQLs into SQLs.

- Sales enablement content to close more MQLs

Very few companies focus on Authority content -- this is content that transcends the sales funnel. It has no interest in selling anything.

Its primary purpose is to serve the audience and market by giving them solutions to pain they are experiencing.

Authority content is not a "10 ways to do X" article. It is not a "Buyers guide for Y".

It is true thought leadership content that builds a connection with the audience because they can see how much you understand them.

Types of content that create this effect:

- Podcasts

- Educational videos

- Books

- Speaking

It's the hardest kind of content to create because the barrier to entry is deep expertise and empathy.

The companies that succeed at creating this content end up greasing all stages of the funnel any...

Content vs Brand Value vs Demand

There is a direct correlation between how much you invest in content, your brand value and how much demand you create.

More content where you give value to your audience / ICP / TAM leads to more brand value being created with that audience / ICP / TAM which leads to more demand gen overall because more people search for your brand or choose your brand over others.

Show me company with a great demand gen engine and I guarantee the company has a significant content engine as well.

Simple concept, yet grossly underestimated by many companies.

Price vs Service Load

Every business should aspire to be in the top left quadrant -- where Price is higher but Service Load is lower. This is when margins are the highest and can be reinvested into building an even better product and business.

This is why some of the biggest companies in the world are B2SMB SaaS companies. Shopify, Hubspot and Atlassian all fit in that quadrant.

It is also why Product-Led Growth companies with price points around $1K eventually end up trying to move upmarket and why B2B Enterprise companies try to lower their service load with better software that needs less customizations.

It is where the most value is created for the customer the fastest. There is more automation, better self-service, more transparency, better outcomes, better experience.

Win-win.

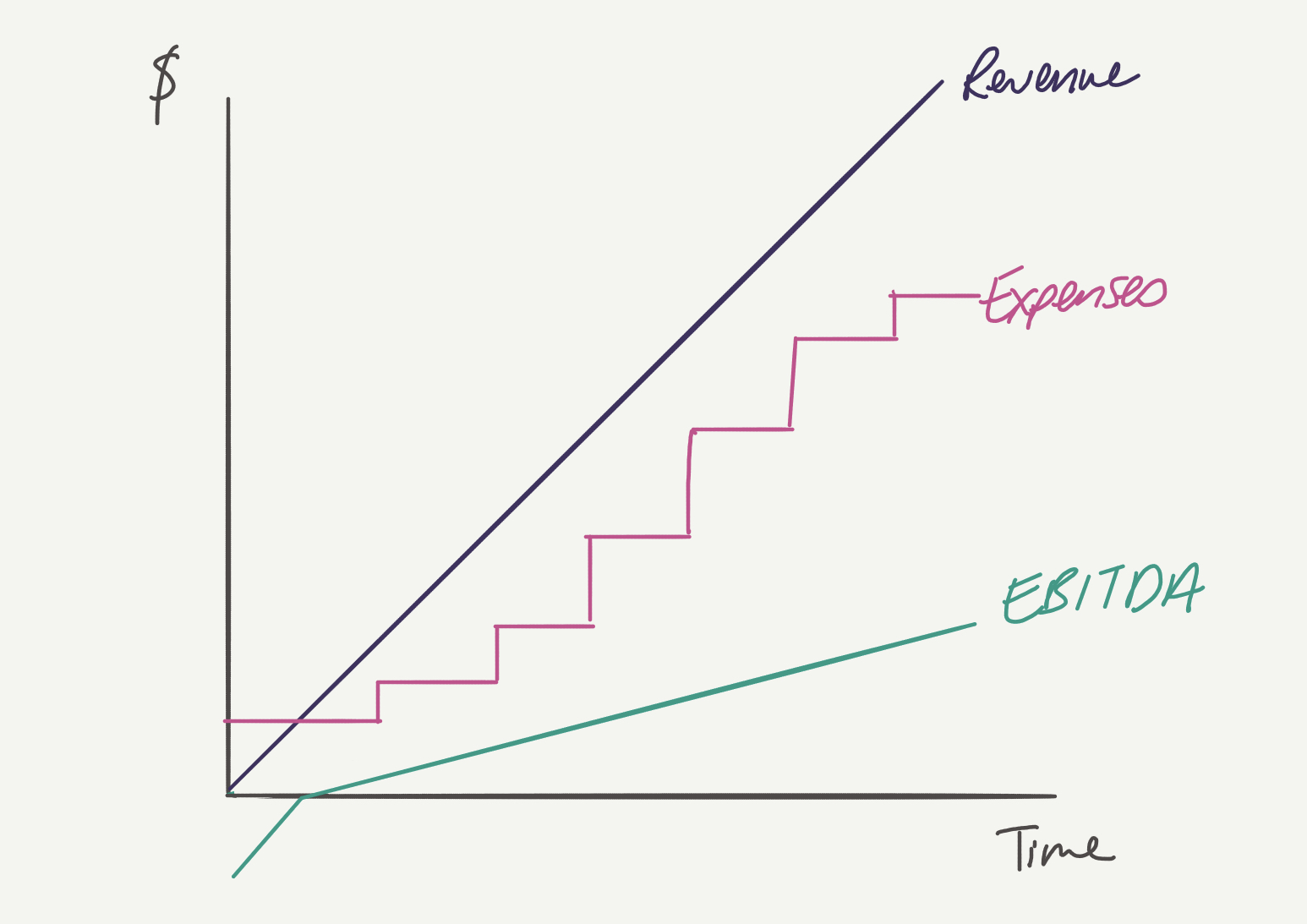

Step Function Expenses

Revenue increases gradually while expenses increase like a step function. This is a key dynamic to understand whether you're the CEO or a team member working in a business.

Every time you ramp up expenses, it cuts into your profitability. This is why ramping up expenses in the right areas is critical.

The right expenses are better framed as investments. They ramp up revenue as well so your profitability curve smoothes out.

Every time you bring a budget proposal to the CEO or board for an expense that doesn't ramp up revenue, the likelihood of getting that budget drops to 0.

They have so many places where they can invest additional dollars that investing it in a place with no ROI has a high opportunity cost as well.

This is why many functions, including marketing, are viewed as cost centers by companies.

Marketing costs look more like expenses than investments when the marketing leader cannot explain how added cost, program or headcount the company will ultimately grow the busin...

AAARE Understanding

End to end understanding of all the levers and conversion points is how you build the right growth model for your business.

1) Acquisition -- building the right model to generate the right demand at profitable CAC levels.

2) Activation -- building the right framework to get the right prospects to activate and onboard on your platform.

3) Adoption -- building the right infrastructure to have your customers embed your solution into their environment, while getting all stakeholders involved.

4) Retention -- driving towards customer success with everything you do (marketing, sales, product, UX)

5) Expansion -- identifying opportunities to grow your relationship with customers with increased usage or additional products, services, and offerings.

The more you understand these levers and pull them effectively, the more budget you can invest into acquiring customers in the first place.

The more you can profitably spend to acquire a customer, the faster you grow.

SDR Demos

Somewhere along their journey, companies decide to treat buyers like mice in a maze. Want a Demo? Sure, you just have to:

- Fill out a form

- Schedule a call with an SDR

- Wait

- Talk to the SDR -- who won't give you a demo but will ask you all their BANT criteria questions and then book a call for you with an AE

- Wait

- Talk to an AE -- or just go jump off a cliff

- Before you know it, 2-3 weeks have passed and the buyer has lost their urgency / has found someone else who has engaged them on solving their problem faster.

This type of workflow also kills demand gen programs that take a lot of effort to get the right prospect in the door, only to have the buyer end up in the Closed Lost column due to a bad sales process.

Start with the buyer. Remove the hard lines between SDRs and AEs.

Pricing Impact on Operating Model

Pricing has a significant impact on your operating model. It is also one of the most powerful growth levers available to most businesses (yet also one of the most under-utilized).

Companies are often scared to increase prices for fear of losing loyal customers, lowered satisfaction ratings and being perceived as price-gouging for their products.

Ironically, keeping your prices stagnant is one of the quickest ways to deliver lesser value to your customers.

Lower margins > lower bandwidth to provide value > lower customer experience > lower customer satisfaction

This does not mean increasing your pricing indefinitely. It means finding the right (and fair) scientific price for your product so that you have a better operating model to deliver more value.

Getting to this answer takes work and going through customer data to truly understand what is a fair price for both sides.

At the heart of such a project, a lot of data needs to be analyzed, including:

- Churn by cohort

- NPS ratin ...