The Impact of Thought Leadership on Hiring

One of the most understated benefits of thought leadership content is its impact on hiring.

Yes, thought leadership content with a unique perspective can evangelize a new category and ramp up pipeline / sales.

But a secondary (and almost, more important) benefit is that it helps grow the employer brand beyond just winning another "best place to work" or "fastest growing company" award.

The right kind of content signals to potential candidates what kind of world you are trying to build. The more candidates that vision and perspective aligns with, the bigger the hiring pipeline that can be built to help a company scale.

Your educational / thought leadership / category evangelism content not only helps your market and customers transform their lives, it also helps bring people into the mission and team to help the market even more.

In a market where everyone is raising millions of dollars, more companies are hiring than ever before and compensation for roles has climbed 20-50%, thought leaders...

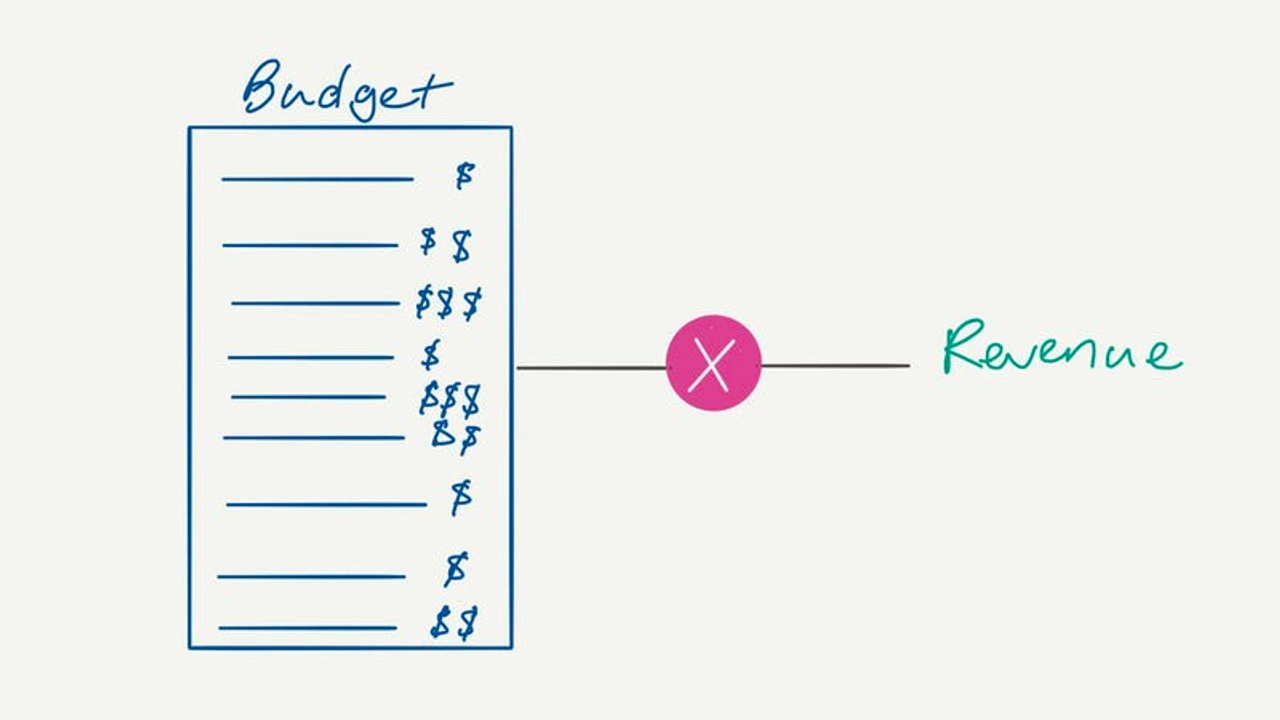

The Budget to Revenue Disconnect You Should Be Aware of

At some point, budgets agreed upon with finance teams must show ROI in the form of revenue.

While playing the patient game with marketing and understanding that not everything can be measured is important, so are results.

If Finance doesn’t ask you why revenue hasn’t gone up, then finance isn’t doing its job. If the CEO doesn’t put Marketing, Sales and Finance in the same room and ask the question, then the CEO isn’t doing his/her job.

While the right channels not getting attribution because of how customers behave is very true, hiding behind brand / comms work is equivalent to hiding behind attribution metrics.

Your overall revenue metrics should trend upwards as you:

-Invest more in content

-Spend more on paid channels

-Add more headcount

-Bring in more marketing tools

-Hire more agencies

This means Marketing Sourced Pipeline goes up, Sales Cycles decrease, Marketing Sourced Revenue goes up.

If they’re not improving over a long period of time, maybe your brand / content / demand gen work isn’t ...

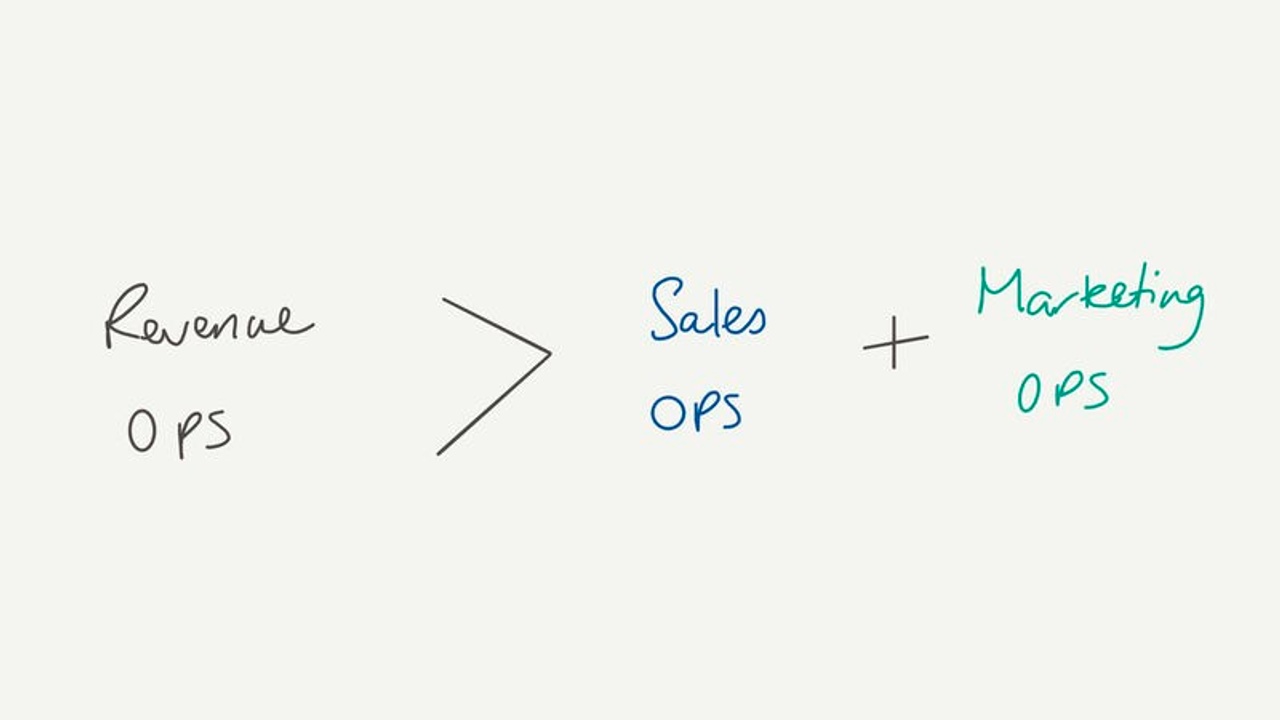

The Overarching Revenue Ops Plan Your Company Needs

Separating out Sales Ops and Marketing Ops makes little sense when you realize that Sales and Marketing are both accountable for revenue.

Every company needs an overarching Revenue Ops plan in terms of:

-Architecture

-Systems and technology stack

-Process

-Data governance

-Definitions and routing

-Feedback loops

Both Sales and Marketing should speak the same language when it comes to all of these. When it comes time to make budgeting decisions, both should be referencing the same data models and outputs.

Thinking about ops and data together is one of the key ways to align sales and marketing.

What Not to Do With Your Website Messaging

Your homepage and website are not a self-promotional tool to talk about how great you and your company are.

Your customers and prospects encounter your website on a journey of trying to resolve a particular pain point.

Do not waste that opportunity by talking about:

-Awards you've won

-Companies you've acquired

-New branding you just launched

None of these things focus on what's really important: helping the customer achieve a stated or unstated goal.

Do this instead:

1) Nail down your positioning and messaging, including who you help

2) Showcase the benefits of your solution and what transformation you help them achieve

3) Include success stories and proof points to highlight how others have found success in a similar position

Wasting the first 10 seconds you have with a prospect on anything else is wasting some of the most precious sales and marketing real estate available.

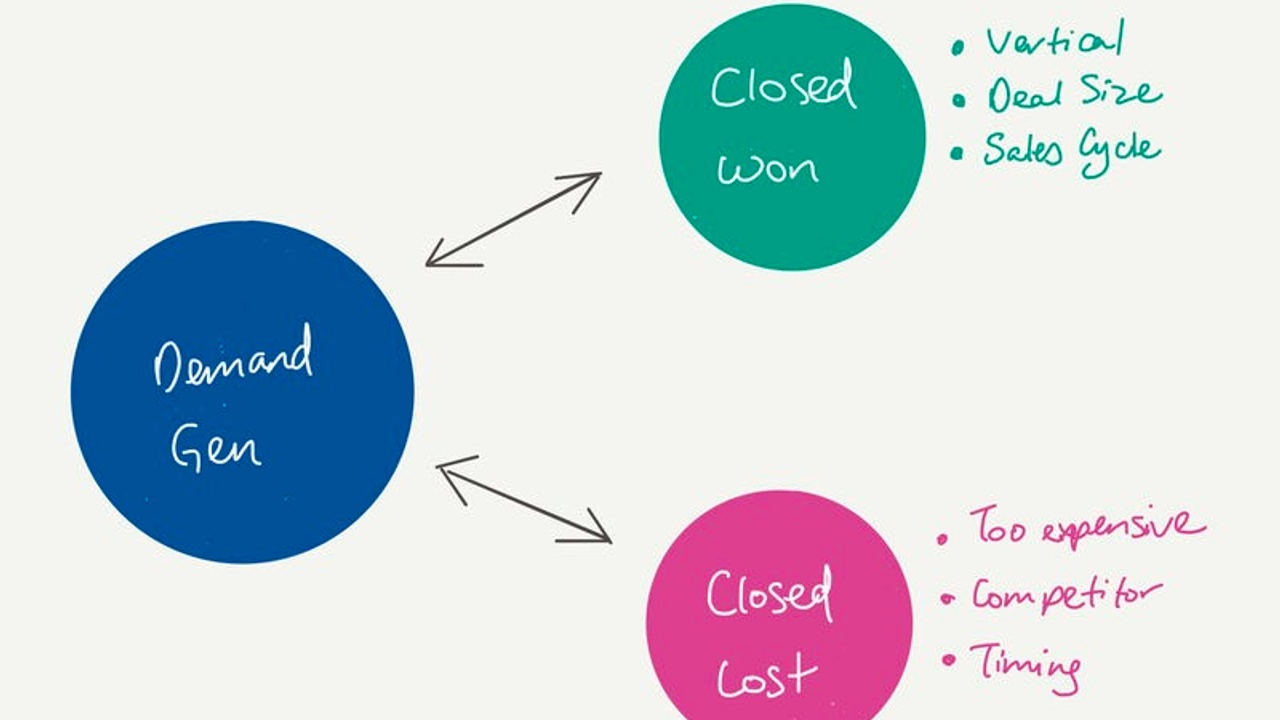

Are You Using Your Gold Mine of Closed Won and Lost Data?

There is a gold mine of information for Demand Gen inside Closed Won and Closed Lost data.

Closed Won:

-What are the verticals we are winning deals with?

-What are the average deal sizes with our different segments / markets / verticals?

-How long was the sales cycle and what touches were involved?

Closed Lost:

-Were we too expensive for the right type of customer or the wrong type of customer?

-Did they go with a competitor? Which one and why?

-Was the timing off or was our pitch not right for the stage they were at?

The answers to all of these questions need to be fed back into the demand gen engine to refine and improve programs so that better pipeline can be generated.

The key word there is: *better* pipeline.

Better pipeline closes more often and doesn't churn as quickly. It has lower acquisition costs and is more efficient.

It's also how Marketing helps the business grow faster.

Pipeline Targets vs. Marketing Budget

Asking for additional marketing budget to spend on new opportunity areas without understanding pipeline targets can lead to targets being at risk and likely not being hit.

Similarly, setting pipeline targets without fully understanding all the potential areas where marketing can scale pipeline can lead to revenue growth opportunities being missed.

Most companies lean one way or the other with these approaches and inevitably fall short.

You need to do both a bottom-up and top-down analysis to fully understand how to fund marketing efforts and to increase the odds of success for the organization.

What Creative Demand Generation Really Means

Companies often mistake Technical Paid Media work for Creative Demand Gen work. Here's the difference.

Technical paid media work focuses on platform knowledge. This includes things like:

-Knowing the technical ins and outs of a platform

-Being able to set up correct structure for campaigns

-Optimizing issues inside platforms

This is what most agencies / partners / internal resources focus on.

While this work has value, it is not the core of where demand is generated.

Creative Demand Gen instead focuses on:

-Audience pain points and frustrations

-Building compelling content and the right offers to attract the right audience

-Growing a community / building an audience following

-Creating a strategic and narrative position in the marketplace to differentiate from the competitors

This is the work that most marketers fail to do in a lot of markets, which presents a blue ocean opportunity for the marketers that choose to focus on it.

This is also the work that creates the most e...

Increasing marketing impact by stopping bad ROI activities

Marketers often complain about a lack of budget, yet the same marketers invest significant portions of their limited resources into things that don't work.

These include:

-Content Syndication

-Overpaying Gartner

-Press Releases

-Buying Lists

Instead, look at how much of your marketing budget is going into these kinds of activities that produce virtually no impact.

Sure, things like Content Syndication raise awareness on broad channels but in most companies the impact to revenue is little (with or even without attribution).

Instead:

- Create a strong point-of-view for your business, prospects, customers and market

- Produce phenomenal content to become the go-to resource for your customers and market to learn from.

- Increase distribution to your ideal customers through targeted efforts.

Same marketing budget, entirely different impact on revenue, profitability and enterprise value creation.

What CMOs Need to Understand About Financial Stewardship

As a marketing leader, you are a financial steward for the business. This means you have a fiduciary responsibility to invest your marketing dollars wisely.

This means dealing with your marketing budget should follow the same principles as when you deal with your own money.

Some obvious rules:

1) Don't spend money on things that are purely cost centers with no ROI.

2) Don't be too prudent or careful and miss opportunities to capture value.

3) Always actively think about where to invest your limited resources more effectively.

Too many marketing budgets burn cash / capital from founders or investors because it doesn't feel like your own money.

But it really is your own money. It's the capital at your disposal to grow the company and the team, and it is your mechanism to helping more customers the more efficient you are.

Treat it as such and operate this way. Your CFO and CEO will become your biggest fans and supporters.

The True Value of Revenue and Profitability

Understanding the true value of revenue and profit generated is the key to knowing how much to invest in Marketing.

If your LTV of a client is 10 years and you’re not cash strapped, being willing to increase your CAC payback period to 18-24 months can drastically increase your speed to acquire customers.

While financial stewardship is critical to scale, knowing when to step on the gas can lead to significant gains.

This is when Marketing can do things like:

-Building much more brand awareness at the top of the funnel

-Invest heavily in content to generate long-term returns

-Scale paid media to outbid the competition that has more stringent cash constraints

Similarly, realizing that generating EBITDA has a 15x (likely more) multiple on exit / fundraising round can change how you view Marketing investment.

Short-term thinking may view this as conserving EBITDA for higher valuations. Long-term thinking looks at long-term EBITDA creation.

If payback periods are expanded to 18-24 m...